Not just a bump, but a permanent economic thump

Get prepared for slower income growth. According to RBA deputy governor Philip Lowe, the favourable developments that have driven the Australian economy over the past two decades are unlikely to be repeated.

Speaking at a conference today on productivity, Lowe said that over the past two decades, income growth has usually been strong in Australia. During the 1990s, this was reflected in productivity growth, which is why real gross domestic product and real gross domestic income per hour worked tracked closely during this period (see graph below).

However, over the past decade, income growth has been driven by a rise in our terms of trade, rather than productivity growth. As commodity prices soared, our export prices (iron ore and other commodities) rose relative to import prices (petrol and whatever Amazon is selling). The rise in the terms of trade resulted in a divergence between the real GDI and real GDP per hour worked lines. Effectively, there has been a much larger increase in the average value of what we produce per hour rather than an increase in the average amount that we produce.

A secondary factor has been favourable demographics over the past two decades. This has resulted in real GDI per capita (as opposed to hours worked) increasing at a much faster pace.

Regular readers of my columns will have read a fair bit about the ageing population (Ageing pension policies will cripple Australia’s growth, November 22; Australia’s irrevocable, inevitable growth challenge, November 15). However, over the past two decades, our demographics have been fairly positive.

Although our population has been ageing – it is not a new phenomenon – this has previously been offset by a substantial rise in the share of the working-age population that is employed. The unemployment rate trended down over most of this period, while at the same time the participation rate picked up. The result was that the number of hours rose at a much faster pace than the population, which caused real GDI per capita to rise more quickly than real GDI per hour worked.

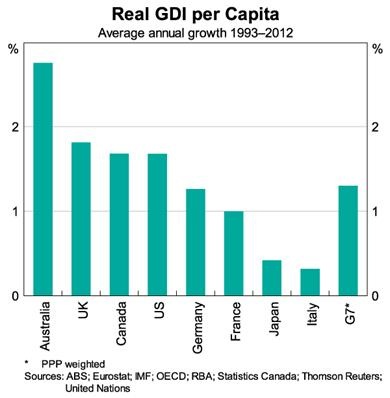

To put this in perspective, the graph below shows how Australia’s real GDI per capita has grown compared with a range of other developed countries. The difference may not seem that big until you consider that this is the average growth over a 20-year period. Over that period, real GDI per capita in Australia has increased by over 30 per cent more than in the G7.

Unfortunately, these circumstances cannot last forever. While the terms of trade could increase further, it is generally expected to begin to decline but remain at a fairly elevated level by historical standards.

At the same time, our favourable demographics are in the rear-view mirror. We face both an ageing population and declining labour market participation. As the boost from these two factors diminish (and that has already begun if you look at the past few years in the first graph), future improvements in our standard of living become increasingly tied to productivity growth.

Can productivity growth offset our falling terms of trade and an ageing population? It appears unlikely, and it certainly won’t be enough to maintain our level of average real GDI per capita growth over the past two decades. Our average rate of growth will begin to slow over the next few decades.

As Lowe said in his speech today, if a lift in productivity growth does not occur, “then we will need to adjust to some combination of slower growth in real wages, slower growth in profits, smaller gains in asset prices and slower growth in government revenues and services – in short, slower growth in our average living standards”.

The solutions to our productivity dilemma lie in the hands of the government and the private sector. The private sector is the main driver of innovation in the economy; they drive capital investment and employ the most people. The government, on the other hand, effectively creates the ‘rules of the game’ and has an integral role in setting the appropriate incentives to encourage investment and innovation, while also improving the efficiency of government services.

At the centre of the productivity debate is the level and quality of Australian infrastructure, which Philip Lowe spoke about in detail. I will address this later today.