Prime the pump for an oil market shift

The removal of trade sanctions on Iran is expected to release an extra 800,000 barrels of oil a day by next year. As Iran’s oil industry returns to pre-sanction levels it is likely the amount of oil per day pumped into the market will increase.

Market focus has promptly shifted to the falling oil price, with analysts divided on the extent of softness in oil prices to come. Iran was the second largest oil producer in the Organisation of the Petroleum Exporting Counties just over a year ago, making its contribution to the global oil supply important.

Oil prices have slipped at the thought of additional supply, but there are also perhaps more structural shifts grinding away at energy markets in general.

Until recently, traditional oil and gas markets and energy producers never even had to consider the thought of competing fuels. Who would have thought a few years ago that the US would generate more electricity from gas than coal.

Oil has traditionally dominated energy use in transportation markets, however the use of gas as an alternative is slowly starting to pick up. In the BP Energy Outlook 2030, BP concluded the transport sector is diversifying away from oil, forcing gas alternatives to the front. Although energy developments across transportation haven’t matched developments which have resulted in substitution in other energy markets, such as utilities, they are gaining traction.

Over the past year FedEx has been trialling trucks using liquefied gas and compressed gas – the success of the experiment will determine if the transportation company will move more of its 90,000 vehicles away from traditional diesel.

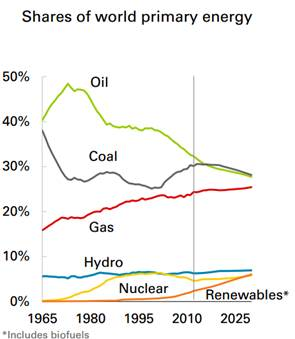

Improving fuel economy of cars is another factor impacting future demand expectations for the black gold. The graph below from BP’s report shows it is expected oils contribution to the global energy mix will continue to decline.

Beyond substitution in key markets of use oil is facing the actuality that global growth has slowed, consequently lowering demand forecasts. Further complicating the long-term prospects of oil are future growth expectations, which are likely to be driven by the less energy-intense developed markets.

If oil prices are affected by demand in conjunction with production by OPEC, it is feasible oil prices could soften further. A caveat would of course be any geopolitical tensions, which would disrupt the oil market.

While changes in the oil market aren’t expected to occur at the same pace as other energy markets, the elements for change are certainly there. The question for investors now lies with selecting the best energy sources to gain exposure to.