Putting this property market in perspective

Summary: Despite the talk of a housing supply glut, the surge in buildings approval is confined to apartments. New dwelling investment has lifted recently, after an earlier period of no growth, but we can conclude this is mainly in apartments too. There is no sign of a supply glut when you look at the increase in the total housing stock. |

Key take-out: Outside of the higher density dwellings, the data still point to a significant underbuild of detached housing and I reiterate my view that this is where the best opportunities for investors perhaps lie. |

Key beneficiaries: General investors. Category: Property. |

Commentators and analysts are starting to proclaim that Australia faces a looming property glut. It didn't take long for talk of a housing shortage to turn to warnings of oversupply.

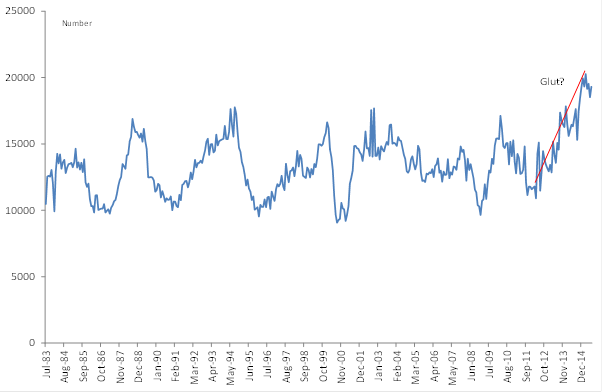

Although the upswing in housing construction is barely underway, you can get a sense from chart 1 below as to where these concerns come from.

Chart 1: Building approvals are surging

Source: ABS, Eureka Report

As the chart shows, building approvals have surged and are up some 13 per cent over the last year alone. Compared to the historical average, monthly approvals are running at about 46 per cent above the historical average. Huge.

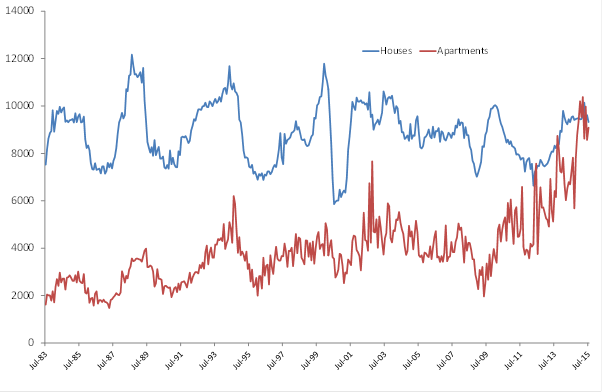

Now as many would know already, this surge in approvals activity is actually only confined to the apartment space.

Chart 2: All the action is in the apartment space

Source: ABS, Eureka Report

In fact nearly all the spike in activity since the GFC has been apartments as you can see in chart 2. So on recent numbers, they are 25 per cent higher over the year while approvals for detached housing are actually down 3 per cent. As to where that surge in apartments is located? It's actually fairly broad-based across the country, especially the eastern capitals – Sydney, Melbourne and Brisbane.

Housing approvals in contrast have actually been weaker since than GFC than they were in the decade or so prior to it. So yes, approvals for detached housing are now higher than average, yet that still doesn't make up for the underbuild we've for so long seen in that space. There is simply no problem when we talk about detached housing.

So when analysts talk about a looming property glut we have to be clear that we aren't talking about detached housing but only the apartment space. This is a very important distinction, because detached housing makes up 75 per cent of the total dwelling stock. So the glut talk really only applies to 25 per cent of the market. Not that it's even clear that we are talking about a broad- based glut. Take a look at chart 3 below.

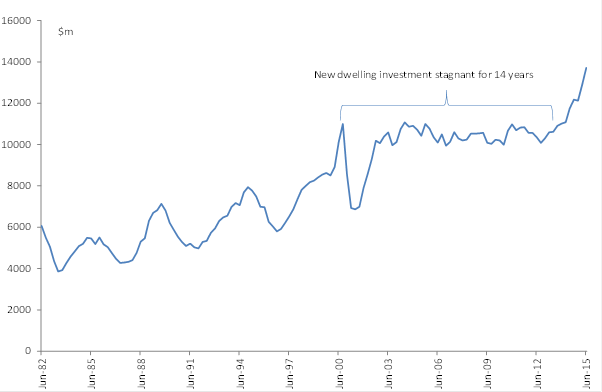

Chart 3: Dwelling investment doesn't look excessive

Source: ABS, Eureka Report

Given that the surge in building approvals has been confined to the apartment space we can conclude that the lift in new dwelling investment is in mainly apartments as well. Yet as chart 3 shows, new dwelling investment in Australia had, until very recently, been stagnant. Effectively no growth. Seen in that context, the spurt we've seen since 2014 isn't that remarkable.

What we should be seeing is steadily rising growth that fits broadly in line with rates of depreciation and population growth. Don't forget that not all new building activity that we see actually adds to the total amount of housing stock. A lot of it is just for replacement to offset depreciation-rebuilds and the like, which is very common in Sydney. Clearly new dwelling investment , for the better part of two decades, has been insufficient to offset those two factors .

That's perhaps why, and noting the latest surge in construction, there really is no sign of a glut when you look at the increase in the total housing stock. The number of dwellings has increased by around 490,000 in four years, to deal with population growth over the same period of just over 1.2 million. That gives an average of roughly 2.58 persons per dwelling. That's actually a rate well above recent averages which, if anything, hints at an underbuild. Why? Because it has contributed to a slight increase in the average number of people per dwelling.

This is interesting, because the trend since 1911 has been for a decline in the average number of people per dwelling. That simply reflects the significant social changes we've seen since then: smaller families, we're living longer, higher divorce rates etc.

Yet if there was a glut of housing or one developing, we should see the number of people per dwelling continue to fall – and at an accelerating rate. That is, at a rate above and beyond what social trends have been dictating for some time now. That we're not seeing this and in fact are seeing the number of person per household rising slightly, strongly suggests the absence of a glut.

This is probably why vacancy rates remain low. Nationally, SQM research suggests that the vacancy rate is 2.2 per cent, with Sydney at 1.7 per cent, Melbourne at 2.2 per cent and Brisbane at 2.6 per cent. In each case, well down on cyclical peaks, such as 4.5 per cent in the case of Sydney. We should expect vacancy rates to rise as construction picks up, but we've got a long way to go before vacancy rates get to problem levels.

The bottom line is that even with the surge in apartment building, there is very little evidence of a supply glut at the moment, or even of one in development. Some areas like inner city Melbourne may be in oversupply, but even then, with vacancy rates in Melbourne still low, it's hard to suggest Melbourne as a whole has a supply problem. Sydney even less so.

Outside of the higher density dwellings, the data still point to a significant underbuild of detached housing and I reiterate my view that this is where the best opportunities for investors perhaps lie.