MARKETS SPECTATOR: Short slaughter

So you call that a short squeeze?

Judging by the most recent open short position data, there’s plenty of upside left in this short squeeze.

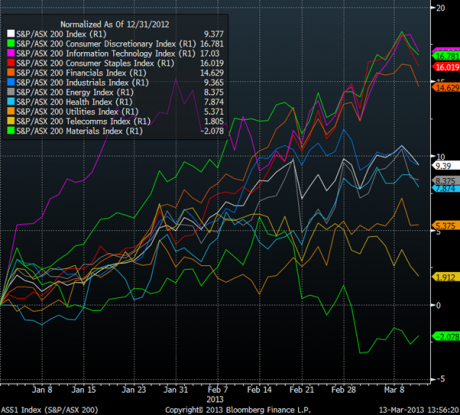

The market has been on a tear so far this year, with the benchmark S&P/ASX 200 index up 9.4 per cent, as can be seen below. From a sector specific point of view, the consumer discretionary and information technology sectors are neck and neck in the race for best performing sector year-to-date.

There has been a lot talked about the consumer discretionary sector of late, especially the more traditional retailers that have seen huge price gains so far this year, which can be seen in the chart below.

The retailers as a sector have been through a torrid time over the last five years with the bulk of them being priced for Armageddon as everyone thought the traditional retail model was doomed at the hands of structural change. While they are still facing a lot of headwinds, the most recent reporting season has shown there is light at the end of the tunnel.

These retail names proved to be very fruitful hunting ground for hedge funds over the last five years as they held big short positions in many of the above stocks. So much so that a lot of the recent surge in prices has been attributed to these hedge funds covering short positions to close out the trade at big profits.

Well, analysis of the most recent short interest data supports this view, but by nowhere near the amount most people believe. Instead, it appears the re-emergence of real buying has been the major driver behind the recent performance.

Perhaps encouraging, it looks like the bulk of the short covering is still to come.

In the above charts, the white line is the price while the purple line represents the number of shares that are held short (short data lags price by five or six days). Only in the charts of Flight Centre (FLT) and Harvey Norman (HVN) has there been a meaningful covering of shorts. Flight Centre’s short position has been reduced by 17 per cent YTD while Harvey Norman’s is down 33 per cent. David Jones short position has actually increased 8 per cent despite a YTD gain of 25 per cent.

Surely one of the most dangerous positions to hold is to be short a stock in a bull market that looks to have bottomed out in terms of earnings. We’ve got an incredibly favourable environment for equity markets at the moment that includes a huge rotation of cash into equities thanks to record low interest rates, increasing consumer confidence and the high probability of a change of government in September. On top of that, the most recent reporting season has surprised to the upside and we’re even starting to see positive outlook comments from some of the biggest multi-year underperformers (including discretionary retailers).

Clearly, there is a lot more short covering to come from hedge funds who, I might add, have had a torrid time in terms of performance over the last year. It’s hardly surprising why.