Markets in February: bloodbath or blip?

Markets in February: bloodbath or blip?

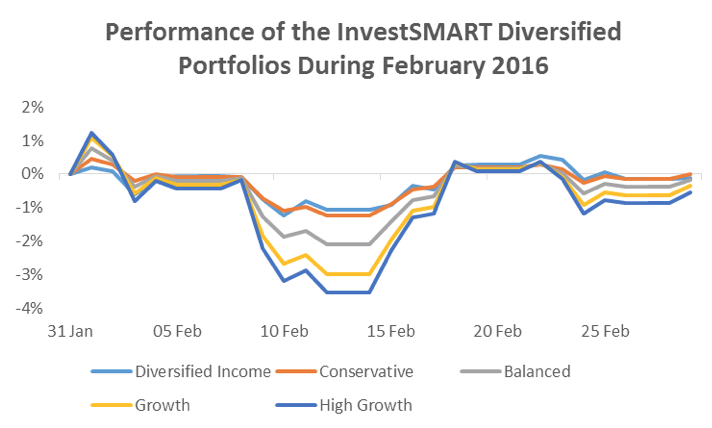

Blip, definitely. The following charts shows the estimated performance of the InvestSMART diversified portfolios.

As you can see they fell a bit in the first two weeks as the world fretted about the extent of the slowdown in China, the state of the Chinese banking system and the knock-on effects to global growth. Then attention turned to what central banks around the world might do about it and a sharp rally took us back more or less to where we started. So why did it feel so much worse and why are we left with a feeling of unease?

Source: InvestSense, Praemium

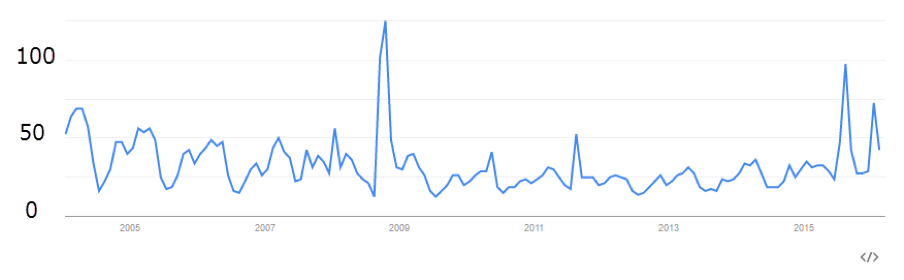

Firstly, the thing that central banks might do is take interest rates below zero. That means you could potentially have to start paying banks for the privilege of having your money looked after. You might as well then pay all your bills a year in advance rather than pay interest to the bank and have less money to pay those bills later. Crazy stuff and very much uncharted waters which clearly implies that the world economy is not yet in a happy place. However, and this is the second point – it really did not take much to spark that little relief rally, especially in the context of a pretty woeful US earnings season. The next graph shows the incidence of the search term ‘market crash’ on Google. The high point is in 2008 and everything else is relative to that. Last August we saw such searches reach 77% of the level in 2008 and then we saw another substantial spike in January.

Source:Google Trends

The fact that we are so worried about GFC2 means that it is to a large extent ‘in the price’. Put simply the prospect of a financial crisis seems very real to investors in a way never imagined in mid-2008. Now something else worse or different may well come along but if the news improves a bit we might also see much stronger markets.

There are 2 broad implications of all of this for the retail investor with a diversified portfolio.

- Is the investment strategy right for me? As we saw last month even the falls of 5-10% in equity markets were more blipish than crash like when compared to the worst case scenario which could be a lot, well worse. If that is likely to either cause you emotional angst or is outside of your risk tolerance for another reason it might be worth thinking about whether one of the less risky diversified portfolios is more your cup of tea. Alternatively, you might have thought ‘a temporary loss of say 20% isn't such a big deal and besides I don't need the money for years and years (let's say ten) so maybe I could invest in one of the more risky options'.

- Either way it may be time for a bit of investment therapy in case there is in fact another storm coming. Questions to ask yourself might include ‘Why do I feel threatened by market volatility? After all, I've known all along that I should suspect this but it didn't stop me catastrophising when faced with a few ugly headlines.’

This last point is especially important now that investments like InvestSMART’s Diversified portfolios give you so much transparency. Note that you won’t be hearing much from traditional managed funds for a few weeks and even then the information will be quite high level. With managed accounts like these you can log-in anytime and see exactly what you are invested in – and how it has done. This can be empowering as an investor but it can also have a significant downside – you are of course much more likely to look when dramatic headlines are flying around. There are an increasing number of studies which demonstrate the extent to which retail investors underperform the markets due to poor market timing decisions – principally that is due to being too confident when markets are up and getting scared after they have fallen. This could (and does) detract 1-2% a year, which would probably overshadow the decision made under point 1 so it's just as important as crunching the numbers and doing your investment homework.

With that in mind we'll use a framework that psychologists call cognitive behavioural therapy next week to see if we can improve our own personal investment performance if and when the smelly stuff and the rotating blades do get to meet........

Frequently Asked Questions about this Article…

In February, markets experienced a brief dip due to concerns about China's economic slowdown and global growth. However, they quickly rebounded, making the downturn more of a blip than a bloodbath. While it felt unsettling, it's important to remember that market fluctuations are normal.

Central banks can influence markets by adjusting interest rates. Recently, there's been talk of taking rates below zero, which could mean paying banks to hold your money. Such measures indicate economic challenges but can also spark market rallies as investors react to potential policy changes.

The fear of a financial crisis, like the one in 2008, is more prevalent now, partly because of increased media coverage and search interest. This heightened awareness means that potential crises are often 'priced in' by investors, affecting market sentiment.

If market volatility causes you stress or exceeds your risk tolerance, consider adjusting your strategy. Diversified portfolios can offer less risky options, while those comfortable with temporary losses might opt for more aggressive investments. It's crucial to align your strategy with your financial goals and risk appetite.

Understanding your emotional responses to market changes is key. Ask yourself why volatility feels threatening and remember that fluctuations are part of investing. Cognitive behavioral techniques can help improve your investment performance by managing emotional reactions.

InvestSMART's diversified portfolios offer transparency, allowing you to see exactly what you're invested in and how it's performing. This can empower you as an investor, providing more control and insight compared to traditional managed funds.

Retail investors tend to underperform due to poor market timing decisions, such as being overly confident during market highs and fearful after declines. This behavior can detract from returns, emphasizing the importance of staying informed and avoiding emotional decision-making.

Improving investment performance involves understanding market dynamics and managing emotional responses. Using frameworks like cognitive behavioral therapy can help you make more rational decisions, especially during market turbulence, ultimately enhancing your investment outcomes.