Our top LICs for income

Summary: The top five LICs for income are actively managed portfolios, as they take profit on a more regular basis than funds that buy and hold stocks. Portfolios that hold companies in the ASX20 will usually deliver above market average income year in, year out, whereas actively traded LICs will see dividends fluctuate more. |

Key take out: LICs pay dividends out of dividends they receive from holdings as well as realised profits. Don't get too excited about a large hit of dividends in your portfolio – preserve this for future gaps in dividend payments. |

Key beneficiaries: General investors. Category: LICs. |

At its very best, the LIC market offers a superb blend to the active investor: Management costs can be kept very low, especially as funds mature, while a concentration on top class stocks along with the ability to build dividend "reserves" means an invest can get the best of both worlds.

In picking the best LICs for the dividend hungry investor, we have matched the best LICs with a proven ability to offer strong dividends in every climate.

How do you find these income LICs? A high dividend yield for a start of course but more so consistent dividend payers. The consistency is important because we do not want to be investing in LICs with high yields simply because the share price has dropped significantly and that was what caused the LIC to have a high yield.

Missing the cut

We have excluded LICs with small market caps making them hard to buy. Newly listed LICs also do not get make the grade just yet, even though there are some new ones that would feature in this list down the track. But right now they have not built up sufficient reserves. And international LICs miss the cut, as they have a history of paying little to no dividends.

Where the dividends come from

With an LIC, a good growing dividend is the function of good performing manager. Dividends are paid through income received by the LIC, which in turn comes from dividends paid by companies it holds as well as through realised gains from profit taken from its investments. It's these earnings, minus the fees and the retained earnings held back to reinvest and/or put in the profit reserves, that make up a LIC's dividends.

The rankings

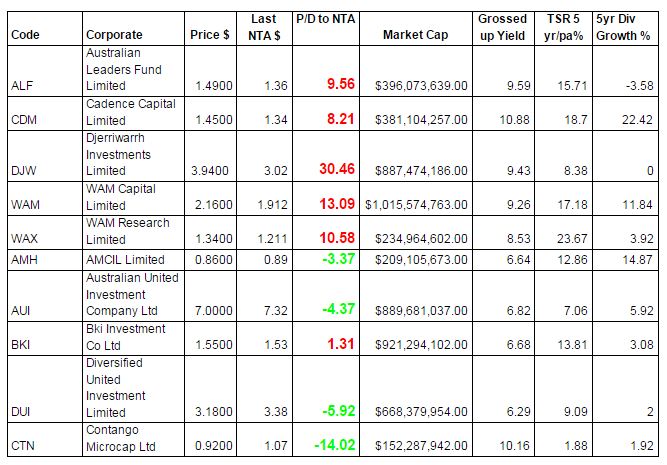

Here is a table of the top ten as ranked by grossed up dividend yield. I have included in the table the premium/discount to NTA, five-year total return numbers and the LICs growth in dividends over five years.

It should come as little surprise to investors that the highest dividend payers are also the best performing LICs. Once again, dividends are paid from returns and prior returns that sit in profit reserves.

The top five names are all actively managed LICs, much more so than those LICs that buy and hold quality names for long periods of time. The top five take profit on a more regular basis from the stocks held as well as income as opposed to the likes of Australian Foundation Investment Company (AFI) and BKI Investment Company (BKI), which predominantly pay out dividends the portfolios receive.

In the past I have written at length about WAX, WAM and CDM and have sat down and interviewed ALF Chief Investment Officer Justin Braitling. We have not discussed DJW a great deal though.

DJW is an LIC that is run by the same team who manage Australian Foundation Investment Company, Mirrabooka and AMCIL. When looking at the top holdings of DJW, you will see the usual top ASX20 names. Where the team at DJW add value is by selling options over holdings. By doing this, they are able to generate extra income and therefore additional yield for shareholders.

