Markets: Smooth sailing for the VIX

Taking the Volatility Index (VIX) as a measure of fear, current levels are well below the 10-year average and are holding at the lowest levels since the global financial crisis. The suppressed level suggests investors might not be as bothered about taper talk as market commentary suggests.

Even in the midst of mixed comments flying around from Federal Reserve Chairman Ben Bernanke and voting member James Bullard about the future timing of tapering, and worries about the German election, the VIX has remained out of the limelight. No phenomenal jumps to reflect nervous investors.

In fact, the VIX has fallen since last Tuesday.

The low reading from the VIX could suggest investors and markets alike aren’t feeling as terrified about the future direction of quantitative easing as we might think. When nervousness envelops the share market, the VIX spikes on expectations that choppy conditions lie ahead. It is often paired with plummeting equity markets.

While not tapering was definitely a surprise for all financial markets given the commentary provided by members of the Federal Reserve in the lead up, the path of the VIX has remained uncharacteristically subdued. Judging by recent surges in the VIX, it should have jumped higher close to last Thursday’s announcement when it was expected the Federal Reserve would pare back the current stimulus.

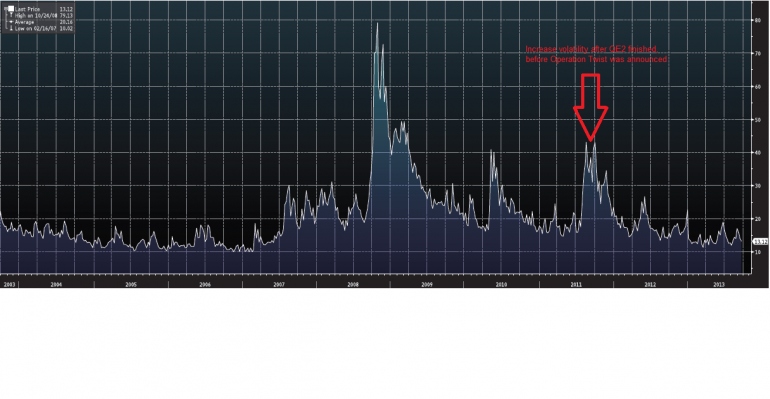

Recent surges in the VIX have been linked with the withdrawal of the share market’s drug of choice, cheap liquidity in the form of quantitative easing. Most recently, the VIX spiked in the second half of 2011 as Quantitative Easing round two closed mid-year. Operation Twist, the next stimulus measure, helped bring the VIX down from a level of over 40 to well below 20 as investors felt more comfortable with market conditions.

Source: Bloomberg

Currently, the low level of the VIX suggests investors are not expecting a substantial amount of volatility over the next month. Although the next statement from the Federal Reserve is not due out until late October, current volatility levels suggest apathy.

Quantitative easing manipulates the economy and allocation of capital, but the low level of the VIX serves a timely reminder that it is far from directly responsible for share market movements.

A spike on the VIX from current levels would suggest a feeling of unease about the next Federal Open Market Committee meeting, not scheduled until the end of October. For now, it indicates business as usual.