Rebutting Buffett on Bitcoin

With 189 years of experience and outstanding investment returns between them, any investor would be wise to listen and carefully consider anything that Warren Buffet and his offsider Charlie Munger have to say.

Few would deny that Buffett, the 91-year-old “oracle of Omaha”, has earned the right to use the annual Berkshire Hathaway shareholders meeting to preach the gospel according to him, Munger and Buffet’s mentor on value investing, Benjamin Graham.

Every year since 1973, when the first shareholders meeting was held in the employee cafeteria of one of Berkshire Hathaway’s subsidiaries, the annual shareholders meeting has grown to become the “Woodstock for capitalists”. It’s beloved by Buffet and Munger disciples (aka shareholders), Berkshire companies selling their wares, and anyone interested in Buffett’s views on financial markets.

Observant readers may have heard Buffett previously refer to Bitcoin as “probably rat poison squared”. At this year’s meeting in downtown Omaha, Buffett spoke again about the dangers of Bitcoin and crypto, even referring to “Berkshire coin” as an emblem of insanity alongside the idea that Bitcoin or some other digital asset might supplant the mighty US dollar.

“If you said … for a 1% interest in all the farmland in the United States, pay our group $25 billion, I’ll write you a check this afternoon,” Buffett said.

“[For] $25 billion I now own 1% of the farmland. [If] you offer me 1% of all the apartment houses in the country and you want another $25 billion, I’ll write you a check, it’s very simple”.

“Now if you told me you own all of the bitcoin in the world and you offered it to me for $25, I wouldn’t take it because what would I do with it? I’d have to sell it back to you one way or another. It isn’t going to do anything. The apartments are going to produce rent and the farms are going to produce food”.

“Assets, to have value, have to deliver something to somebody. And there’s only one currency that’s accepted. You can come up with all kinds of things — we can put up Berkshire coins... but in the end, this [holding up a $20 bill] is money”.

Not to be outdone, 98-year-old Charlie Munger also doubled down, adding to Buffett’s comments:

“In my life, I try and avoid things that are stupid and evil and make me look bad in comparison to somebody else – and bitcoin does all three”.

“In the first place, it’s stupid because it’s still likely to go to zero. It’s evil because it undermines the Federal Reserve System ... and third, it makes us look foolish compared to the Communist leader in China. He was smart enough to ban bitcoin in China”.

According to Buffett and Munger, Bitcoin and its ilk are tantamount to the devil and likely to send us into the gates of hell.

But intelligent investors considering investing in Bitcoin or other crypto would be wise to consider the merits and context of Buffett’s remarks.

Warren Buffett and Charlie Munger are 91 and 98 respectively. While rejecting ageism, it may nevertheless be valid to consider whether Buffett and Munger’s “circle of competence” extends to the emerging world of crypto, digital assets and distributed ledger technologies.

Being canny acquirers of businesses with competitive moats that deliver sustainable and growing earnings and basing valuation on traditional metrics like return-on-equity, debt-to-equity, profit margin and Buffett’s own intrinsic value formula, crypto assets don’t fit the mould. By their measures, crypto assets aren’t capable of being valued. But just because they can’t be measured using “Buffettology”, does that mean they’re value-less?

Buffett and Munger characterise Bitcoin and crypto assets as being worth only what a “greater fool” would pay, thereby equating crypto to the Dutch tulip mania or the South Seas bubble. But this ignores the possibility that crypto assets can provide real utility in satisfying an increasing number of real-world use cases, and in turn, sustainable value for token holders. The South Sea bubble occurred over months, the tulip craze perhaps three years. Crypto is in its 13th year and is now worth $US1.6 trillion by coin market cap alone (not counting the value of exchanges, mining business and the wider ecosystem).

They may be unaware of the rapidly growing array of decentralised finance (“DeFI”) services that are emerging to offer both yield (income) and debt (lending) over crypto assets. It is already possible to borrow against crypto and earn yield through staking or saving, and the size of this market is growing.

