Last bet in a bold monetary gamble

The Federal Reserve moved one step closer to policy normalisation in October as it finally ended its asset purchasing program, but it will be a “considerable time” before they take the next step: raising rates.

At its October meeting, the Federal Reserve cut the asset purchasing program by $US15 billion, signalling the end of its latest round of quantitative easing. This comprised $US5 billion per month of mortgage-backed securities and a further $US10 billion of longer-term Treasury securities.

The end of the asset purchase program was widely expected, and has been for months, yet markets still reacted strongly to the event. The US dollar surged on the news -- and the Australian dollar fell to below 88 US cents -- while the S&P500 also took a hit.

Attention now shifts to when the Fed will take the next step on the path to normalisation. On this front, the Fed offers no forward-guidance other than to say that the federal funds rate will remain at its current level for a “considerable time”.

A lot will depend on how the US economy develops. The signs thus far have been positive and point to a rate hike next year. The timing is more difficult to pin down and may partially depend on how well financial markets handle the end of their precious quantitative easing.

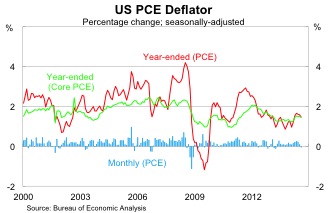

The Fed sees the risks to the outlook for economic activity and employment as “nearly balanced”. They also believe that the “likelihood of inflation running persistently below 2 per cent has diminished somewhat since early this year”.

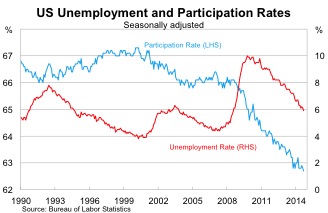

The unemployment rate fell to 5.9 per cent in September and has improved by 1.3 percentage points over the past year (US employment's soft underbelly, October 6). While some of that improvement reflects falling participation, job creation has been strong, with non-farm payrolls on track for its strongest year since 1999.

There still remains some spare capacity -- as evidenced by soft wage growth -- but as the Fed notes “underutilization of labor resources is gradually diminishing.” Nevertheless, wage growth remains a key to policy normalisation and declining real wages partly explain why inflation remains contained and household spending hasn't shifted gears.

For wages, the ongoing weakness appears to be more structural than cyclical -- a view which Fed chairwoman Janet Yellen discusses in detail here. The economy is producing more lower-paid positions and those positions have absorbed a great deal of the spare capacity across the US economy.

If that is correct, then a structural shift in the labour market -- which puts downward pressure on national wages -- has helped to keep inflation in check. The core personal consumption expenditure (PCE) deflator -- the Fed's preferred measure of inflation -- rose by just 1.5 per cent over the year to July. By comparison, the more widely publicised core CPI rose by 1.7 per cent over the year to September.

Wage growth and expectations should begin to pick up as spare capacity continues to diminish and measures of inflation should quickly follow suit. A stronger US dollar is expected to weigh modestly on inflation but shouldn't be too constrictive given so many international markets utilise the US dollar as the medium of exchange.

This is all a very roundabout way of saying that the outlook for interest rates in the US remains data dependent.

If the recent employment gains are persistent -- and the unemployment rate shifts to, say, 5.5 per cent by March next year -- then I expect the Fed to hike rates more quickly than the market anticipates. Similarly, a hike might be delayed if job creation slows or if improving conditions result in an upward shift in labour force participation.

Quantitative easing may be over but monetary policy in the US remains exceptionally loose. The Fed continues to provide support to the economy that would be considered unprecedented in the absence of the global financial crisis.

Policy normalisation is on the cards but the Fed will be in no hurry. When its begins to raise rates – and I expect it to do so by mid next year – it will take a slow and steady approach. The outlook for the US economy remains solid and – despite recent market choppiness – it appears well placed to end the year on a high.