Looking for income in other places

| Summary: Investors in the sharemarket have done well over the last two years, especially those invested in the major banks. But it may be time to lock in some market gains and use some proceeds to diversify into other income streams such as listed bonds and bond exchange-traded funds. |

| Key take-out: Investors who held a portfolio split 60% to shares and 40% to bonds during the GFC would now be substantially better off than those who were 100% invested into shares. |

| Key beneficiaries: General investors. Category: Fixed interest. |

Australian investors have had some attractive returns from the sharemarket in the last couple of years. The ASX 200 has managed total returns of roughly 20% in both calendar 2012 and 2013. Better still, high-yielding blue-chips - such as bank stocks - have managed up to 30% in total returns, but concerns are mounting in the market that it may be difficult to extend these type of gains much further. It may be time to consider some less volatile investments and alternative sources of income.

Will shares continue to rally?

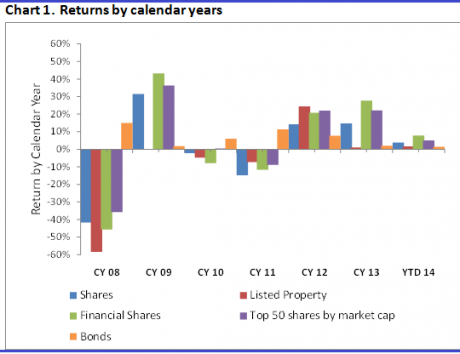

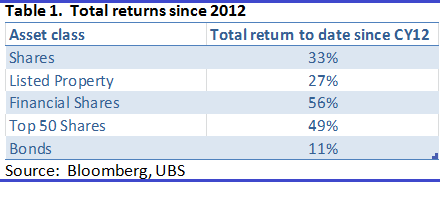

Shares have performed strongly since 2008. In particular bank shares, listed property and other large cap shares have done well since 2012 (see chart 1).

The search for yield is likely to continue in the current low interest rate environment. After seeing nearly a 33% return for the sharemarket (56% for financials and 27% for listed property) in just over two years, it may be time to lock in some sharemarket gains. An important lesson learnt from the GFC years was not to over-allocate to shares. So it may be time to take a more balanced view, with an allocation to less volatile assets such as bonds and protect future returns.

A good example of what can happen is the US experience. Recently we saw how rapidly the previous high-flyers of the US sharemarket, technology shares (tech shares), were sold down. This follows a 41% rise in the index that represents tech shares, the Nasdaq, in 2013. Some of the major tech names including, Twitter, Yahoo and Facebook, saw price gains of 100% and upwards.

Twitter, one of the star performers in the US market last year, was and still is trading at a large premium to other tech shares, almost double the valuation of Facebook. But disappointing results for Twitter suggest it is a long way from being profitable.

Companies like Twitter may be setting the scene for more of what could happen in the future. The tech crash of 2000 saw the S&P 500 index fall heavily, as investors realised that many dot com companies were trading at large premiums with no earnings to support the valuations.

As we have seen in previous situations, Australia is not immune to volatility in global markets.

The strong market returns over the last few years in Australia have already priced in future earnings (see chart 2).

Markets tend to be forward looking, so what is expected to happen with respect to earnings is usually already factored into prices before it actually happens.

Investors, including SMSFs, are holding large core weightings of Australian banks and other outperforming shares and they may be reluctant to part with them. The capital gains tax consequence, and companies paying high-yielding franked dividends, provide a disincentive to sell.

Yet, as it is intrinsically difficult to pick market peaks and troughs, an allocation to a less volatile asset class may be beneficial in the next few years.

A strategy to lock in some market returns

Bonds also have had some good returns but may see more subdued returns going forward, due to the current low interest rates environment.

Although shares will most likely continue to deliver stronger long-term returns, there are no guarantees that volatility will not return to the sharemarket.

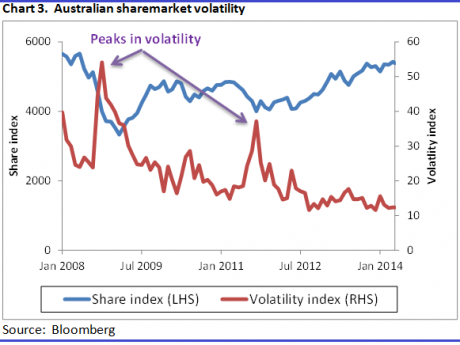

Volatility has been relatively low for Australian shares (see chart 3). In a low-yield environment investors generally are happy to take on higher risk, and bid up companies that have more opportunistic growth potential.

