Oil: Lower and lower

Summary: The price of crude oil could test its August low, with possible further falls driven by sentiment and Western governments' desire for low inflation. The market is still net long crude oil but short positions are elevated. The market is set for the biggest glut of crude in at least 20 years but the amount of excess supply is nothing to get excited about. |

Key take-out: Nearly every forecaster looks for the price of crude to rise over time and I think that is the right call based on the fundamentals. But the short-term momentum certainly favours continued downside. |

Key beneficiaries: General investors. Category: Oil and gas. |

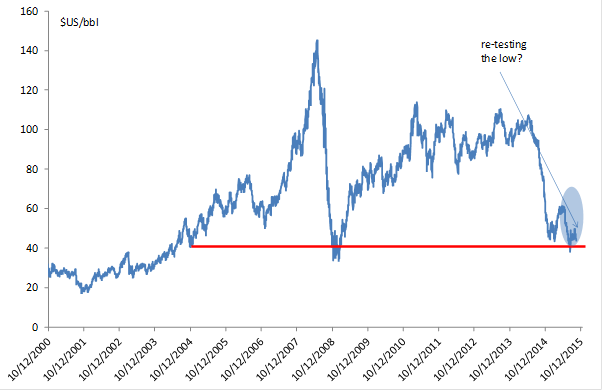

Global crude benchmarks look to be tumbling again with West Texas (WTI) in particular falling about 10 per cent in a little over a week. It may not be quite that bad for all the benchmarks, but overall we're looking at falls of between five and seven per cent. The way the momentum is currently, it looks as though crude could retest the August low of $US38.2 on WTI. This was the lowest since the GFC and then since 2004 before that.

Chart 1: Crude price

Source: Bloomberg

Not that this is the expectation, it should be noted. Whether you're looking at forward pricing or even the forecasts of analysts, the expectation is that the price of crude will pick up from this point. But not by a lot. On forward pricing (provided by Bloomberg) crude (WTI) should be around $US45 by the end of the year rising to $US46.6 by the first quarter of 2016. Analysts are a little more bullish and expect a price recovery to $US51 by the first quarter of 2016.

What's hard to see though, is what exactly will drive that?

Near-term, it looks like there is little in the way of a further fall in the crude price. Thought of another way there is almost nothing – near-term – to support the price.

I say this because, and as regular readers will know, when it comes to the commodities market, and especially the crude market, I don't think fundamentals (supply and demand for crude) are the key factors to watch. Instead there are a number of other driving factors:

- Sentiment.

- Western governments want low crude prices to keep inflation down.

- They also want low crude prices as a way of punishing Russia and redirecting income and growth away from the emerging markets back to the advanced world.

- Apparently the Saudis are happy for lower prices to shut the shale industry down and to deprive Iran and Iraq of cash. The Saudis can survive lower prices for longer apparently.

- The US and Europe have cracked down, and are continuing to crack down, on banks trading in commodities. The over the counter derivatives market has shrunk to about one-quarter the size that it was. There has been a huge outflow of funds.

None of these have really changed. As for the first point? Sentiment is still very bearish, notwithstanding the quite reasonable forecasts discussed above (more on that later).

Think of the back drop though. The global growth slowdown story is in in the ascendency and a renewed bout of pessimism has taken hold of the market. As discussed in past weeks I think this is overdone. Much of that growth angst is directed at the Fed I suspect, as there is a lot of pressure to keep the big central banks of the world printing money for as long as they can. Not because the global economy couldn't handle higher rates. It could. Rather it's because no government wants to pay interest on their bills anymore and the large investment banks thrive on cheap credit!

The talk of the town now is that the European Central Bank is primed to print more money as early as December. China just eased again and Japan probably will too at some point. Some even talk of the US engaging its fourth round of money printing. It's not an environment that is really bullish oil.

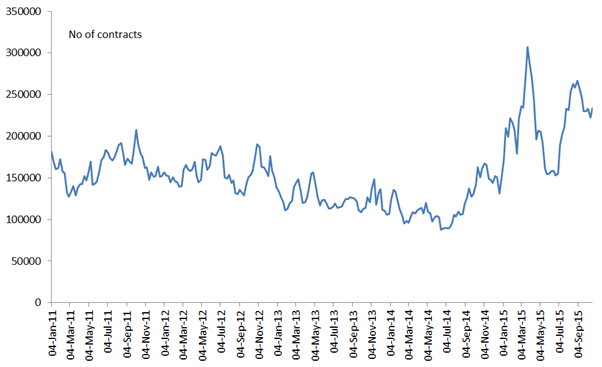

Similarly this is occurring at a time when US crude inventories are surging – to 85-year highs apparently. Moreover, as you can see from chart 2 below, the number of short positions on crude oil contracts is relatively high which creates further downside pressure.

Now it must be stressed that the market still has a net long (bought) position on crude oil, but that is pretty much always the case. What's important to note is that these net long positions have fallen down sharply recently, and that of course, reflects a pick-up in these short positions.

Chart 2: Short positions are still elevated

Source: Bloomberg

What's often not thought about though is that this 80-year (or so) high still only represents a little over 20 days of supply (50-60 if you include the strategic petroleum reserve).

This hasn't really changed much over the years. A few days, even a week's supply maybe. So these comments that US crude stocks are at an 80-year plus high are meaningless. So they've got a few extra days of supply – that hardly equates to a major fundamental bearish influence.

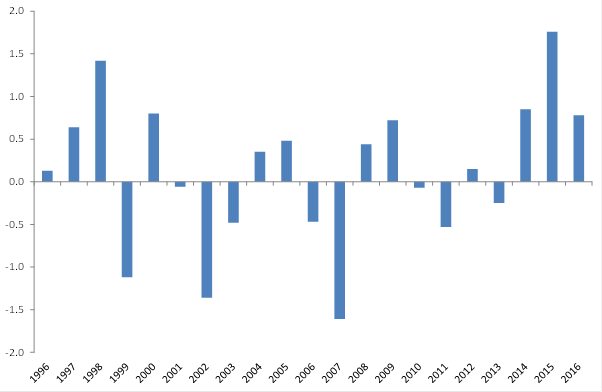

You can see that more clearly when you look at the global supply-demand dynamics. As chart 3 shows, periods of undersupply and oversupply are common. But they are never really significant. So in 2015 we are expected to have the biggest glut of crude in at least 20 years – of about 1.76 million barrels per day. Yet that 1.76m barrels excess isn't even an hour's worth of daily consumption. The world consumes something like 94 million barrels of crude per day. It's nothing to get excited about.

Chart 3: Global supply glut concerns exaggerated

Source: Bloomberg

I suppose this is why nearly every forecaster looks for the price of crude to rise over time and I think that is the right call based on the fundamentals. That said the short-term momentum certainly favours continued downside and it's not exactly obvious what the catalyst for change would be.