Oil and Gas: The global view

| Summary: Oil prices face further downside risk. So do gas prices, with the exception of our eastern states, where prices are still rising. |

| Key take-out: Concerns have increased over central banks cutting back stimulus measures in the near term and over tensions in Syria. |

| Key beneficiaries: General investors. Category: Energy. |

Oil Markets

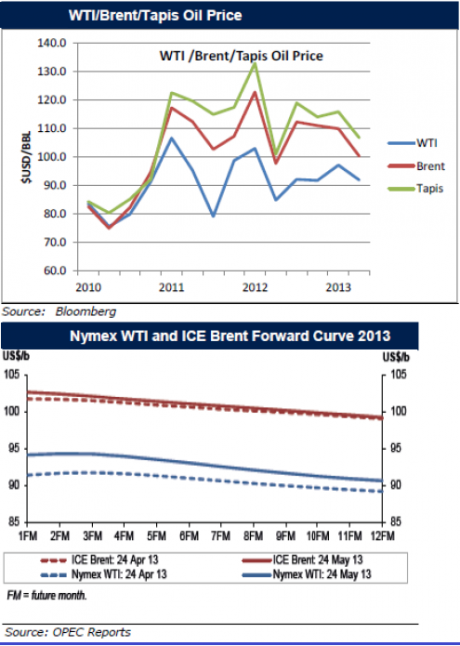

Oil prices have fallen slightly in the period to settle at $95 per barrel (bbl) from $96bbl (WTI) as concerns increased over central banks cutting back stimulus measures in the near term and tensions in Syria increased, which could potentially impact oil supplies.

Crude oil rose 7% to 8% since the beginning of June on geopolitical tension arising from the conflict in Syria and a weaker dollar, however fell sharply toward to end of the period on news the US Fed may begin pulling back its stimulus efforts later this year and sentiment worsening due to concerns over Chinese demand after HSBC’s PMI data for June fell to its lowest level in nine months.

OPEC recently trimmed its global oil-demand growth forecast for 2013 by 144kbopd (thousands of barrels of oil per day) with demand for oil forecast to grow by about 780kbopd this year. Risks are skewed towards the downside for demand due largely to the weak economic outlook for Europe, as well as to any possible setbacks in the US economic recovery. On the supply side, concerns remain centered around the abundance of US crude oil stockpiles where supplies reached their highest levels since 1973 driven by tight and shale oil productions.

Brent oil for July settlement was down during the period at $102bbl on the London-based ICE Futures Europe exchange and the premium to the West Texas Intermediate contract was maintained at $7/bbl. The spread has narrowed considerably this year to be at its lowest level since Jan 2011 driven by the reduced overhang in Cushing inventories due to the completion of several pipeline projects in the US gulf coast region.

Gas Markets

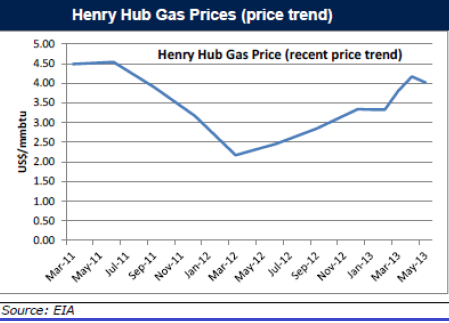

US natural gas prices have fallen during the period from $ US 4.19/mmbtu (million British Thermal Units) to $US3.89/mmbtu as forecasts for milder weather and lower nuclear plant outages weighed on sentiment. There are lower nuclear outages compared to 2012 and the previous five year average and as a result the call on natural gas to supplement nuclear power generation is lower. Higher build up in natural gas inventories is also contributing to the decline in prices. In 2013 US gas prices have rebounded from the low prices of $US1.90/mmbtu in April 2012.

In Australia, east coast prices continue their upward momentum with the trend moving toward $6-9/pj for contracts beyond 2015 after start-up of the East Coast Australian LNG plants. LNG prices in Asia continue to average approximately $16/mmbtu for Spot LNG cargoes into Japan/China/Korea with US LNG exports projected to grow.

Sam Fimis is a private client adviser with Patersons Securities and author of Premiership Portfolio: 6 Step Guide to Succeeding in the stockmarket. For more information visit www.premiershipportfolio.com