Portfolio Update February 2020 - don't panic and hold the line

We need to start with this statement: we understand that February will have impacted your investment performance and we understand that the kind of market movements we have seen in February can rock your investment resolve. We understand it because we too are investors that have skin in the game and have also felt February’s wrath.

- Yes, February logged the fastest ‘correction’ (a 10 per cent fall or more) in US market history, falling 12 per cent in six days.

- Yes, the ASX corrected for the first time in over two years in February and has fallen further to start March

- And yes, the very near future looks uncertain as highlighted by the now ‘synchronised response from monetary policy,’ adding to the fear around what the coronavirus might mean for the global economy.

What happened in the backend of February is one of those events that can cause ‘emotion investing’ or should that be ‘divesting’. When volatility is up, decision making needs to be at its clearest, as allowing ‘emotion’ to drive investment decision-making creates irrational choices and can create bigger losses long term.

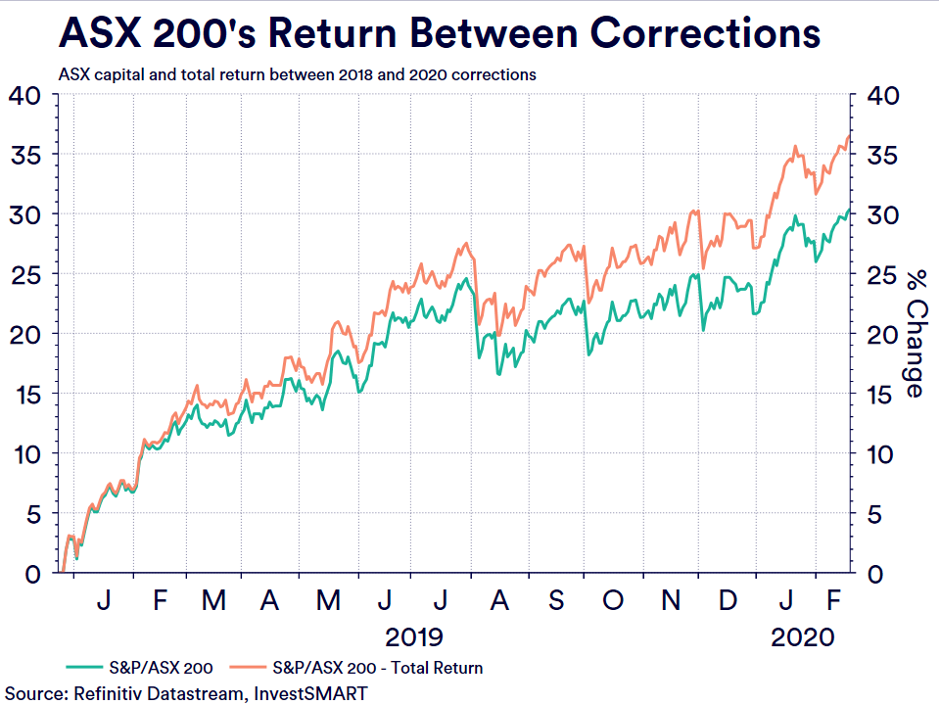

Why we say this is that, what was lost in all fear was that February was a record all-time high for six MSCI Developed Markets including the ASX 200 and S&P 500. Also lost in the February hysteria is that since the last correction in late 2018 to the start of this one (February 20), the ASX 200 was up 30 per cent on a capital basis and over 36 per cent on a total returns basis.

If we roll forward and include the final week of February, that return falls to 17.3 per cent on a capital basis and 23.1 per cent on a total returns basis.