They characterise the dollar as the only money or currency that is accepted. But crypto is already being used as a means of transferring value digitally from sender to receiver. El Salvador’s use of Bitcoin as a means of exchange to circumvent the costs of international money transfer and the rise of stablecoins as both a store of value and a medium of stable exchange evidence that fiat currency is not the only way to transfer value. Crypto does not need to supplant fiat currency to behave in some ways like money.

Plenty of evil and stupid things have been done, been caused by or result from actions involving the dollar or other fiat currency too. Neither fiat currency or crypto are inherently evil or stupid. The same cannot always be said of institutions, businesses, markets, or investors.

The popular philosopher Yuval Noah Harari said, "The most powerful forces in the world are fictional realities. Money in fact is the most successful story ever invented and told by humans, because it is the only story everybody believes. Not everybody believes in God, not everybody believes in human rights, not everybody believes in nationalism, but everybody believes in money”.

While this might seem a bit abstract as actionable investment advice, his point is that even fiat currency is ultimately a belief system. The difference is that fiat currencies derive their value from the institutions of the state, while crypto assets derive their value from the market. As Buffett himself said, in the short term the market is a voting machine but over the long term, it’s a weighing machine.

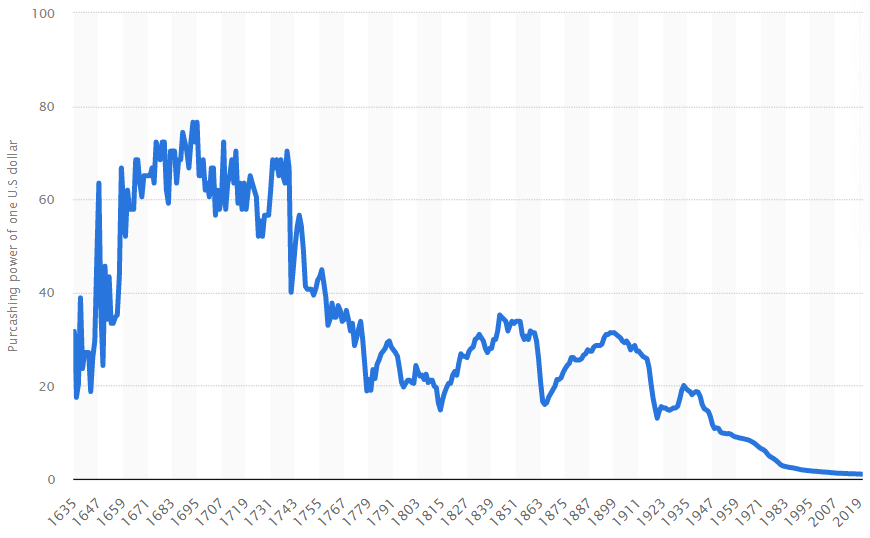

Most fiat currencies lose their purchasing power over time as the market’s belief wanes. Even the US dollar has lost most of its purchasing power over a long-time horizon:

