Research Roundup: Dividend gifts, earnings and jobs

Welcome to the research roundup for this week, which features plenty about the most recent reporting season, as well as some property insights.

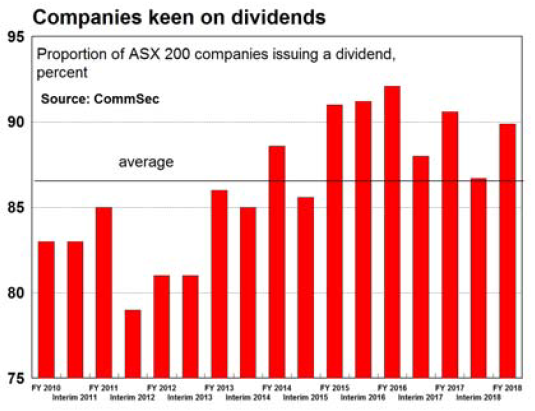

CommSec: Dividends aren't dead yet

Reporting season is a time when investors hope it doesn't just rain, but pours: dividends that is. Which is just what has happened from the latest swag of earnings, with almost $30 billion set to be paid out to shareholders in the coming weeks. As CommSec has found, it seems the vast majority of major Australian companies see value in paying dividends, with close to 90 per cent of the ASX 200 sharing profits with shareholders and 90 per cent of these companies lifting or maintaining dividends. But the proportion of companies seeking to pay out dividends is still down from the highs in the 2015 and 2016 financial years. In other words, companies are seeking to strike a balance between rewarding shareholders and ploughing money back into their operations.

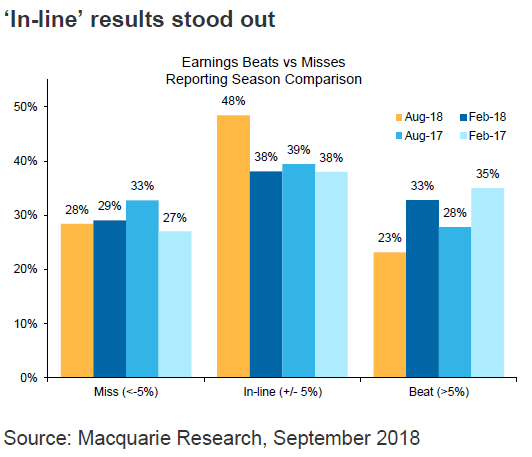

Macquarie: Evaluating reporting season

Macquarie has taken an in-depth look at the latest reporting season. While dividends are flowing, only 23 per cent of companies exceeded Macquarie's earnings estimates, with almost half reporting an earnings figure within a 5 per cent range of the investment bank's projections. Macquarie attributes the substandard performance to a range of factors, including rising costs, the weakening property market and the drought. The bank expects the retail, telecommunications, and banking sectors to struggle in the future.

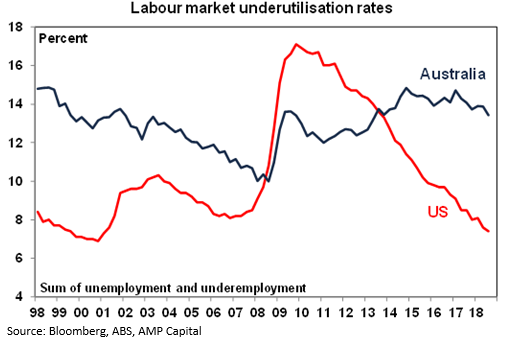

AMP Capital: Underemployment remains high

The strong labour market has also cut into underemployment which fell to 8.1 per cent in August from 8.5 per cent in May. However, total labour market underutilisation (ie, unemployment plus underemployment) remains very high at 13.4 per cent in contrast to the US where its fallen to 7.4 per cent, which is about as low as it ever gets. As a result, the pick-up in wages growth is likely to remain very gradual in contrast to the US.