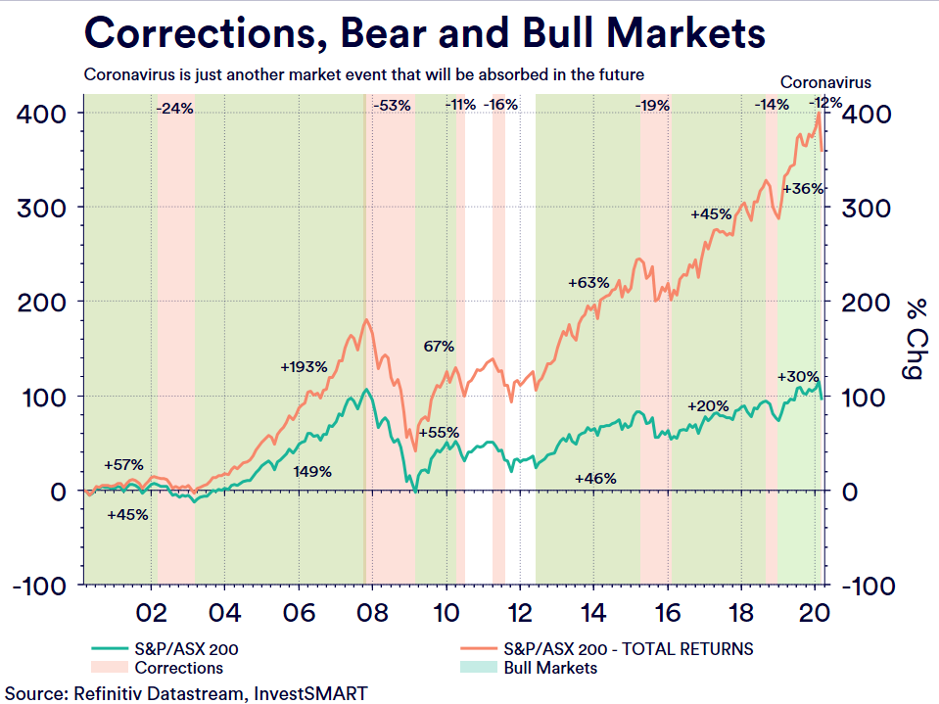

However, let’s look back even further to look forward. Over the past 20 years the ASX has had seven corrections (a 10 per cent or more decline) including the February correction. Of the seven corrections, two were bear markets (a 20 per cent or more decline). Over the same period there have been five bull markets (gains of 20 per cent or more). These bull markets are amplified when you view it for total returns, highlighted here.

This is the chart that should give you confidence and the reassurance that whatever happens over this period, the markets will recover. And, in all likelihood, will overtake the correction sometime in the future. Remember, since 1900 the US market, on average, experiences a correction every year. Corrections are a natural part of market behaviour, an unfortunate part, but a part, nonetheless.

With events like we are currently in, your time horizon, diversification and risk profile are key to overcoming emotional investing. Please evaluate whether your risk level and diversification are meeting your needs but also factor in your time horizon. The longer your time horizon, the more time you have to average down your pricing, to diversify your investment assets and allow the reinvestment of your returns to amplify your overall total returns by also averaging out your investment cost base.

Yes, February hurt and yes it will have you asking questions about your strategy. But, looking back over history at all the events that have caused corrections and even bear markets, one thing is clear: markets have always returned stronger and better than before.

So, don’t panic and hold the line as an event like the one transpiring now should not change your overall long-term investment strategy.

Diversified Portfolios

Individual capital performance of the securities held by the Diversified Portfolios, with weightings varying depending on risk appetite.

Conservative

- Contracted 2.17 per cent after fees in February as coronavirus fears hit equities.

- Domestic equities (-0.95 per cent), International Equities (-0.95 per cent) and Property (-0.43 per cent) detracted from performance while Treasuries ( 0.29 per cent) and Cash (0.02 per cent) attributed to performance.

- The Yield on the Conservative Portfolio sits at 2.78 per cent.

Balanced

- Contracted 3.96 per cent after fees in February as coronavirus fears ramped up.

- Domestic Equities (-1.8 per cent), International Equities (-1.67 per cent) and Property (-0.57 per cent) detracted from performance while Treasuries ( 0.26 per cent) and Cash (0.02 per cent) attributed to performance.

- The Yield on the Balanced Portfolio sits at 3.19 per cent.

Growth

- Contracted 5.35 per cent after fees in February as coronavirus fears ramped up.