The banks and other shares paying high yields have been sought after – and this may continue to be the case – but there is increasing downside risk for these segments of the market.

Volatility in the markets can be caused by policy or economic concerns – or other reasons such as contagion from other countries’ increased risks, including political, economic and geopolitical risk.

Investors would be wise to diversify their portfolio to less volatile assets, such as bonds in their portfolio.

Bonds can provide a yield that is above cash and term deposits, and with an element of capital preservation, can provide a buffer to swings in sharemarkets.

Why buy bonds if rates are going up?

The Reserve Bank of Australia (RBA) has indicated that it no longer has an easing bias. But despite that, it does not mean that interest rates are likely to rise in the near term, especially with the current situation of low inflation and slow economic growth.

Inflation has not become a concern yet, although it has been towards the top end of the 2-3% range with which the RBA is comfortable. If inflation were to be outside the range desired by the RBA, then it would have to do so for consecutive quarters before any interest rate action is taken by the RBA.

The timing and size of interest rate movements are inherently difficult to predict. A rally in bond prices from here (if there were another cut in rates) would provide a nice boost to bond returns.

The likely scenario is for the low-yield environment to continue.

Indeed at Eureka Report, Adam Carr, (see Could the RBA cut rates?) believes that another interest rate cut is not totally unlikely. If we saw moderation in the strong housing market, it could result in another interest rate cut.

When interest rates do rise, the higher yield will enhance bond market returns as well. The stability of the returns from the bonds market will have the greatest influence on the longer-term returns for investors.

Diversification is the key

The sharemarket has been in a growth phase for some time, but positive returns can easily turn negative – as we saw in 2008. It is worth reiterating that the volatility of the sharemarket is about four times that of the bond market.

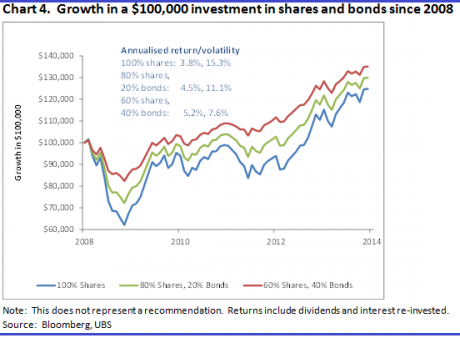

A diversified portfolio across different asset classes makes more sense going forward. If $100,000 was invested in shares just before the GFC hit, the investment would have fallen to nearly $60,000 in 2008 (see chart 4). A portfolio with 40% in bonds and 60% in shares during that period would have resulted in a fall in the investment to just above $80,000 – $20,000 ahead of the portfolio 100% invested in shares.

The end result now would be a portfolio valued at $125,000 for the portfolio 100% invested in shares versus $135,000 for the portfolio with 60% in shares and 40% in bonds. Despite the strength in sharemarkets in the last few years, the portfolio including a bond allocation is still ahead of the 100% share portfolio.

Conclusion

One of the harder investment decisions to make is to take profits when markets are still rallying. But diversifying your investments during the rally, rather than after the rally, makes sense – especially if you are searching to secure and diversify income and returns.

High dividend yields and high priced shares may not last, so it is important to widen your sources of income. The following suggestions are for investors who know that timing is the essence of smart investing:

- Take profits: lock in profits from your strong share performers

- Diversify: Invest in other sources of income.

- Buy bonds: Due to the large minimum amount for individual over-the-counter (unlisted) bonds, an investor could look at some of the bonds listed on the ASX. There are more than 50 listed bonds and hybrid securities.

- Buy bond ETFs: There are three diversified bond ETFs that provide exposure to the broader bond market. Seven other bond ETFs available to investors target sub-sectors of the bond market.

* Rosemary Steinfort will be appearing at Eureka Report's 'Maximising Income for the Future' conference to be held at Sydney Town Hall on Tuesday May 27: To find out more about the event or book a ticket please click here.