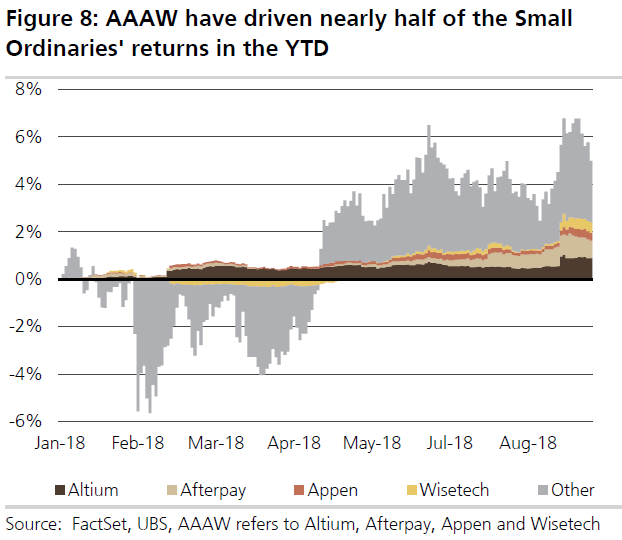

UBS: Small company strength led by few

UBS has evaluated the impact of high-profile technology companies such as Altium, Appen, Afterpay and Wisetech on the total returns of small caps in Australia. Unsurprisingly, the four have played a major role, accounting for close to 50 per cent of Australian small cap returns so far in 2018.

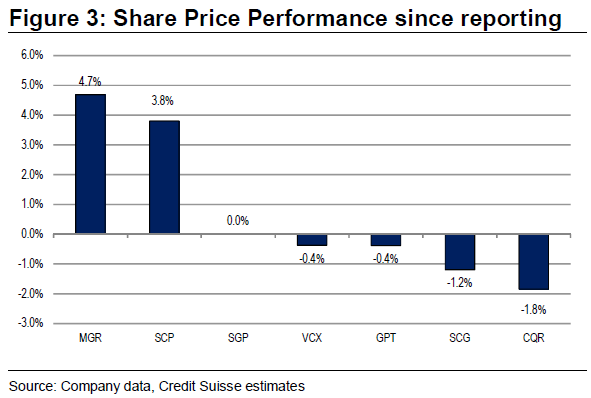

Credit Suisse: REIT share prices post-results

Last week, we focused on REITs – particularly their performance compared to the market. Credit Suisse has examined how the share prices of a number of REITs have changed since announcing their financial results. As you can see, it's a bit of a mixed bag, with Mirvac and Shopping Centres Australasia Property Group registering positive share price movements, while Vicinity Centres, GPT Group, Scentre Group and the Charter Hall Retail REIT have fallen. According to the investment bank, REITs reported financial figures which aligned similarly with estimates.

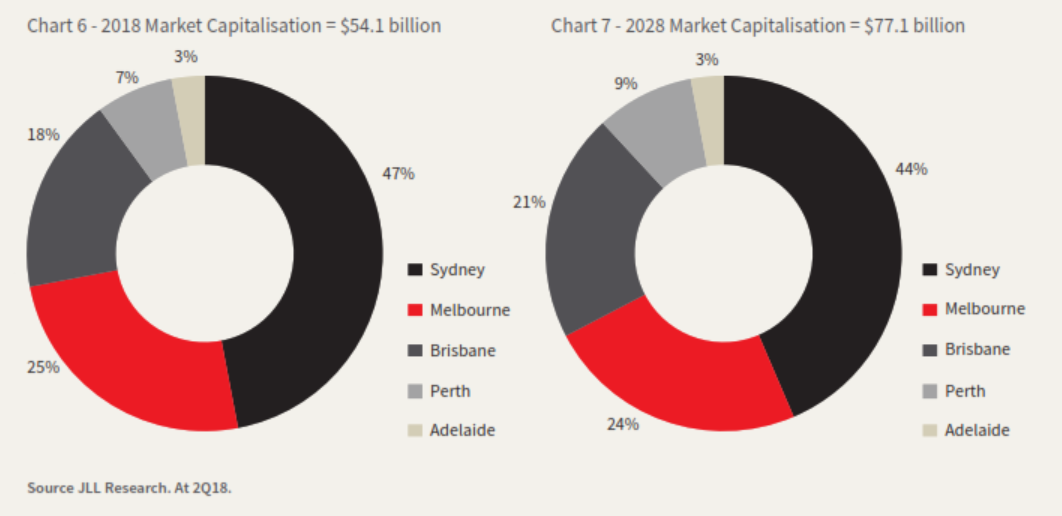

JLL: Commercial property to grow

Investment manager JLL has conducted a report studying the industrial property market in Australia. According to the report, the sector could grow by over 42 per cent over the next decade. JLL also expects that Brisbane and Perth will become more prominent in the commercial property sector in this timeframe, although Melbourne and Sydney will continue to drive the market.