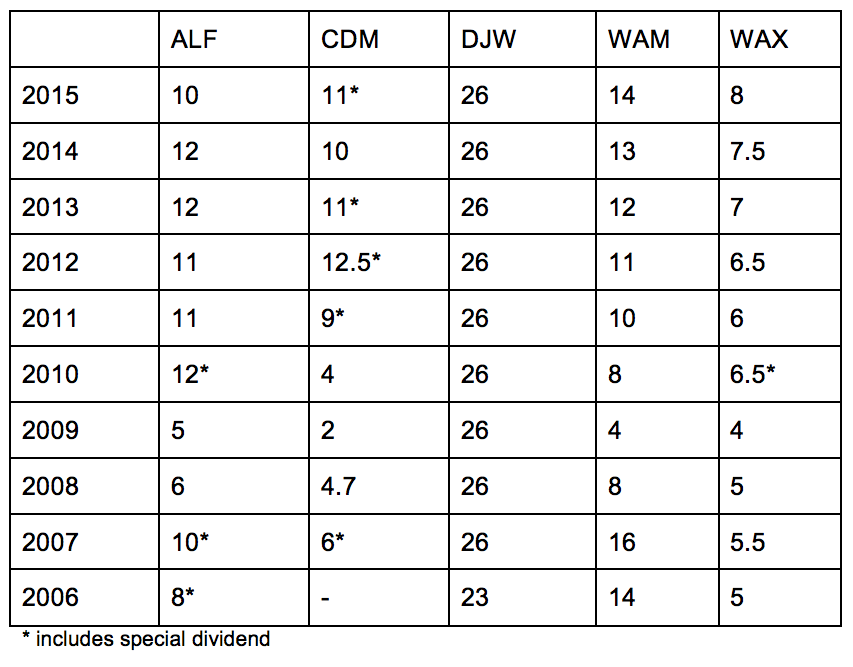

Many investors may be put off by the large premium to NTA DJW appears to constantly trade at. I would suggest investors look more towards the yield rather than the premium. The yield tends to keep the share price at a steady premium of 30 per cent. Also there is no mystery to what the dividend will be with DJW. Year in and year out it comes in at 26 cents per share. Due to the high payout ratio, expect little in the way of capital growth with DJW. Additionally when the market is running, DJW tends to lag behind.

Large cap focused portfolios will typically yield slightly higher than the market average year in and year out, whereas the more agile and actively traded funds' dividends will fluctuate with each portfolio's performance. Going forward, it will be interesting to see dividends from the likes of CDM, ALF, WAM and WAX.

A word of caution

Do not think you will be getting nine per cent over more out of these LICs going forward. The dividend yield is based on the latest dividend paid, and of course the majority of share prices have fallen in the last few weeks. As a result, the yield looks inflated. What you will need to keep an eye on is the underlying performance of the LIC via the NTA. Once again this is what will allow them to pay dividends going forward combined with reserves.

Late last year we took a look at how LICs use profit reserves (see Which LICs are prepared for leaner times?, October 19, 2015). As part of this we also highlighted some LICs that were a little thin when it came to reserves.

BKI has since paid a dividend but the others are yet to announce half yearly reports. We highlighted in the above piece that ALF was in need of picking up performance or the dividend would be in danger of being cut.

A history of the top five dividends

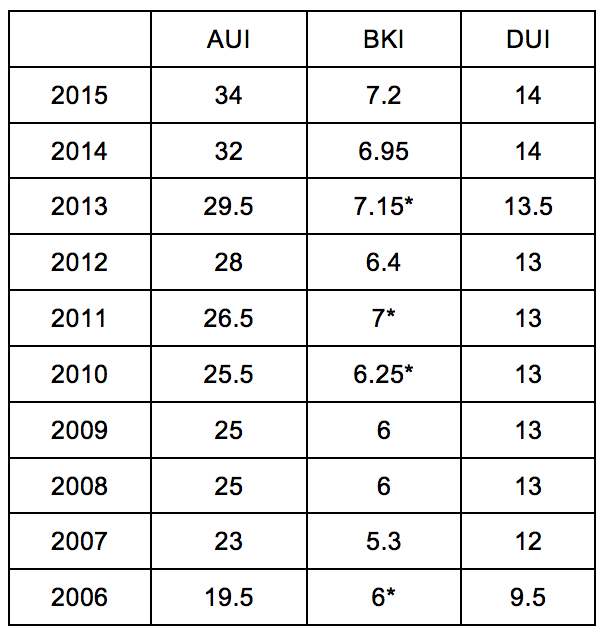

What you will notice in the above table (which shows dividends over the last ten years in cents per share), only one LIC did not cut its dividend through the GFC. That was DJW. Looking at the list of ten LICs in the top table, there were three other LICs that did not cut dividends either. In fact these three LICs have never taken a step back in dividend payments.

What does the above tell us? These long term portfolios that have in some cases been running for decades are incredibly consistent and manage dividend distributions well. The returns of the portfolios will ebb and flow with the market but the company structure allows for a steady flow of dividends.

Portfolio construction

When thinking about portfolio construction focusing on income LICs a combination of the consistent payers and the high fliers would not be a bad mix. Investors who want certainty with their income would be more beneficial investing with the likes of BKI, DUI and AUI. It is clear from looking at the dividend history and these LICs reports dividends are a core focus. There are no certainties in the market but these LICs maintaining the current level of dividends would be a relatively short priced bet.

When it comes to the higher dividend paying LICs, just like higher growth stocks, you should expect more risk. You run the risk of the dividend being cut off the back of weaker performance but at the same time you also open yourself up to upside potential as well.

Importantly, I think more people should think like a LIC manager when it comes to paying themselves from their super fund.

A LIC does not just pay a distribution from dividends received alone. Distributions are made of realised profits and dividends. To be income focused you do not just have to stick with the highest dividend payers and forget about growth. Take profit from your LICs or holdings when valuations are stretched. That is how the names up the top of the list can pay out what they do.