InvestSMART Portfolios - August in Review

Diversified Portfolios

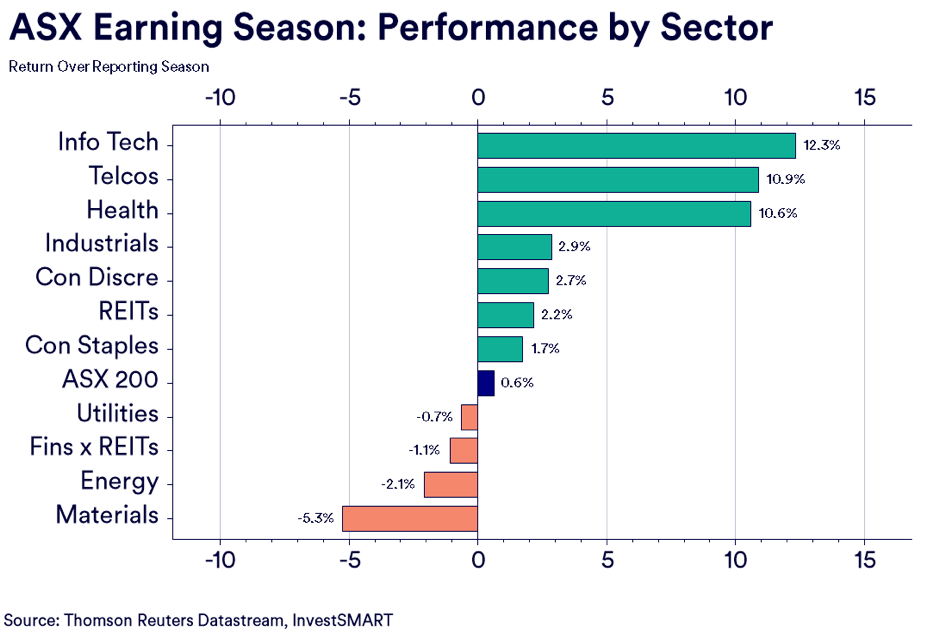

Movers of the month- August saw the most of S&P/ASX 200 securities reporting full-year earnings for the 2018 financial year. The ASX added 0.6%, however the performance of the sectors over the month was diverse.

- The performance of the S&P/ASX 200 over the past year shows that investors continue to invest in high multiple stocks. The average EPS upgrade was only 1.5%, yet the capital growth of high multiple sectors has increased. The best 15 performing stocks over the earning season already had average P/E of 25x.

