Pricing the shale revolution

Growth in US shale oil production could have the most significant long-term impact on oil prices of any supply event in recent decades. It has already been the major factor in rebalancing future expectations of supply and demand, thus anchoring long-term oil prices and reducing volatility in the market.

Should the potential of shale materialise, the resulting stability in future oil prices would likely spur the global economy, potentially allowing it to grow without facing energy bottlenecks. An expanding economy should, in turn, increase demand for other industrial commodities, benefiting commodity investors.

Moreover, persistent disruptions in current oil production and reduced storage-holding requirements due to lower fears over future supplies could combine to create a backwardated oil futures curve (in which prices for near-term deliveries are higher than those made for later on). This would contribute to positive roll yields (realised when futures contracts gain in value as delivery nears) and remove a factor that has been a drag on commodity investment returns for much of the past decade.

The discovery and development of deep water reserves globally and improved recovery and exploration techniques over the past two decades have helped non-OPEC producers to grow crude supplies only modestly, often trailing global demand and leaving the market reliant on increased output from OPEC. However, US shale and eventually shale production globally (combined with production from Canada’s oil sands) is potentially of the scale to change forward energy balances for the first time since the oil spikes of the 1970s led to the widespread development of new reserve basins. Over the past few years, in contrast, US production has grown by nearly 2.5 million barrels per day, the majority of which has been shale oil (see figure 1). Given that US production had been in decline for more than two decades, this is a remarkable turn of events.

Over the past few months, countless press reports have highlighted hopes for US energy independence and the prospect that the US will reclaim the mantle of largest global oil producer, a position last held in the mid-1970s. While an exciting and meaningful prospect, particularly for the US economy and trade balance, the flashy headlines lack important context for understanding global oil-supply balances, the impact on the world economy and implications for commodity investors.

Rebalancing global supply

First and foremost, growth in US onshore production has been required to meet demand growth over the past two years because of significant production declines due to geopolitical issues, such as the Arab Spring, and geological challenges in Azerbaijan, the North Sea, Brazil and Angola. If not for US shale oil, prices would have been significantly higher, exerting a meaningful drag on an already fragile global economy.

Although growth in US shale has not yet been sufficient to meaningfully weaken oil prices, it has had a notable impact on long-term price expectations, on both the upside and downside. As figure 2 shows, the rolling five-year forward oil price has been fairly stable at $90/barrel the past few years, roughly the marginal cost of shale oil production. This differs considerably from most of the prior decade when the back end of the oil market closely followed prompt (spot) prices higher. In 2008, in particular, the five-year forward price of oil rallied to $140/bbl as the front hit $140/bbl because no new supply source was evident to anchor expectations.

Often overlooked is the likelihood that continued US-centric growth in shale oil production will make non-OPEC output more sensitive to down moves in prices, more rapidly establishing a floor to oil prices should an adverse economic event occur. Specifically, Brent at $75/bbl today would likely do more damage to the 12-month outlook for supplies from reduced shale investment than in previous periods. In the past, the long lead time, large-scale nature of investments forced oil majors to look beyond short-term price volatility and invest through down cycles.

In addition, international oil companies often found more favourable conditions for investments in countries in need of money when prices were low. In contrast – although shale production has benefited from the widespread nature of reserves, short lead times between drilling and production and the large number of small players – shale extraction and production companies have less financial wherewithal than IOCs and national oil companies and would likely adjust spending more readily as prices decline, helping to more quickly establish a floor under the oil market. In essence, $90/bbl is today what $20/bbl was at the turn of the century.

Commodities become more compelling

Although lower outlooks for oil prices and volatility might not sound like a positive backdrop for commodity investors, there are many reasons to be optimistic. Counterintuitively, long-term anchoring of price expectations may contribute to positive roll yield, providing a tail wind to return potential. This is in stark contrast to the 2004 to 2008 period when negative roll yields were a persistent drag on commodity investor returns. Before 2003, investors realised a positive roll yield from petroleum of nearly 5 per cent, on average, compared with a -8 per cent average from 2003 to 2010, according to PIMCO calculations. During this latter period, when market participants lacked comfort in future supplies, the two means for providing energy security were to increase prices to motivate investment in supply and to increase storage to bring current supplies into the future. As such, market participants sent forward prices substantially higher, motivating producers to begin investing and increasing prices to the point where a physical surplus was created and barrels were stored to meet future needs.