Source: https://www.statista.com/statistics/1032048/value-us-dollar-since-1640/

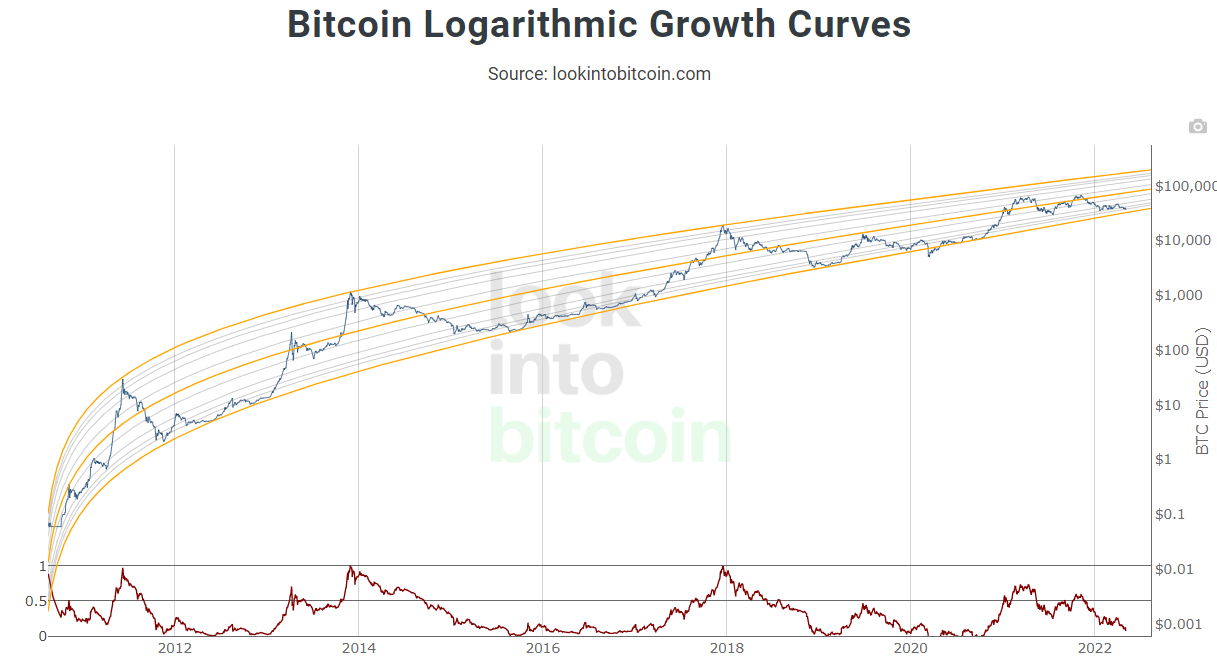

While unquestionably volatile, Bitcoin’s price trajectory follows the kind of curve seldom seen during Buffett and Munger’s heyday, that of a digital network with exponential adoption. Whether this growth sustains depends on whether the market continues to believe and maintain faith in Bitcoin’s utility.

Source: https://www.lookintobitcoin.com/charts/bitcoin-logarithmic-growth-curve/

So, while it would be wise for an investor to listen and carefully consider anything that Warren Buffet and Charlie Munger have to say, this might also include a careful consideration of their exhortation to investing within one’s circle of competence.

If Buffett and Munger acknowledge that their circle of competence most certainly does not extend to emerging crypto and digital tokens, assets, markets, services, and technologies, then investors should perhaps balance their education with other more informed sources.

Frequently Asked Questions about this Article…

Warren Buffett uses the term 'rat poison squared' to express his skepticism about Bitcoin's value. He believes Bitcoin lacks intrinsic value because it doesn't produce anything tangible like farmland or apartment buildings, which generate income. Instead, he views Bitcoin as speculative and akin to historical financial bubbles.

Charlie Munger criticizes Bitcoin for being 'stupid,' 'evil,' and making investors look foolish. He argues that Bitcoin is likely to go to zero, undermines the Federal Reserve System, and contrasts poorly with China's decision to ban it. Munger sees Bitcoin as a risky and potentially harmful investment.

Buffett and Munger focus on traditional investment metrics like return-on-equity and intrinsic value, which they believe crypto assets lack. They view cryptocurrencies as speculative and not fitting their value investing model. In contrast, crypto investments often rely on market belief and utility in digital transactions, which don't align with Buffett and Munger's approach.

Yes, cryptocurrencies can offer real-world utility and sustainable value. They are used for digital value transfers, as seen in El Salvador's adoption of Bitcoin for international money transfers. Additionally, decentralized finance (DeFi) services provide yield and lending opportunities, showcasing crypto's potential beyond speculative investment.

Investors should consider Buffett and Munger's views as part of a broader investment strategy. While their insights are valuable, it's important to recognize that their expertise may not extend to emerging technologies like cryptocurrencies. Balancing their perspectives with other informed sources can help investors make well-rounded decisions.