Markets: A tale of two outlooks

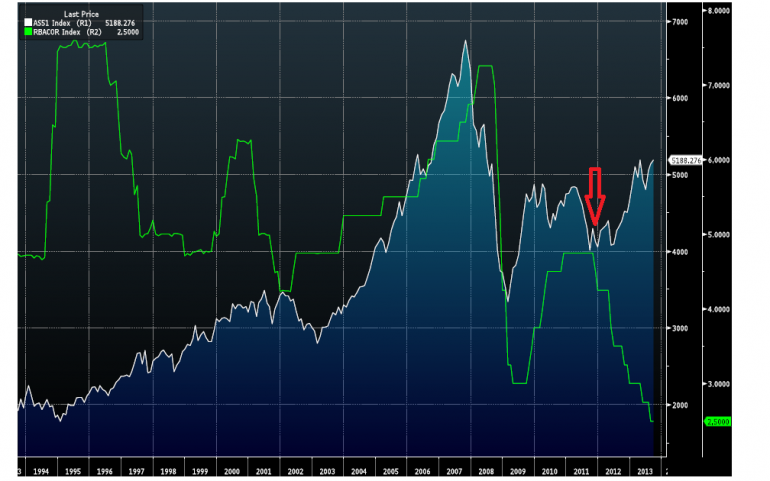

The gap between interest rates and equities is the widest it has been in 20 years, with interest rates being the lower bound. The beginning of 2012 marked the beginning of the divergence, with the ASX 200 marching higher and the official cash rate sliding to historical lows.

While it is widely expected the Reserve Bank will keep interest rates on hold today, the gap between the two measures is widening as the ASX continues to climb to recent highs on expectations interest rates will remain low for the time being.

One consequence of lower interest rates is to encourage investors to invest in riskier assets. We are starting to see some support for other risk assets, such as property, but it hasn’t sparked an overwhelming conviction in equities just yet.

Since the RBA began slashing interest rates in November of 2011, taking 2.25 per cent from the official cash rate, the ASX has gained 21 per cent.

Below the graph displays the movements of the measures, with the red arrow flags the starting point of the separation. The white line represents the ASX 200 and the green line, the official cash rate.

Source: Bloomberg

(The spike in interest rates in 1995 and 1996 was when inflation running around 3.3 per cent, above the RBA’s upper bound of 3 per cent. It wasn’t until inflation subsided that the RBA began to cut interest rates.)

Lower interest rates offer support to our equity market, inspiring investors to take risk to achieve a return. With the official cash rate at 2.5 per cent and inflation running at 2.4 per cent, investors are accepting equities over term deposits.

Markets have not been following normal economic theory since the extraordinary and experimental policies of the financial crisis. At some point however - maybe even today - rates will rise and the market can have one of two responses.

Where once a rate cut would mean the economy is in trouble and the markets would get nervous, now the opposite is happening. Perhaps the end of this rate cycle will tell us if we are back to normal or not. If rates turn upwards, markets may think that things are getting better and soar; alternatively a rise in rates, and subsequent shift in the returns for 'safe' assets like treasuries or bonds will pull the rug from under our dividend and yield driven market.

Frankly that's anyone's guess.