It's not over yet...

Summary: The main reason for this correction was a fear the China slowdown is more serious than official statistics indicate. The China situation is a fear, not a reality, but we all need to watch events in China very carefully. A rise in US rates may still happen but I think the rise will be less than most are predicting because of the share market turmoil. The sharp share price rises around the world may not be the end of the correction – it is very difficult to pick the bottom. |

Key take-out: In this correction, all investors had the chance to test whether they were comfortable with their equity exposure. Did you lose sleep? |

Key beneficiaries: General investors. Category: Shares. |

While it's good to be back after an overseas holiday, my timing, marketwise, could have been better.

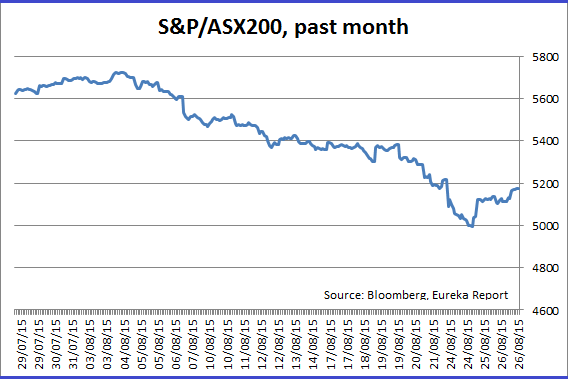

We have just been through a major correction in Australian and global share markets and that correction will have taught all investors a lot about their own portfolio and about the risks and rewards that are ahead.

The first and most important repercussion of the correction was that all investors had the chance to test whether they were comfortable with their equity exposure. It's only when there is a fall that you get to test your comfort level. Did you lose sleep or feel the urgent need to quit your long-term holdings?

During the last few years I have been writing regularly that the right equity exposure is not what advisors tell you but what you are comfortable with given your financial circumstances and age. If you felt the need to panic during the latest correction perhaps your equity holdings are too high.

But unlike 2007/8 I could not feel the sense of urgency that goes with the likelihood of fundamental adverse changes in global financial circumstances. This time we are experiencing a “fear attack”. But if I had equity exposure greater than I was comfortable with the feeling of panic might have been different.

Nevertheless the correction has a number of very important implications for the future of all classes of security. And as you will see below there is a likelihood of further falls which was illustrated by the late fall in New York overnight Tuesday.

The main reason for the correction was a fear that the China slowdown is much more serious than official statistics indicate. The performance of the Shanghai share market, the radical measures used to try and stem China's equity falls and the devaluation are all signs of problems, masked by inflated statistics.

But there is no doubt that the Chinese still have a large array of stimulus options that they can apply if they feel they are necessary. At this stage what we have is a risk of a significant China slow down – not an actuality. For Australia the share market focussed that risk on commodity prices and in particular on oil and iron ore. But as Eureka Report readers are well aware the involvement of China in Australia goes much further than commodities and mining.

For example the Chinese are the biggest investors in new dwellings in Sydney and Melbourne and I suspect they are behind a lot of purchases of existing dwellings. If the Shanghai share market erodes a lot of the savings of the middle class in China our dwelling market in Sydney and Melbourne will not necessarily collapse but dwellings will certainly deliver lower returns. Australia therefore has an extremely big stake in what happens in China.

Both share and property investors need to understand that they are in similar boats, albeit that the markets currently only recognise the share market exposure.

I emphasise again that at this point the China situation is a fear not a reality but we all need to watch events in China very carefully and not just from the point of view of commodities.

And taking that situation one step further, a large amount of global investment banking capital has been invested in emerging countries that benefit from China's growth. If anything serious happens in China it will have implications through our region and onto the global banking scene. But I don't think the risk exposures are anything like we saw in the global financial crisis.

On the equity upside, the fall in the global market will make central bankers around the world – and particularly in the US – nervous about interest rate increases. The most commonly accepted view in world markets has been that in the next 12 to 18 months we will see a steady rise in American interest rates starting next month.

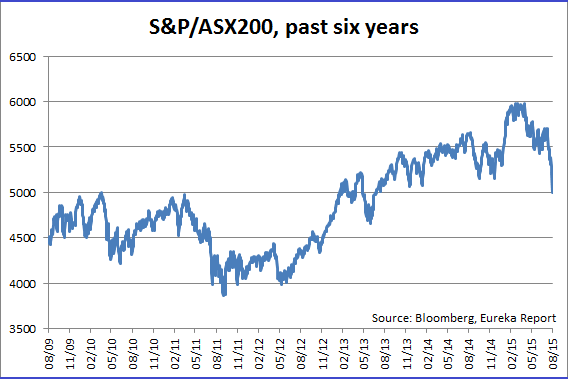

That may still happen but I think the rise will be less than most are predicting because of the share market turmoil we have seen in the last week or so. And here in Australia if the China problem starts to impact on our wider business community we will see more interest rate falls. The bottom line is that the looming environment of rising world interest rates may well have been delayed which increases the attraction of soundly based share yields – which, by the way, have been increased by the fall in share prices. More fundamentally, I think that there is no doubt that many share markets, including Australia, got ahead of the ability of companies to generate higher profits.

One question that many Eureka Report readers have asked me is: ‘Why have we seen these enormous fluctuations?' The simple answer is that the bulk of share market volumes in leading stocks are created by gambling institutions including some of our superannuation funds. The gambling funds trade both long and short positions and when they short stock they are often forced to cover. Accordingly the shorters drove the market down further than normal trading would have done and in turn the so-called short covering, where traders buy back stock that has been shorted, propelled our market higher yesterday (Tuesday August 25) and boosted overseas markets last night. Shorters in Australia are able to decimate markets because the big superannuation funds lend share members' scrip to enable shorters to deliver securities they do not own. The more we have self-managed funds the less we will see of this questionable ethical practice but that's a matter for another day.

This week, we saw Fortescue Metals Group announce its profit and the shorters pummelled the stock. The next day it started to rise and they were forced to cover creating an enormous gyration. And although the total market did not move down and up as much as Fortescue there was a substantial fall and rise in a short period in part created by shorting and by short covering. In addition those who bought shares on margin and can't pay calls are usually sold out in the first 15 minutes of trading so you often see sharp falls at the start of trading.

Eureka Report readers should be aware that the sharp rises around the world that we have just seen may not be the end of the correction because so much of the buying was short covering. It is likely, but not certain, that the shorters will be back and we will see more falls, taking the index below 5,000 again. I hope I am wrong.

When you have a fall as big as the one we have just experienced it creates ceilings of selling and you do not go from such a correction back to a bull market in a few days.

There are going to be a lot more fluctuations along the way, at least in my view, and you need to be able to ride through those corrections without losing sleep. Finally the lower share prices both here and around the world do make equity investment look more attractive than it was at the peak of the market.

But it is very difficult to pick the bottom and you may buy a stock one day only to see it fall the next day. Finally a correction of around 10 per cent in the share market is just that – a correction. If the fall extends out to 20 per cent that usually (but not always) indicates that substantial damage has been done to the economy so it will be reflected in later business activity and corporate profits. For that to happen China must really slow down and we need bad news in the US and/or Europe. Alternatively some other adverse event must take place. It may be a war in the Ukraine or Korea. Let's hope that doesn't happen.