Kill the risk in your SMSF

Self-managed super fund trustees may relish the control they have over their retirement destiny but the portfolios they’ve assembled are way more risky than they think. A heavy emphasis on direct Australian stocks and cash means many DIY funds that are focused on preserving and growing capital are actually more vulnerable to loss than an investor following a conservative strategy.

This is the true picture of the nation’s self-directed retirement savings revealed in research by Vanguard Australia when it looked at rolling three-year returns for 3000 DIY funds.

The result shows that SMSFs are on thin ice — and they probably don’t know it.

HEAVY CONCENTRATION

Researchers found the average portfolio had 18 stocks, about 10 of which were the same, says Vanguard Australia senior manager broking and wealth management Tim Sparks. “Through their stock selection, the self-managed super funds were taking on more risk than the broader market,” Sparks says.

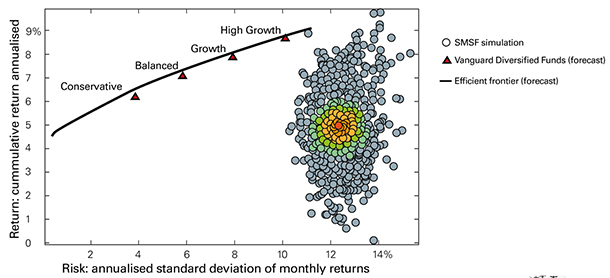

The chart shows the returns and annualised variance of monthly returns for the SMSF sample compared with four Vanguard model portfolios and the “efficient frontier”.

Professional investment managers are obsessed with the “efficient frontier”, Sparks says, a theoretical line which plots the risk and return for optimal portfolios, where volatility has been reduced as much as possible.

The relationship between risk and return is not drawn as a straight line, and incremental increases in returns bring the expectation of greater and greater levels of volatility.

If you want higher returns, you have to take bigger risks. And “risk” means there is no guarantee. The short term might bring significant losses.

The optimal portfolio for any risk profile is near the efficient frontier, but SMSFs are far from it.

GET IN LINE

Data for Vanguard’s multi-asset LifeStrategy funds were used as a comparison in the research, where the results for the four investment styles (conservative, balanced, growth and high growth) lay close to the efficient frontier.

The sample of self-managed super portfolios, however, were somewhere else altogether. The bunch of results in the first chart shows them taking on more risk than a high growth strategy and often achieving lower returns than a conservative strategy.

“Through their stock selection the self-managed super funds were taking on more risk than the broader market,” Sparks says. “That’s fine if it’s their intention, but it isn’t. They don’t know that they’re taking on more risk than the broader market through their stock selection.”

SILVER BULLETS

Trustees of SMSFs favour managing their own affairs because it gives them control over their destiny, but Vanguard wanted to test that if by simply accepting market returns for a portion of their portfolio DIY super funds might actually do better.

The researchers tested the hypothesis by liquidating a portion of the portfolios and investing in four broad asset classes, using ETFs for Australian equities (using the Vanguard ETF over the S&P/ASX300, code VAS), US equities (using its US Total Market ETF, code VTS), international markets outside the US (using its All-World Ex-US Shares Index ETF, code VEU) and local bonds (using its Australian Fixed Interest ETF, code VAF).

As the allocation to ETFs was increased, the SMSF portfolios bunched closer together and nearer to the efficient frontier. This is a result of the risk associated with a small number of direct holdings being reduced as the portfolio includes to increasing degrees hundreds more assets, including global stocks and Australian government and corporate bonds. As a portfolio is diversified, future returns can be expected within a narrower range.

In the animated chart below, the first image (where dots appear more scattered) shows the average asset allocation for a sample of 3,000 SMSFs. Thereafter, the dots move as we increase the weighting of ETFs within these portfolios from 17% to 66% across Australian fixed interest (6%), US equities (4%), Australian index equities (4%) and global equities ex-US 3%.

.gif)

“It made the returns more appropriate for the amount of risk that the investors were taking,” Sparks says.

“Through layering in those ETFs they are able to still have the same outlook that they have in terms of returns, however if they are doing so with lower levels of volatility they are less likely to make incorrect investment decisions in times of severe stock market dislocation.”

FEWER ZIGS AND ZAGS

Diversification is a simple law of risk-reduction in investing, but investors should know that diversification in one country and in one asset class isn’t really enough. “Having a well-diversified portfolio across asset classes gives [self-managed super funds] smoother returns over time and the best chance of being in tune and committed to their investment objectives,” Sparks says. “Self-managed super funds are taking on more risk than the broader market, and ETFs can lower that risk.” Vanguard is a provider of exchange-traded funds, the low-cost investments which track various indices here and around the world. Its LifeStrategy funds are managed portfolios of its ETFs. The InvestSMART model portfolios are similar but have the freedom to use ETFs of any provider.

Frequently Asked Questions about this Article…

SMSFs often have a heavy concentration in direct Australian stocks and cash, which can make them more vulnerable to loss compared to a conservative investment strategy. This concentration means they might be taking on more risk than they realize.

Vanguard Australia's research showed that SMSF portfolios are generally riskier than the broader market, with many funds unknowingly taking on more risk through their stock selection.

SMSFs can reduce investment risk by diversifying their portfolios. Incorporating exchange-traded funds (ETFs) that cover a range of asset classes, including global stocks and bonds, can help bring portfolios closer to the efficient frontier, reducing volatility.

The 'efficient frontier' is a theoretical line that represents optimal portfolios, where risk is minimized for a given level of return. Portfolios near this line are considered well-balanced in terms of risk and return.

ETFs allow SMSFs to diversify by investing in a broad range of assets, including international equities and bonds. This diversification helps reduce the risk associated with holding a small number of direct stocks.

Vanguard's LifeStrategy funds offer a diversified investment approach by using a mix of ETFs. This helps SMSFs achieve more stable returns with lower volatility, aligning better with their investment objectives.

Diversification is crucial because it spreads risk across different asset classes and geographies, leading to smoother returns over time and reducing the likelihood of making poor investment decisions during market downturns.

Yes, by accepting market returns through diversified investments like ETFs, SMSFs can potentially achieve better returns with lower risk, as opposed to relying heavily on direct stock selections.