Our annual bond portfolio review

Summary: In the listed bond market, most securities pay floating rate coupons, which helps ensure capital stability. Risks include credit risk and subordination risk, but bonds should offer a better return than term deposits. For my model bond portfolio, the current yield's spread over the Commonwealth government bond rate is virtually unchanged from inception a year ago. |

Key take-out: The portfolio has put in a sound performance, but as two senior bonds are approaching maturity, there are advantages to substituting these for two other offerings. |

Key beneficiaries: General investors. Category: Investment bonds. |

A little over a year ago, I wrote in Eureka Report about building a listed bond portfolio (see The $6,000 diversified bond portfolio, March 31, 2014). By listed bonds, I mean interest rate securities listed on the ASX.

Despite the listed interest rate securities market being only a fraction of the size of the wholesale corporate bond market, I demonstrated that it was relatively easy and feasible to put together a portfolio that offered capital stability, an attractive and predictable income stream, and diversity of issuers and bond maturity dates.

Given that a year has passed, it is appropriate to review the performance of the portfolio and consider whether any changes need to be made to the composition of the securities that are held.

The portfolio has performed very well, as is shown below, and it is time to consider some changes with two securities approaching maturity. But the level of challenge has increased with a dearth of issuance of anything other than hybrid securities.

But before getting into this, it may be useful to recap the advantages identified for the listed interest rate securities market.

Benefits of listed bonds

As noted at the time, the most obvious advantage is that the market is a listed market.

As such, buyers and sellers are matched by the brokers that operate in the market. The wholesale market relies a lot more on what a trader may have in his trading inventory on a given day or what the trader wants to buy.

Another advantage albeit not exclusive, is that almost without exception, the interest rate securities pay floating rate coupons. That is, the coupons are determined by a credit margin that is paid over the bank bill rate.

So as the bank bill rate moves up or down over time, so will the coupon paid. Some may argue that has proved not to be an advantage over the last year, as interest rates have continued to decline.

At the time of writing the original article, the consensus view was that interest rates had reached the bottom of the cycle and the next move from there would be up. It was not expected that the official cash rate would in fact, remain steady throughout the year before the Reserve Bank cut the rate in February and cut again, last month.

Can we say that we have reached the bottom of the cycle now? Who knows, but we must be closer.

Nevertheless, floating coupons are an important factor in ensuring the capital stability of an interest rate security portfolio.

A typical fixed rate bond portfolio will rise in value as interest rates fall and will decline in value as interest rates rise because the return on that portfolio is fixed, while interest rates in the market place will change. As the return on a floating rate portfolio will move largely in line with interest rates in the market, there will be little impact on the capital value of the portfolio, as is shown in the performance review below.

Weighing up the risks

Also discussed in the original article were the risks that investors need to be aware of:

- Credit risk – both changes in the credit quality of a bond issuer or a default by a bond issuer will adversely impact capital stability.

- A lack of issuer diversity in the listed market can lead to concentrated exposures to a few industry sectors, particularly banking in our market.

- And there is subordination risk with the listed market being dominated by subordinated and hybrid security issues. The level of subordination within an issuer's capital structure increases the likelihood of loss, should the issuer default.

It is important to remember that the reason for investing in bonds, within the constraints outlined above, is to preserve capital, generate income and minimise downside risks. It is not about seeking the upside that comes with shares.

Moreover, bonds should offer a better return on your money than simply having cash on deposit in the bank or stuffed under the mattress.

Reviewing the portfolio

The listed interest rate securities portfolio developed was comprised of senior, subordinated and hybrid notes in almost equal measure. The portfolio also avoided duplication of issuers but it was necessary to include one fixed rate senior bond.

The Heritage Bank bond pays a fixed coupon of 10 per cent per annum. But as it comprised approximately 8 per cent of the portfolio, changes in capital value should have only a limited impact on the capital value of the portfolio.

The portfolio as constructed in March 2014 is presented below:

The Model Listed Bond Portfolio | ||||||||

Security Name | ASX Code | Security Type | Last Price 21/3/14 | Yield to Call | Early Redemption Date | Final Maturity Date | Minimum Units | Portfolio Value |

ANZ Capital Note | ANZPD | Hybrid | $102.25 | 7.29% | Sep-21 | Perpetual | 5 | $ 511.25 |

Bank of Queensland CPS | BOQPD | Hybrid | $108.54 | 7.00% | Apr-18 | Perpetual | 5 | $ 542.70 |

NAB CPS II | NABPB | Hybrid | $101.00 | 6.82% | Dec-20 | Perpetual | 5 | $ 505.00 |

CBA PERLS VI | CBAPC | Hybrid | $103.98 | 6.44% | Dec-18 | Perpetual | 5 | $ 519.90 |

AGL Energy Subordinated Notes | AGKHA | Subordinated | $105.55 | 6.00% | Jun-19 | Jun-39 | 5 | $ 527.75 |

