Quarterly Performance of our CEO's portfolio

In June last year, my wife and I began sharing a series of emails on how we arrived at our decision to invest $1m in InvestSMART’s capped fee products (see part 1). It created lots of interest and requests for follow-ups.

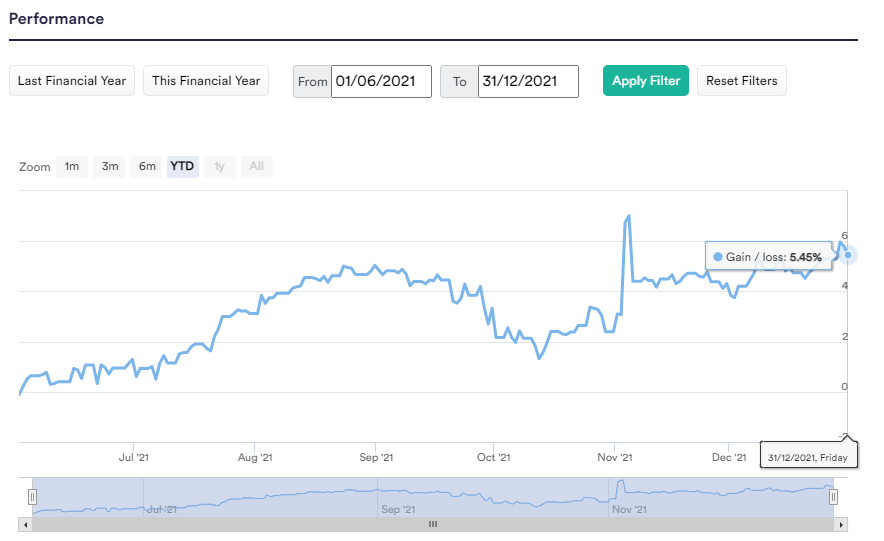

So, here we go. As the chart shows, over the six months to 31 December 2021, our Balanced investment portfolio rose 5.45%.

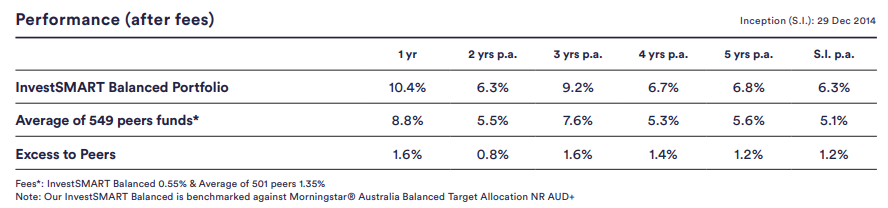

Each quarter, we like to compare this performance to other similar funds, although ultimately it’s long term that matters.

InvestSMART Balanced Portfolio is benchmarked against the Morningstar® Australia Balanced Target Allocation NR AU index, formerly known as the Morningstar Aus. Msec Balanced TR AUD index. The InvestSMART website shows our investment performing well over all timeframes.

As per the 31 December 2021 Quarterly Report, “the December quarter finished off what was an astonishing year for the Balanced Portfolio. Over the quarter the portfolio increased 1.85 per cent after fees.”

What made us wonder about that figure is disclosed in the chart below, which shows our portfolio returning 1.99% over the quarter rather than the 1.85% noted in the quarterly report.

The difference can be explained by the fees. For reporting purposes, InvestSMART calculates fees of 0.55% p.a. on all portfolios based on a minimum $50,000 investment.

But because InvestSMART fees are capped at $451 for investments above $82,000, with a portfolio like ours my wife and I only pay $451 a year rather than $5,500 (0.55% of $1m).

As a result, our portfolio performance will always be better than that reported on the InvestSMART website.

More importantly, as our portfolio grows the fee we pay as a percentage of the portfolio’s value will get even smaller. This is the value of a fixed, economical fee. The money we save each month in fees will compound over the years. Rather than filling InvestSMART’s coffers, it will generate more money for our retirement.

That’s the beauty of capped fees and why it’s such a radical idea to other wealth managers that have grown fat on relatively high percentage fees.

Given my wife and I are still some years off retirement (much to her annoyance) we’re happy with our core investment in the diversified InvestSMART Balanced portfolio alongside some Australian shares we own to maintain a bias towards growth over the next 10 or so years.

Over the last quarter, we haven’t added to our portfolio. However, with the recent market pull back we are looking to invest more through the Intelligent Investor Ethical Share Fund (INES), which has low fees, a great track record of beating the index and recently opened a new secondary offer. Up until this month it's made about a 50 per cent return over the past three years, compared to 20 per cent for the index over a pretty tough period during COVID. They have shown they can deploy cash quickly to invest in great companies at great prices, my wife and I are not watching the market closely enough to be able to do this ourselves.

Topping up our investments when markets pull back is a sensible strategy. Over the long term, we believe this approach will increase the pace of growth in our diversified portfolio of investments.

Until next time, happy investing.

Links to the original series:

https://www.investsmart.com.au/investment-news/qanda-from-ceo-invests-1m-series/150003

Frequently Asked Questions about this Article…

The InvestSMART Balanced Portfolio rose 5.45% over the six months to 31 December 2021. In the December quarter alone, it increased by 1.85% after fees.

The InvestSMART Balanced Portfolio is benchmarked against the Morningstar® Australia Balanced Target Allocation NR AU index. It has performed well over all timeframes compared to similar funds.

InvestSMART's capped fee structure is beneficial because it limits fees to $451 for investments above $82,000, which is significantly lower than the typical 0.55% fee on all portfolios. This means more of your investment returns are retained, compounding over time to generate more wealth.

The capped fee means that as your portfolio grows, the fee you pay as a percentage of the portfolio's value decreases. This results in better performance compared to what is reported on the InvestSMART website, as more money is retained in your investment.

Investing during market pullbacks is seen as a sensible strategy. By topping up investments when markets are down, you can potentially increase the pace of growth in your diversified portfolio over the long term.

The Intelligent Investor Ethical Share Fund (INES) is a fund with low fees and a strong track record of outperforming the index. It has made about a 50% return over the past three years, compared to 20% for the index, and is known for quickly deploying cash to invest in great companies.

A diversified investment portfolio is important because it helps manage risk and can provide more stable returns over time. By investing in a mix of assets, you can balance growth and security, which is especially beneficial for long-term financial goals like retirement.

Capped fees can significantly impact retirement savings by reducing the amount paid in fees, allowing more of your investment returns to compound over time. This can lead to a larger retirement fund, as less money is diverted to fees and more is reinvested for growth.