It has been a difficult 18 months for all of us; to put it lightly

Flicking through various bank statements it is evident that my spending habits have changed.

Small luxuries we took for granted like a trip to the cinema, tickets to a concert or an after-work drink with colleagues are expenses that don’t exist in the current climate.

And it isn’t just the fun expenses that have gone for the moment with no need to fill up the car, pay tolls or public transport fares to get from point A to point B.

It is the COVID-era version of forced savings.

So how do we take this lemon and make lemonade?

It would be easy to leave excess savings sitting in the bank account; it is safe and can be called upon at a moment’s notice but with interest rates at historic lows and inflation creeping higher it is not without drawbacks.

What about investing? What about investing for your kids?

Check out our recent series explaining inflation: Part One – Part Two – Part Three

Investing is the other option and comes with a disclaimer; whether you are investing conservatively or aggressively it will have an associated level of risk but also the potential for reward.

Parents have begun to look ahead and consider investing savings for their children not only to help them as adults but due to their age they generally have a large amount of time on their side for it to grow.

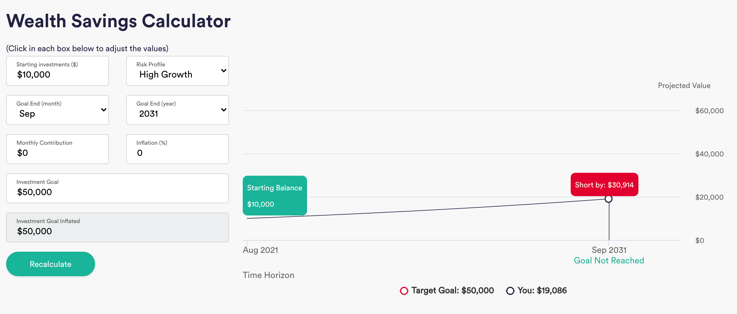

Using the InvestSMART Wealth Calculator we can see that investing $10,000 for a child today could result in a portfolio of around $19,000 for them in ten years’ time.

If you were to add just $200 in contributions per month it is estimated that the portfolio would value in excess of $53,000 over the same time frame which is the power of compounding at work.

InvestSMART offers a low-cost investment platform for parents and children which you can read about here

Frequently Asked Questions about this Article…

With many everyday expenses reduced during the COVID era, you might find yourself with extra savings. Instead of letting them sit in a low-interest bank account, consider investing. Investing can offer potential growth, especially in a low-interest environment, though it does come with risks.

Investing for your children can be a great way to help secure their financial future. Since children have time on their side, investments can grow significantly over the years, benefiting from the power of compounding.

If you invest $10,000 for your child today, it could grow to approximately $19,000 in ten years, thanks to compounding. Adding regular contributions can increase this amount significantly.

By adding just $200 in monthly contributions to your child's investment, the portfolio could grow to over $53,000 in ten years. This demonstrates the power of regular contributions and compounding.

Investing always comes with risks, whether you choose a conservative or aggressive approach. However, it also offers the potential for higher rewards compared to keeping money in a savings account.

You can start investing for your children by using platforms like InvestSMART, which offers low-cost investment options tailored for parents and children. It's a great way to begin building a financial future for your kids.

The InvestSMART Wealth Calculator is a tool that helps you estimate the potential growth of your investments over time. It can be particularly useful for planning long-term investments for your children.

Leaving savings in a bank account during periods of low interest rates can be less beneficial because the returns are minimal. With inflation on the rise, the real value of your savings could decrease over time, making investing a more attractive option.