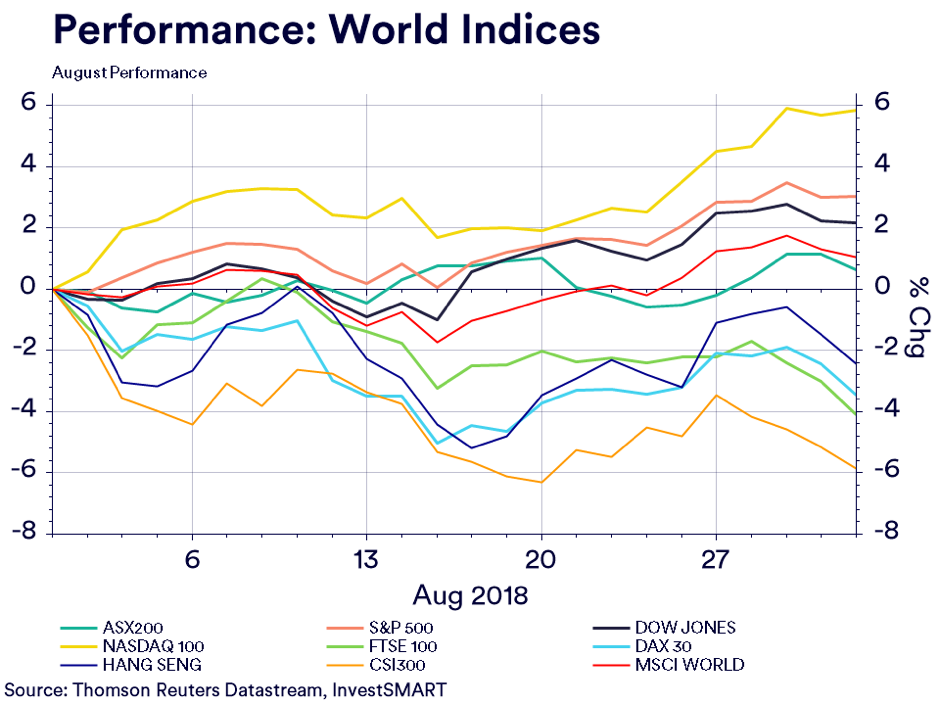

- The NASDAQ increased 5.9% in August despite Facebook, Twitter and Google falling after testimony at a US Senate on the Russian hacking. The S&P 500 added 3% in the month and continues to be the best performing index in the portfolios. The S&P was up 7.6% to the end of August.

US GDP growth was 4.1% year-on-year in August and US employment is at levels not seen since the end of the Second World War. We maintain our view that US markets will outperform over the coming periods.

- Emerging markets (EM) suffered their second big shock of the year in August as Turkey’s currency fell to its lowest level against the US on record. Balance of payment issues, rampant inflation and political issues with the US were the cause. The currency weakness spread to other EM markets such as South Africa, Indonesia and Malaysia.

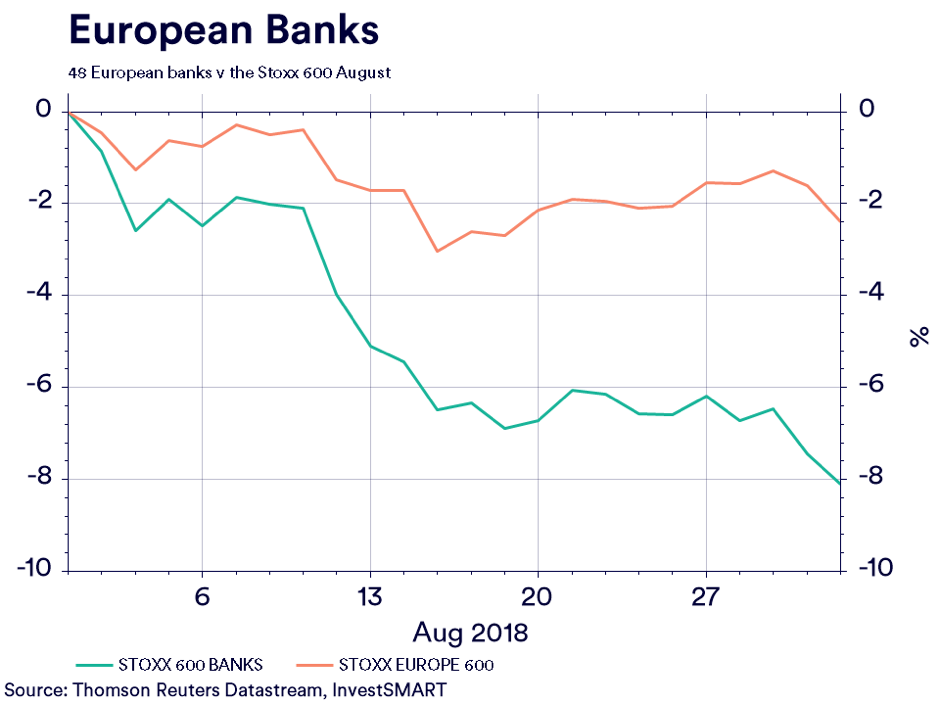

Spain, France and Italy have large corporate bank lending exposures with Turkey and the fear of ‘contagion’ saw the European banks underperform the market.