- Domestic equities (-2.27 per cent), International Equities (-3.5 per cent) and Property (-0.51 per cent) detracted from performance while Treasuries ( 0.03 per cent) and Cash (0.001 per cent) attributed to performance.

- The Yield on the Growth Portfolio sits at 3.54 per cent.

High Growth

- Contracted 7.03 per cent after fees in February as coronavirus fears ramped up.

- Domestic Equities (-3.01 per cent), International Equities (-2.44 per cent) and Property (-0.66per cent) detracted from performance while Treasuries ( 0.1 per cent) and Cash (0.01 per cent) attributed to performance.

- The Yield on the High Growth Portfolio sits at 3.96 per cent.

Satellite Portfolios

International Equities

- Contracted 7.03 per cent after fees in February as coronavirus fears hit international supply chains.

- S&P 500 (IVV) detracted -2.95 per cent, European Equities (VEQ) detracted -0.84 per cent while the global holding VGS detracted -3.31 per cent.

- All facets of the portfolio detracted from the portfolio.

Interest Income

- Expanded 0.57 per cent after fees in February as investors shifted into defensive assets.

- Treasuries attributed 0.57 per cent, corporate fixed interest attributed 0.04 per cent while floating rate notes were flat.

- All facets of the portfolio contributed to performance in February.

- The Yield on the Interest Income sits at 1.98 per cent.

Property and Infrastructure

- Contracted 5.72 per cent after fees in February as coronavirus fears hit.

- Domestic Property detracted 1.12 per cent, International Property detracted 1.38 per cent, TCL detracted 0.55 per cent while international infrastructure detracted 1.85 per cent.

- The Yield on the Property and Infrastructure sits at 4.03 per cent.

Hybrids portfolio – Commentary by Portfolio Manager Alastair Davidson

- The total portfolio return was -1.78% for the month including franking credits

- The total portfolio return was -0.86% and 3.20% for the quarter and 12-month period. Since inception the total portfolio return is 3.69% including franking credits, which is -0.73% over its return objective of the RBA Cash rate plus 3%.

- The trading margin of ASX-listed hybrids increased from 2.64% to 3.44% during February as gross yields increased on most securities as prices traded lower. This resulted in our portfolio recording a loss for the month.

- We expect this price decline to reverse shortly, as investors resume the search for yield

- The RBA cut the official Cash rate on 2 March to 0.50%. Low cash and bond yields continuing to drive investor demand for higher yielding securities and asset classes.

- February had no securities trading ex-distribution.

- At end of February the portfolio had 6.7% allocation to cash.

For more information on our Diversified Portfolios, click here.

Frequently Asked Questions about this Article…

The stock market experienced a correction in February 2020 due to heightened fears surrounding the coronavirus and its potential impact on the global economy. This led to a rapid decline in market values, with the US market falling 12% in just six days.

Investors should avoid panic and emotional decision-making during market corrections. It's important to maintain a long-term perspective, evaluate your risk level and diversification, and remember that markets historically recover and often come back stronger.

Historically, the US market experiences a correction, defined as a 10% or more decline, approximately once a year. These corrections are a natural part of market behavior.

In February 2020, various investment portfolios experienced contractions due to coronavirus fears. Conservative portfolios contracted by 2.17%, Balanced by 3.96%, Growth by 5.35%, and High Growth by 7.03% after fees.

Diversification helps mitigate risk during market volatility by spreading investments across different asset classes. This can help stabilize returns and reduce the impact of any single asset's poor performance.

A long-term investment horizon allows investors to ride out short-term market fluctuations, average down pricing, and benefit from the reinvestment of returns, ultimately amplifying total returns over time.

The Interest Income portfolio expanded by 0.57% after fees in February 2020 as investors shifted towards defensive assets like treasuries, which contributed positively to the portfolio's performance.

The RBA cut the official cash rate to 0.50% on March 2, 2020, which, along with low cash and bond yields, is expected to drive investor demand for higher-yielding securities and asset classes.