New Zealand's shifting demographics demand tough choices

Much like Australia, our friends across the Tasman do not face an immediate fiscal crisis. But demographic changes, including a rapidly ageing population, create a range of difficulties for the New Zealand government, which will weigh on fiscal conditions over the next couple of generations.

A new report from The New Zealand Initiative, published today, details the challenge facing the New Zealand economy. An ageing populations is a characteristic of most developed countries -- and some emerging economies -- and will weigh on global growth in the coming decades.

New Zealand's demographics are certainly not as unfavourable as the likes of Japan, Germany and China. Nevertheless, the combination of low fertility rates, longer lifespans and the retirement of the ‘baby boomers' will dramatically change the composition of the New Zealand economy.

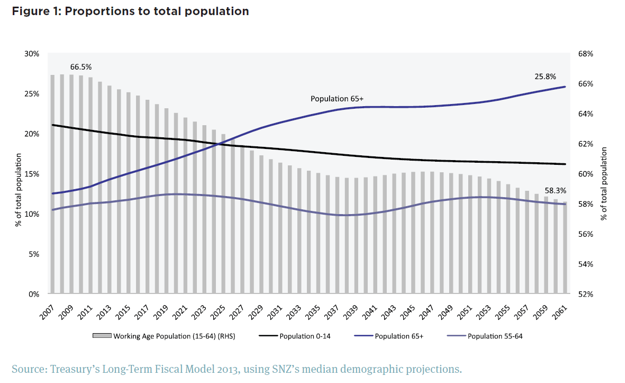

The number of dependents in New Zealand -- those either under 15 or over 64 years old -- is projected to increase from 50 per 100 people in 2010 to 72 in 2060. Statistics New Zealand estimates that the country's median age will rise from 35.8 years in 2010 to 43 years by 2060.

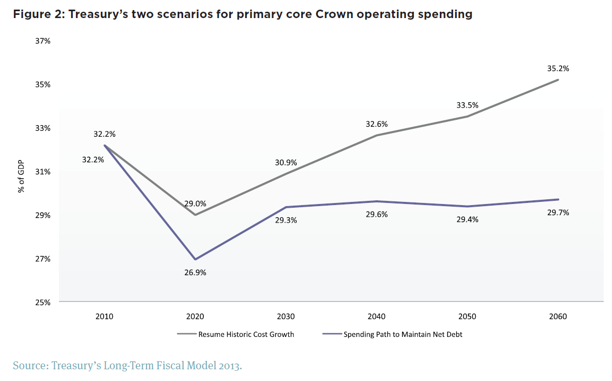

The New Zealand Treasury derived two scenarios in their earlier publication, Affording Our Future: a Resume Historic Cost Growth and a Spending Path to Maintain Net Debt path.

The first scenario simply assumes that components of government spending increase at their historical growth rates (on a per recipient basis) after 2015-16. It incorporates demographic changes into its estimates but assumes no changes to legislative policy settings.

The second scenario projects a spending path that is low enough to maintain net core government debt at 20 per cent of nominal GDP beyond 2020.

The annual spending patterns for both scenarios are included in the graph below. The key differences between the scenarios are that spending on health care and superannuation rise sharply during the baseline scenario; that is further compounded by interest costs due to the higher deficits and stock of debt in the first scenario.

An important point to make is that the first scenario is not plausible unless taxes rise sharply. If spending rose at historical rates -- and tax revenue was left untouched -- government debt would increase to 200 per cent of nominal GDP by 2060.

The New Zealand government would be forced to either cut spending or raise taxes well before it reached that level. As a result, budgetary reform is certain to occur at some point.

But cutting spending or raising taxes is rarely, if ever, publicly popular. Passing budget reform will be fraught with difficulties; consider for example that the population aged 60 or over will account for 37.6 per cent of eligible voters and 50.2 per cent of those actually voting by 2053-54.

Cuts which target ‘baby boomers' or the elderly more generally are unlikely to succeed if budget reform is delayed. The best opportunity to pass these reforms is in the next five to 10 years. Further delays run the risk of creating a significant budget shortfall, necessitating emergency measures that are politically unpalatable.

New Zealand faces similar challenges as the Australian economy and the same fiscal choices. Do you cut health care spending? Introduce a GP co-payment? Should they increase the retirement age? Or cut pension payments? What about the GST?

We also shouldn't ignore the important role of productivity growth in easing the burden of an ageing population. According to The New Zealand Initiative, “productivity growth could improve the long-term balance sheet without as many cutbacks.” Of the available options, higher productivity growth is the best long-term solution -- it's also the most difficult to achieve.

Treasury's scenarios assumed labour productivity growth of 1.5 per cent per annum over a 40-year period. That's a pretty optimistic estimate given New Zealand's average rate over the past 40 years has been just 1.1 per cent per year.

Realistically, the scenarios outlined by Treasury may be a little rose-tinted and highlight the best-case, rather than the most plausible, scenario. Although some might argue that, with labour productivity in New Zealand well below Australian levels, there may the potential for some catch-up over the next few decades.

The New Zealand Initiative has a fairly strong preference for the central government to cut spending. But I think they miss the central point; the discussion shouldn't be about ‘Big' versus ‘Small' government -- an ideological debate with no inherent value -- but about the optimal level of government spending and its composition. That's a debate to be had between the government and the voters.

A breakdown of central government expenditure shows that around 77 per cent of spending is for social assistance programs. They spend only $1,538 per household on gross fixed capital formation; only barely enough to cover capital consumption.

I support a strong safety net, particularly given the role it plays in reducing poverty and inequality, but it needs to be balanced against public works that increase the productive capacity of the New Zealand economy. It appears that the balance is disproportionately weighed towards assistance programs at present.

The central government budget in New Zealand is currently in a reasonable position -- really no worse than in Australia -- but they face a range of medium- and long-term challenges. Containing health and superannuation costs will not be easy; productivity growth is the best way to mitigate the challenge but the most likely scenario is a mix of spending and tax reforms.

Given the demographics of New Zealand and the voter implications, the New Zealand government would be wise to consider reforms within the next five to 10 years, rather than take their chances after a budget emergency begins to arise.