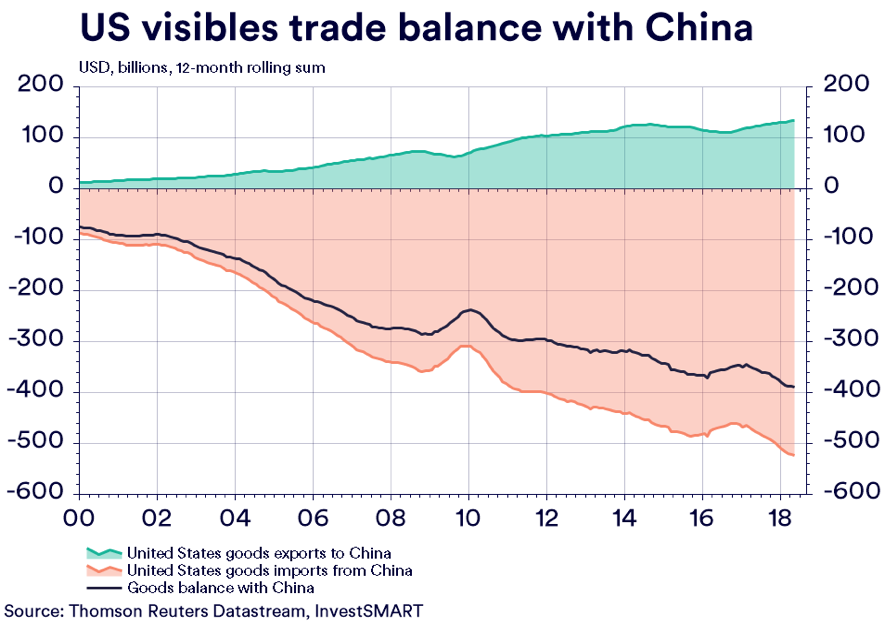

- InvestSMART’s main exposure to EM is the China A50 index, which has felt the full force of the US-China trade war this year. Year-to-August, the index is down 16.5%, and year-to-date the A50 is down 19.1%. August saw the first wave of tariffs from the US on Chinese exports – US$50 billion worth at 25% being signed into law.

$US200 billion of additional tariffs have passed written submission, and a further $US267 billion are being proposed. Tariffs could cover the total value of all Chinese exports in 2018.

Our exposure to the China A50 is included in the MSCI World.