Suncorp Subordinated Notes | SUNPD | Subordinated | $102.40 | 6.01% | Nov-18 | Nov-23 | 5 | $ 512.00 |

AMP Subordinated Notes 2 | AMPHA | Subordinated | $101.36 | 5.97% | Dec-18 | Dec-23 | 5 | $ 506.80 |

Westpac Subordinated Notes | WBCHA | Subordinated | $102.92 | 5.25% | Aug-18 | Aug-22 | 5 | $ 514.60 |

Tatts Group Bond | TTSHA | Senior | $104.60 | 6.08% | Jul-19 | Jul-19 | 5 | $ 523.00 |

Heritage Bank 10% Bond | HBSHB | Senior | $105.65 | 5.47% | Jun-17 | Jun-17 | 5 | $ 528.25 |

Australian Unity Notes | AYUHA | Senior | $103.85 | 5.09% | Apr-16 | Apr-16 | 5 | $ 519.25 |

Primary Bonds Series A | PRYHA | Senior | $104.65 | 5.09% | Sep-15 | Sep-15 | 5 | $ 523.25 |

Weighted Average Yield to Call | 6.04% | |||||||

Weighted Average Term to Call | 4.5 years | |||||||

Total Portfolio Value | $6,233.75 | |||||||

At the time of inception the portfolio was generating a yield to maturity/first call date of 6.04 per cent per annum and had a weighted average term to maturity of 4.5 years. The yield was well ahead of what could have been achieved with a term deposit but the credit risk of the portfolio is higher. In relative terms, the weighted average yield provided a credit spread of 2.42 per cent over the interpolated 4.5 year swap rate and a spread of 2.61 per cent over the equivalent Commonwealth government bond rate.

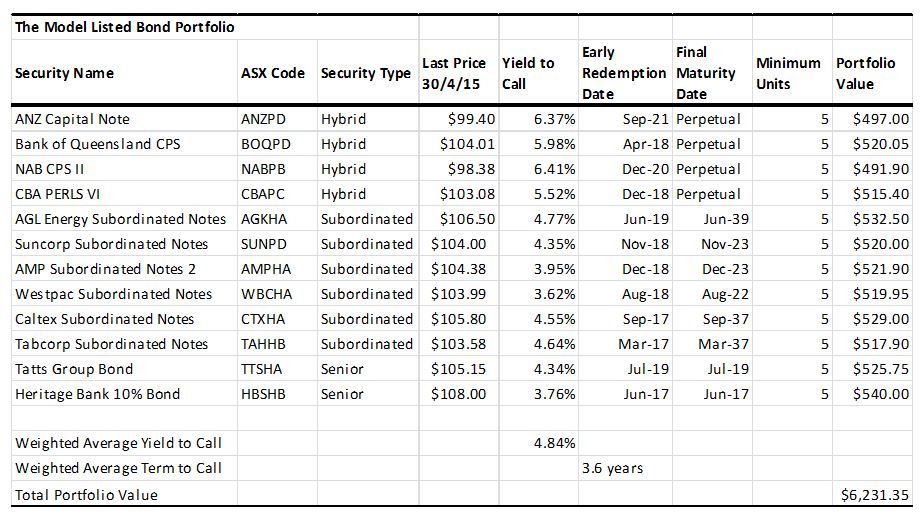

In the table below, last price, yield to call and portfolio value are updated to the end of April 2015, with the changes in weighted average yield to call and term to call noted.

The Model Listed Bond Portfolio | ||||||||

Security Name | ASX Code | Security Type | Last Price 30/4/15 | Yield to Call | Early Redemption Date | Final Maturity Date | Minimum Units | Portfolio Value |

ANZ Capital Note | ANZPD | Hybrid | $ 99.40 | 6.37% | Sep-21 | Perpetual | 5 | $497.00 |

Bank of Queensland CPS | BOQPD | Hybrid | $104.01 | 5.98% | Apr-18 | Perpetual | 5 | $520.05 |

NAB CPS II | NABPB | Hybrid | $ 98.38 | 6.41% | Dec-20 | Perpetual | 5 | $491.90 |

CBA PERLS VI | CBAPC | Hybrid | $103.08 | 5.52% | Dec-18 | Perpetual | 5 | $515.40 |

AGL Energy Subordinated Notes | AGKHA | Subordinated | $106.50 | 4.77% | Jun-19 | Jun-39 | 5 | $532.50 |

Suncorp Subordinated Notes | SUNPD | Subordinated | $104.00 | 4.35% | Nov-18 | Nov-23 | 5 | $520.00 |

AMP Subordinated Notes 2 | AMPHA | Subordinated | $104.38 | 3.95% | Dec-18 | Dec-23 | 5 | $521.90 |

Westpac Subordinated Notes | WBCHA | Subordinated | $103.99 | 3.62% | Aug-18 | Aug-22 | 5 | $519.95 |

