Research Roundup: ETFs growth, and low-cost multi-asset funds

The roundup this week includes data surrounding exchange-traded funds, an insight into how managed fund fees can affect volatility, and other snippets from the Australian investment arena.

BetaShares: ETFs surpass LICs for the first time

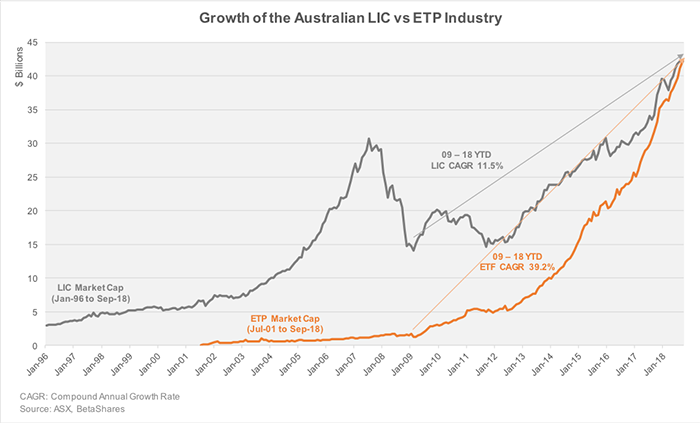

Research from exchange-traded funds issuer BetaShares has found that, at the end of September, the amount of capital in Australian-listed ETFs exceeded those in Listed Investment Companies (LICs).

The data – contained in BetaShares' most recent review of the Australian ETF industry – shows that ETF funds under management reached $42.29 billion versus the $42.23 billion held in LICs.

The Australian ETF sector has been able to steadily overtake growth its more established counterpart, thanks in large part to a rapid assets under management growth rate of around 39 per cent per year by ETFs since 2009. On the other hand, assets under management in the LIC sector has grown at around 11.5 per cent per year in this timeframe.

The growth isn’t limited to assets under management, with BetaShares outlining that the number of LICs on the ASX is less than half the number of Exchange Traded Products (ETPs).

Believed to be among the reasons for the increasing popularity of ETFs among Australian investors is the fact that fees for ETFs tend to be lower than those of their LIC competitors.

InvestSMART: How fees can destroy your wealth

This week InvestSMART released a white paper, shining a spotlight on the devastating effect high fees and costs can have on investor nest eggs.

Data modelling in InvestSMART’s new paper, How fees can destroy your wealth, shows someone who had invested $100,000 in Australian shares over the 30 years to June 2018 at a fee of 0.5% would have $1,207,807 at the end of the period, while a fee of 1.5% would have netted them just $896,5081 – almost 26% less.

From financial advice fees to platform and fund manager fees, the total costs involved in investing are having a significant impact on investment outcomes.

Commenting on the findings InvestSMART CEO Ron Hodge said in most cases, fees rather than returns make the biggest difference to investors’ quality of life in later years. The high total costs of investing are caused by ‘fee stacking’ – an accumulation of apparently small fees including financial advice fees, implementation fees, platform administration and investment management fees, which can easily add up to 2% per annum.

Zenith: Volatility has larger impact on lower-cost funds

Meanwhile, a report from Zenith has found that low-cost multi-asset managed investments tend to be less stable than their higher-cost competitors during market downturns.

The report – entitled 2018 Multi Asset Diversified Review – found that the worst loss over a five-year period in the lower-cost funds sector was 1.3 per cent greater than that of the higher-cost sector, indicating a greater degree of risk in among low-cost funds. This came even though there is only a small difference in the level of returns achieved across the two sectors over this period of time.

Zenith outlines three potential reasons for the differences in volatility among higher-cost and lower-cost funds when the market falls: low-cost funds generally feature a smaller allocation to the alternative asset class (which can counteract volatility), a lower prevalence of active asset allocation and more exposure to ETFs and passive funds.

For the purposes of the report, funds with management fees greater that 0.58 per cent per year were deemed to be ‘high-cost’, while those with management fees under this threshold were considered ‘low-cost’.

