Readings & Viewings: August 31, 2018

Welcome to this week's Readings & Viewings, a collection of news, analysis and other interesting snippets we've spotted from around the world during the latest week for your reading pleasure.

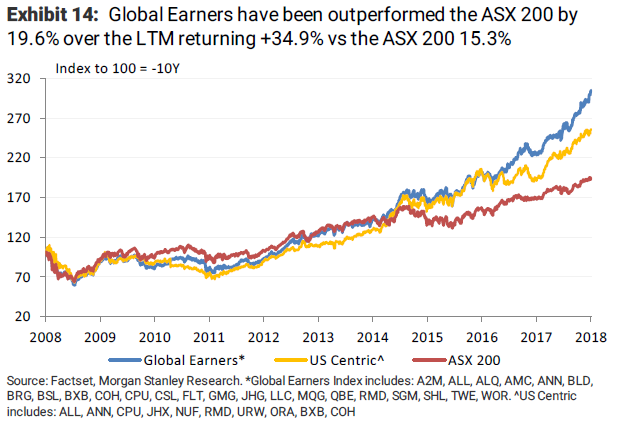

We'll open this week with an examination of the performance of the ASX200: not by sector, but with an intriguing differentiating factor nonetheless. Investment bank Morgan Stanley has put together an index of ASX200 companies for which revenue from overseas makes up a reasonable portion of their overall revenue. Some of the prominent companies in this group include Macquarie, CSL and Bluescope Steel, among others. As you can see in the below chart, the companies in this index have outperformed the rest of their peers in the ASX200. Morgan Stanley attributes the better performance of these more outward-looking companies to our lagging currency.

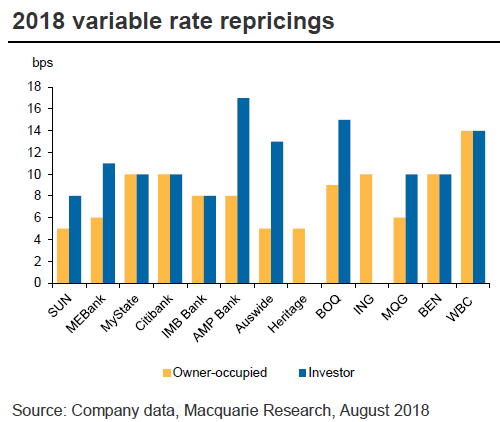

On to a topic we just can't seem to escape at the moment: bank profitability. Whether we're talking about the disturbing findings of the Royal Commission, or potentially anti-competitive behaviour among the ‘Big Four', the Australian news cycle always seems to be awash with bank news. It was no different this week, with Westpac announcing a 14-basis point increase in its variable loan interest rates. Investment bank Macquarie notes that thanks to increases in the cost of funding and contractions in credit growth, bank profitability hasn't been at its strongest level in recent times. That's all well and good, but as you would expect, the move has not been popular among the Australian public. The below chart shows how banks across Australia have changed their variable rates this year. You may notice that the other three major banks do not appear on the chart. This is because they are yet to announce whether they will follow the lead of their competitor. We wait with baited breath…

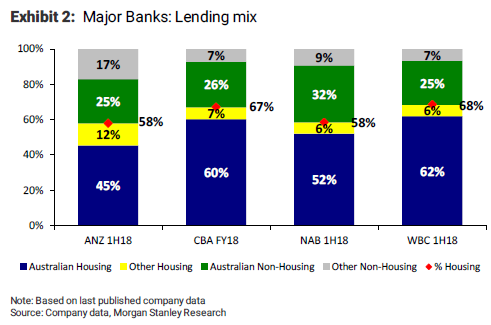

While we're talking about the banks, here's a look at the lending composition of each of the ‘Big Four'. Westpac is the most exposed to the housing sector, with 68 per cent of its loan portfolio consisting of property loans. This level of exposure may partly explain the reasoning behind the 0.14 per cent increase in variable loan rates announced by the bank. The CBA comes in at a 67 per cent exposure to property loans, while property loans make up 58 per cent of loans for the NAB and ANZ. The NAB continues to live up to its reputation as a non-mortgage bank, with Australian non-housing loans making up 32 per cent of its total loan portfolio, a substantially larger percentage than the other three banks.

On to international matters, you may remember that as the FIFA World Cup was getting underway, the Russian government announced potential reforms to its pension system. These proposals were met with derision by the Russian public, and almost two months later, the suggested changes have been wound back slightly.

Brexit won't be wound back, but there is still plenty to be sorted out before the exit itself actually occurs, including a consideration of how Britain's relationships with the European Union are going to be changed along the way. If comments made by France's Finance Minister Bruno Le Maire are anything to go by, things are going to be different.

Le Maire hasn't been the only politician talking tough. Donald Trump has been angling to change the North American Free Trade Agreement (NAFTA) for quite some time, and this week he reached a breakthrough, with Mexico agreeing to an adjusted version of the agreement. All eyes are on Canada now, as the country tries to negotiate itself back into the agreement. With Trump pushing a tight deadline for negotiations, it's likely the Canadians will need to make some concessions to get a deal done.

If you've ever wanted to own an Aston Martin, now might just be your best chance. Well, not really. But with the luxury auto manufacturer planning its IPO in the near future, owning a piece of the iconic brand will likely be as close as most of us can get.

That's all for this week. Have a fantastic weekend.