Tatts Group Bond | TTSHA | Senior | $105.15 | 4.34% | Jul-19 | Jul-19 | 5 | $525.75 |

Heritage Bank 10% Bond | HBSHB | Senior | $108.00 | 3.76% | Jun-17 | Jun-17 | 5 | $540.00 |

Australian Unity Notes | AYUHA | Senior | $102.00 | 3.88% | Apr-16 | Apr-16 | 5 | $510.00 |

Primary Bonds Series A | PRYHA | Senior | $101.45 | 4.09% | Sep-15 | Sep-15 | 5 | $507.25 |

Weighted Average Yield to Call | 4.74% | |||||||

Weighted Average Term to Call | 3.4 years | |||||||

Total Portfolio Value | $6,201.70 | |||||||

On a point to point measurement, the value of the portfolio has slipped by $32.05 or 0.5 per cent of the original sum invested. This is nothing to be concerned about.

Remember that the interest rate securities were all acquired at prices above face value, indicating that the securities were generating coupon payments that exceeded market requirements at the time. So any diminution in capital value at redemption is covered by the excess coupon payments received prior to redemption.

All but two of the securities continue to trade at a premium to face value but the price now reflects the yields currently required in the market. This requirement has reduced as a result of the intervening reductions in the official cash rate and it has reduced as the securities get closer to their call or maturity dates.

As a result, the weighted average yield to call/maturity is 4.74 per cent (6.04 per cent at inception) and the weighted average term to call/maturity has reduced to 3.4 years (4.5 years). The current yield on the portfolio still offers a spread of 2.43 per cent (2.42 per cent) over the interpolated swap rate and a spread of 2.58 per cent (2.61 per cent) over the equivalent Commonwealth government bond rate.

The credit spread generated by the portfolio is virtually unchanged from that generated at inception, while the term risk profile of the portfolio has reduced by 1.1 years on a weighted average basis. This is a sound performance.

Measuring to the end of May, total income over the period was $370.92 or a return of 5.95 per cent on the original investment. But this not an annualised rate because the period being measured is 58 weeks. The annualised rate of return is 5.33 per cent. This is consistent with the decline in interest rates over the period.

Now what changes need to be made?

Unfortunately two of our senior bonds are approaching maturity. The Primary Bonds Series A will mature in September this year, and the Australian Unity Notes will mature next April.

I say unfortunately, because there are no alternative senior ranking bonds that can be acquired in the secondary market without duplicating issuers in the portfolio, swapping into a similarly short dated maturity, or both. There has been a dearth of senior ranking bond issuance, and since the start of 2014, subordinated note issuance has dried up with only hybrid issuance continuing.

That said, XTB bonds listed on the ASX just last week. XTB bonds are effectively exchange-traded funds based on individual bonds sourced from the wholesale corporate bond market.

While these bonds are readily available to investors, they are fixed rate bonds and offer considerably lower yields than those being achieved in the portfolio at the present time. XTB bonds may be the subject of a separate article.

Thus, holders of the current portfolio can continue to hold the Primary Bonds and Australian Unity Notes until maturity, in the hope that alternative issues will emerge in the interim or that the issuers may elect to issue new bonds. Or consideration must be given to other subordinated notes (not already included in the portfolio) listed on the ASX.

One advantage of taking the latter approach is that the sectoral diversity of the portfolio can be increased, along with the weighted average yield generated. There are several corporate issuers of subordinated notes that were not considered for the original portfolio because of the very long final call dates attached to their notes.

The issuers include APA Group, Crown Resorts, Caltex Australia, Tabcorp and Woolworths. However the APA Group and two Crown Resort subordinated notes issues have final maturities beyond 2070 (yes, that is correct and not a typo), while the others have final maturity dates beyond 2030.

In each case the notes are expected to be called within the next few years, but this is not guaranteed. As a result the yield on the notes is a little higher.

Among those with shorter final maturity dates, the Caltex and Tabcorp subordinated notes are preferred, as the Woolworths notes are expected to be called in November 2016. The impact on the portfolio of substituting these issues for the senior bonds approaching maturity, as at 30 April 2015, is shown in the table below.

The weighted average yield to call for the portfolio has increased by 0.1 per cent to 4.74 per cent, giving a spread of 2.53 per cent over the interpolated swap rate and a spread of 2.88 per cent over the equivalent Commonwealth government bond rate. This is achieved with only an increase of 0.1 years in the weighted average term to call of the portfolio.

However, with only a limited number of subordinated notes to choose from, it has not been possible to achieve the same staggering of call/maturity dates and the inherent risk of the portfolio has increased incrementally.

Philip Bayley is a former director of Standard & Poor's and now works as an independent consultant to debt capital market participants. He also writes on matters concerning debt capital markets and banking for various publications and is associated with Australia Ratings.