In contrast, the current market is rather sanguine about future spare capacity. However, recurring supply outages have tightened real-time balances and supported high spot prices relative to deferred contracts. Figure 3 shows the recent trend in supply outages, one that is likely to continue given current geopolitical instability. This should result in a backwardated crude oil curve and positive roll yields for investors. Since the start of the Arab Spring, Brent crude oil has averaged a positive 5 per cent roll yield, raising the S&P GCSI Brent Crude Excess Return Index in 2012 to 8 per cent, despite a spot increase of only 3 per cent, demonstrating the power of positive roll yield contributions to returns. NY Harbor NYMEX spec gasoline shortages were even more extreme than Brent in 2012 as the closure of several US East Coast refineries created spot shortages. As a result, the RBOB sub-index (for gasoline without ethanol) had a 22 per cent positive roll yield, raising the S&P GSCI Unleaded Gasoline Index return from 4 per cent for the spot index to 26 per cent for the excess return index.

Looking ahead, the increased share of Brent in the main indexes as well as the likely reconnection of West Texas Intermediate to global markets following two years of supply bottlenecks will likely boost the contribution from roll yields to commodity index returns. In addition, the recent willingness of Saudi Arabia to curtail production when refiners desired lower supplies, as demonstrated by the kingdom reducing output by roughly 800,000 barrels per day since the third quarter of 2012, will likely support market structure, as long as the swing in production does not exceed the Saudi’s willingness or desire to balance the market.

A win for the global economy

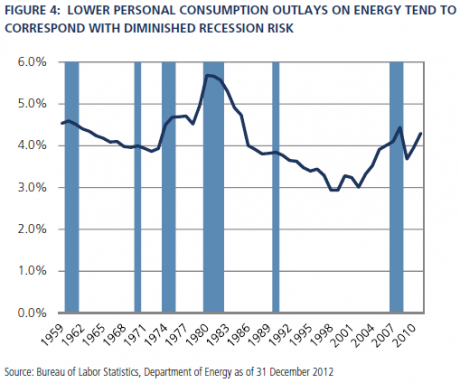

An important likely beneficiary of rising shale oil production is the global economy. After acting as a significant brake on economic activity during the run-up in prices during the last decade, greater energy availability will at the very least be a positive for global growth. Historically, when energy has consumed more than 6.5 per cent to 7 per cent of global GDP, economic growth has slowed substantially, often into recession. In the US over the past several decades, personal consumption expenditure on energy in excess of 4 per cent to 4.5 per cent has frequently corresponded with recessions, while lower energy PCE has had the opposite tendency (see figure 4). Currently, this implies oil prices would have to rise above $145/bbl to induce a material slowdown in the global economy. In our opinion, it is only shale oil production that is preventing this.

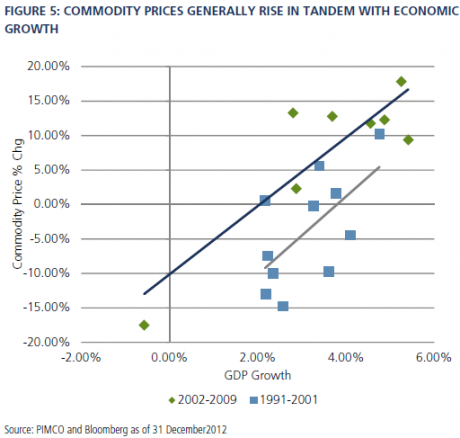

Importantly, for investors in diversified indexes, an economy less constrained by energy inputs will lead to increased economic activity, spurring incremental demand for other commodities. In fact, for every 1 per cent rise in the global GDP growth rate, commodity prices historically have been boosted by 4 per cent to 5 per cent (see figure 5), with energy and base metals exhibiting the highest beta and agricultural commodities the lowest. Ultimately, what is good for global growth is good for commodity investors. All of this is in addition to our belief that the backdrop of persistently negative real interest rates will continue to be a tailwind for real assets.

The shale oil revolution in the US is a classic example of high prices and improving technology spurring methods of commodity production that may have been historically unimaginable. As this revolution spreads across the world, we believe it is likely to significantly impact the global economy, the shape of the oil futures curve and concurrent potential returns for commodity investors.

Greg E Sharenow is an executive vice president and a porfolio manager focusing on real assets at Pimco. Mihir P Worah is a managing director and head of the real return portfolio management team.

Pimco. © Pacific Investment Management Company LLC. Reprinted with permission. All rights reserved.