Newman dug his own grave on privatisation

Both Queensland Labor and the Liberal National Party's approach on energy are an ill-thought-out mess requiring serious revision.

Labor has managed an extraordinary recovery in its political fortunes built partly on a policy of no privatisation of government power assets.

Yet as explained in the article Queensland voters fooled over power bills and privatisation, and a series of articles in Climate Spectator over the years on power network regulation, these state-owned companies are as ruthless and indeed more effective than their private sector peers at extracting money from power consumers. Privatisation would most likely be good news for Queensland power consumers (if generation companies were broken up from two into three or more) as well as freeing up money to spend on other vital government-provided infrastructure, such as schools and transport.

To a large extent this backlash against privatisation was a problem of the Newman Government's own, rather odd, ideological and fervent hope that all of the national meteorological scientific agencies across the civilised world were wrong about dangerous global warming (yes, every single one).

The LNP would have done a far better job of selling their proposal to lease their government-owned power networks if they'd properly explained that the networks' gold plating was the primary reason for consumers' power bills going up so much.

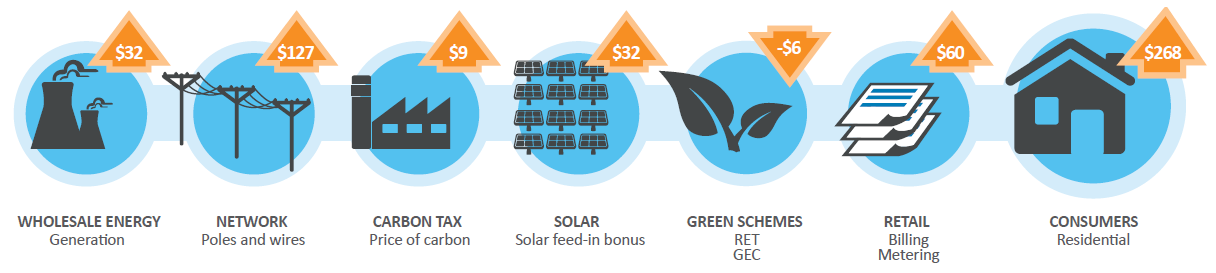

Yet instead they seemed determined to use the renewable energy sector as the scapegoat for power bill increases. The electorate was told over and over again by the government that the reason their power bills were going up so much was because of the carbon tax and Renewable Energy Target. This was even though data from the Queensland regulator (illustrated below for 2013) showed that network expenditure and energy costs were in fact the major cause of power bill rises over the prior few years.

Figure 1: Queensland Competition Authority infographic showing breakdown on 2013 power bill increase.

Source: Queensland Competition Authority Fact Sheet – Residential Electricity Prices from 1 July 2013

This was clearly politically attractive (not just ideologically) because it allowed the Newman Government to blame federal Labor, absolving itself of responsibility to deliver on its unrealistic election promise to reduce the price of electricity.

But given this, you can understand why the electorate was rather sceptical when the Queensland Government then told them that privatisation was necessary to curb large price increases that were the fault of government-owned power businesses.

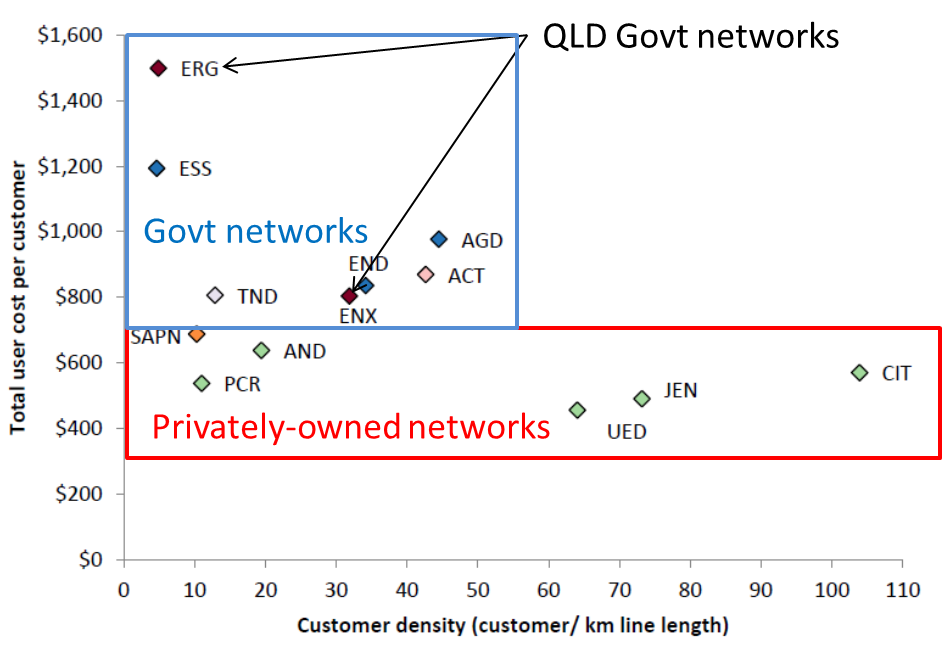

The chart below from a benchmarking study undertaken by the Australian Energy Regulator shows the privately-owned electricity network businesses manage to provide power supply at costs consistently and significantly lower than the those owned by government. This is the case even taking into account customer density. For example, Powercor (PCR), Ausnet Services (AND) and SA Power Networks (SAPN) deliver lower costs per customer than Energex (ENX) in spite of having substantially lower customer density. And Queensland Government-owned Ergon's (ERG) costs are almost off the chart.

Figure 2: Annual power network costs to serve per customer by each network company.

Source: Australian Energy Regulator (2014) Electricity distribution network service providers - Annual benchmarking report

Privatisation of power companies is a sound policy. But you can't sell it by demonising renewable energy.

At the same time a comment on the Queensland election can't go by without making mention of Newman's desperate effort to stimulate the Queensland economy by subsidising mining magnates efforts to open up the Gallilee Basin coal fields. This was state-driven economic adventurism at its worst. The grim financial reality surrounding the Galilee Basin coal fields was explained in quantitative terms by Tim Buckley and other investment bank financial analysts back in November (Newman gambles taxpayers' money on coal). Mining companies are perfectly capable of developing mines and associated rail and port infrastructure all by themselves with plenty of precedents available. If they can't manage to persuade banks and investors to risk their money on such ventures, then one wonders why Premier Newman felt it was such a good investment for taxpayers.