.png)

Morgans: Evaluating valuations

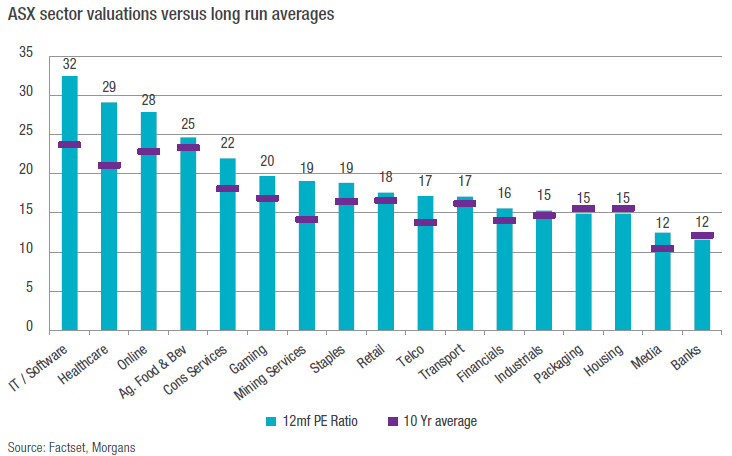

Broker and advisory firm Morgans has compared current valuations of ASX sectors against their 10-year averages. In a positive sign, no sector is performing substantially below its 10-year average, with – perhaps unsurprisingly – the IT, Healthcare and Online sectors well outperforming their averages over the last 10 years. Packaging, Housing and Banks are currently valued at a level very close to their 10-year averages. Morgans is bullish on commodity prices, which it expects to flow through to the mining sector, and is also confident in the ability of the banks to make it through this challenging period without cutting dividends. The firm is somewhat down on the consumer discretionary sector, partly due to the weaker property market and the looming election.

Macquarie: Analysing AGMs

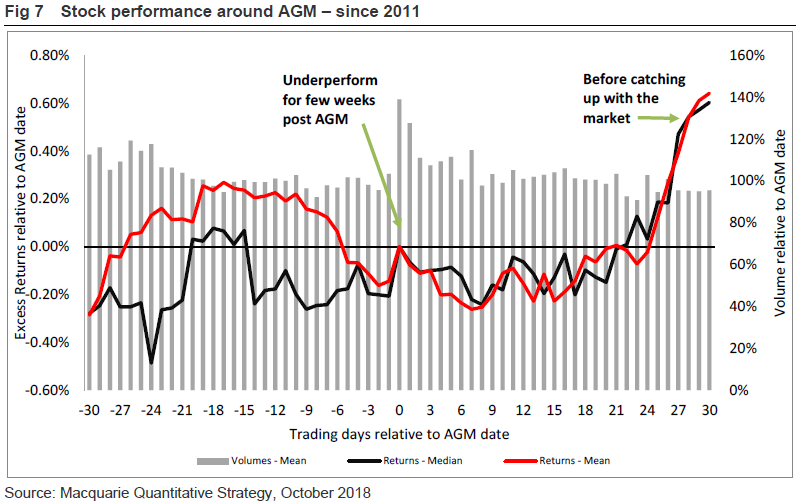

We’re getting to that time of year in which a number of listed companies hold their AGMs. To mark the occasion, Macquarie has analysed how the prices of shares listed on the ASX react in the days leading up to, and just after a company’s AGM. As the below chart shows, companies’ share prices generally underperform in the immediate aftermath of their AGMs, a trend which can last for around four weeks. The chart also illustrates that companies trade at much higher volumes on the day of their AGMs.

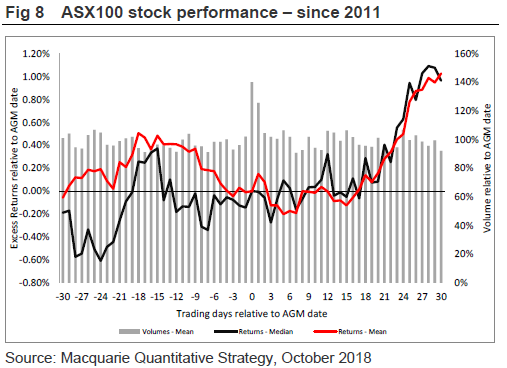

The chart further below outlines the same phenomenon, but focuses solely on those stocks in the ASX 100. Macquarie notes that similar themes are present, with the major difference being that these stocks tend to recover more quickly after the event.