Portfolio Allocation Update

You may have heard about the US Federal Reserve recently raising rates and we wrote about the surprising extent to which it will affect investors in Australian Government bonds. In truth no-one really knows what the Fed will do next and there will most likely be some miss-steps and uncertainty along the way. That means volatility - short term losses as well as gains.

Perhaps more importantly the last few years have seen Australian Government bond yields decline significantly. This means that their expected return is now only slightly above current inflation. More volatility and less returns is obviously not an appealing prospect, therefore many investors have shifted their assets into shares and property trusts that pay decent dividends. This obviously isn’t an option for truly defensive portfolios.

With that in mind we at InvestSMART are starting to broaden our interpretation of what defensive means. We have diversified some of the defensive assets that were in a fixed income ETF (IAF) into another product called the Macquarie Income Opportunities Fund (MIO).

What is the Macquarie Income Opportunities fund and what does it bring to the portfolio?

MIO is an actively managed fund that can invest in company debt as well as cash and government bonds. It also has an absolute return objective so it is incentivised to be defensive if the yield is simply not there. This is in contrast to many active managers who have an incentive to invest in higher risk assets in order to outperform the market benchmark and then blame the markets if things turn sour.

More importantly the Fund predominantly invests in Floating Rate Notes. These are bonds issued by companies whose coupons (interest payments paid by the company to you) move upwards with inflation.

We haven’t thrown the baby out with the bath water as traditional fixed income may yet be helpful in times of stress. There is still a little room for reductions in interest rates in Australia and expectations of lower interest rates generally mean fixed income funds do well over a short, stressful period in markets. With that in mind we have moved only around 40% of the portfolios’ fixed income exposure into MIO, which we think will make the defensive part of the portfolio more, well, defensive.

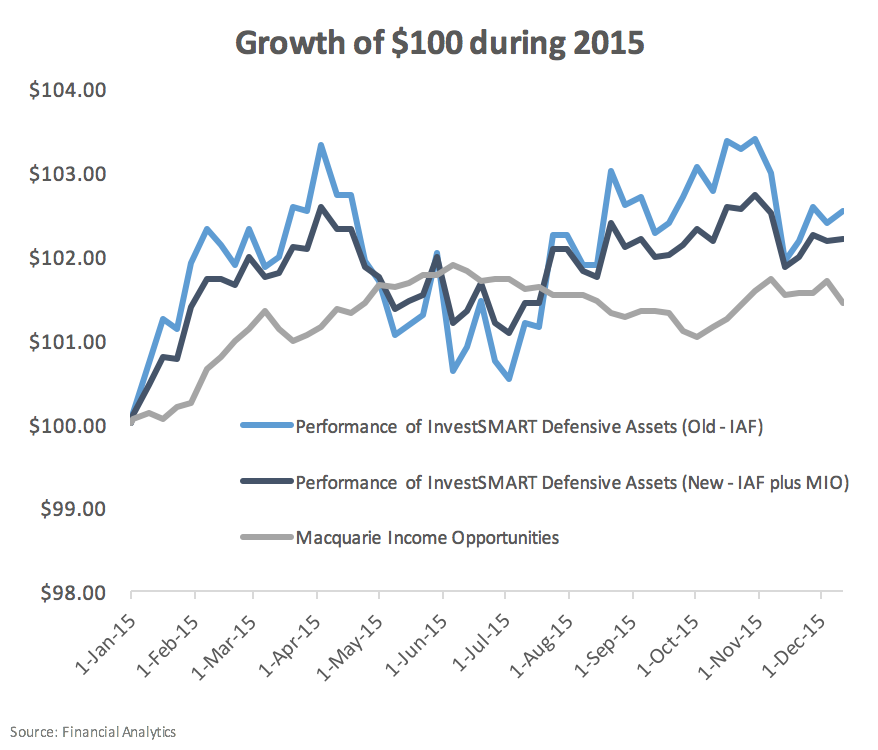

A comparison of the new portfolio’s performance with the old one’s over the last year clearly highlights the difference: the new portfolio achieved a similar result with much less volatility.

In summary therefore:

- We think this will reduce overall volatility of the portfolio in coming years.

- The new configuration has an average yield-to-maturity of 3.8%, compared to 2.49% for the old one. So even accounting for the slight increase in potential default (a company not being able to pay interest or return capital) we expect higher returns.

- MIO is well diversified with exposure to 100’s of different companies. This could seem like a lot but is actually quite normal for a bond funds, whose exposure to different companies can run to many thousands. It is also not too big (which can also be a problem for bond funds these days).

- The fund is reasonably priced (management fees are just under 0.5% per annum) and has a good track record.

Remember though, this new configuration is more defensive and as such will lag when fixed income markets rally hard (and that could be just when equity markets suffer). So we have traded some potential downside protection in certain (deflationary) scenarios with better expected returns and probably better downside protection if inflation ever rears its ugly head again. We think that’s a good trade-off.

Frequently Asked Questions about this Article…

The US Federal Reserve's rate hike introduces uncertainty and potential volatility in the market, affecting Australian Government bonds by making their expected returns only slightly above current inflation. This has led many investors to seek alternatives like shares and property trusts.

The Macquarie Income Opportunities Fund (MIO) is an actively managed fund that invests in company debt, cash, and government bonds. It aims for absolute returns and is designed to be defensive, especially when yields are low. MIO predominantly invests in Floating Rate Notes, which adjust with inflation, making it a strategic addition to a defensive portfolio.

InvestSMART is diversifying into the Macquarie Income Opportunities Fund to reduce portfolio volatility and enhance defensive capabilities. By moving around 40% of fixed income exposure into MIO, they aim to achieve higher returns with less volatility compared to traditional fixed income assets.

Floating Rate Notes are bonds issued by companies with interest payments that adjust upwards with inflation. They are important in the MIO fund because they provide a hedge against inflation, ensuring that the fund's returns remain competitive even when inflation rises.

The new portfolio configuration has achieved similar results to the old one but with much less volatility. It offers an average yield-to-maturity of 3.8%, compared to 2.49% for the old configuration, indicating better expected returns despite a slight increase in potential default risk.

Yes, the Macquarie Income Opportunities Fund is well diversified, with exposure to hundreds of different companies. This level of diversification is typical for bond funds and helps mitigate risk by spreading investments across various issuers.

The management fees for the Macquarie Income Opportunities Fund are reasonably priced at just under 0.5% per annum, making it a cost-effective option for investors seeking a defensive investment strategy.

The new defensive portfolio configuration may lag when fixed income markets rally, particularly during deflationary scenarios. However, it offers better expected returns and improved downside protection if inflation rises, which InvestSMART considers a worthwhile trade-off.