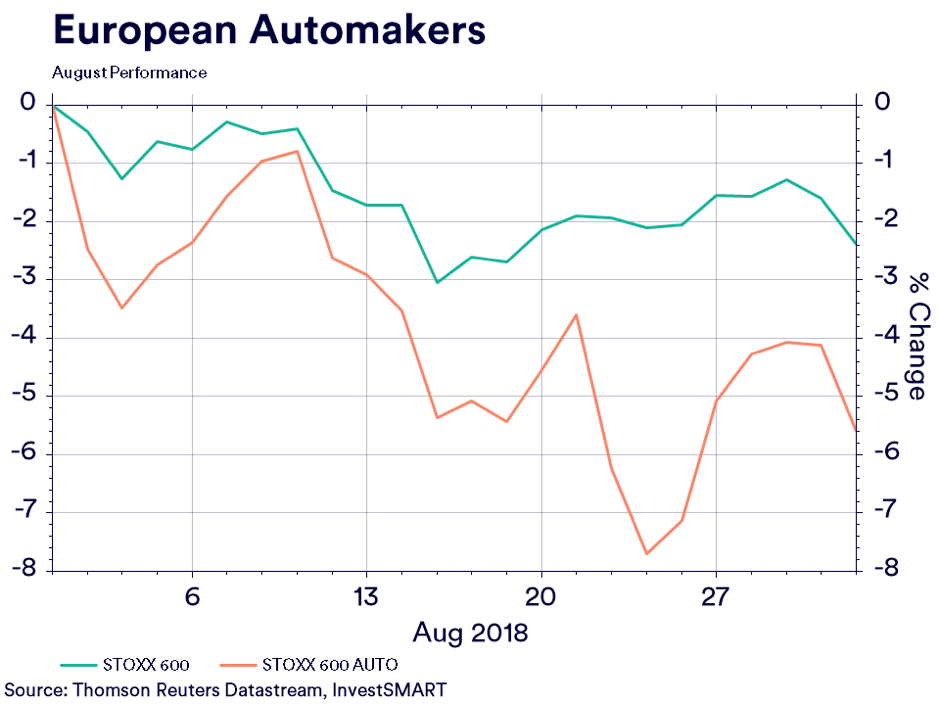

- European markets had two geopolitical issues to deal with in August. Turkey and its possible financial issues were one, and the other was the White House proposing a 25% tariff on all European car imports.

- Treasuries markets began to price in further rate hikes from the US Federal Reserve. US 2-year treasury yields increased to 2.71% from 2.52% on anticipation of a rate hike in September strengthened off the back of US data. US 10-year yields fell as global risks drove capital into US treasuries and closed August at 2.85%.

- Property prices have fallen 1.9% over the past 12 months, although Australian housing is still 31% higher than it was five years. The July data shows a decline of 0.6% month-on-month, which is the worst monthly performance since September 2011.

Tighter credit conditions and out-of-cycle rate rises are mainly to blame for the dampening housing market activity.

To see more information on our Diversified Portfolios, click here.

InvestSMART International Portfolio

The international portfolio continued its strong performance in August, adding 3.59%. The main attribution to the fund came from the 49% exposure to US markets which remains core to our international portfolio. Further short-term volatility in global markets is expected as geopolitical issues remain.

We have altered the securities of the International Fund to better reflect global markets while offering a lower fee structure. To read more about the change, click here.

To see more information on our International Portfolio, click here.

InvestSMART Interest Income Portfolio

The Australian 10-year bond fell from 2.71% to 2.52% in August based largely on concern over Emerging Market risks. A speech given by RBA Deputy Governor Guy Debelle stated that they believe inflation in Australia will fall in the second half of the calendar year. The RBA wants to increase the cash rate when possible, though the time frame for a rate rise has been pushed out further. Both of the above pushed up the capital value of floating notes in our portfolio.

The portfolio added 0.63% in August off the floating notes appreciation. Looking to September and floating notes face the potential of a third interest rate hike this year from the US Federal Reserve.

To see more information on our Interest Income Portfolio, click here.

InvestSMART Diversified Property & Infrastructure Portfolio

Property securities snapped back in August with both the domestic and international exposures gaining 2.4% and 4.6% respectively. The performance of property masked the underperformance coming from infrastructure.

Some of our infrastructure securities - Transurban and Sydney Airport - provided solid returns and met market expectations. Utility providers face a tougher climate as risk of a public hearing into energy prices has increased.

The portfolio added 1.88% in August and the yield of the portfolio ticked up to 4.97%.

To see more information on our Property & Infrastructure Portfolio, click here.

InvestSMART Hybrid Portfolio

The total portfolio return for August was 1.13% and it has returned 3.91% for the quarter. The total return of the portfolio exceeded its respective objective for the month, quarter, half year, and full year. The yield of the portfolio has fallen from 5.2% to 5% (including franking).

The main contributors to performance were NABHA ( 4.7%), MBLHB ( 4.6%), and MQGPC ( 2.4%). The only detractor to performance was AXLHA (- 0.5%), which gave up gains following listing in July.

To see more information on our Hybrid Portfolio, click here.

Frequently Asked Questions about this Article…

In August, the S&P/ASX 200 added 0.6%, with diverse performance across different sectors. Despite a modest average EPS upgrade of 1.5%, high multiple stocks saw significant capital growth.

The US markets, particularly the S&P 500, performed strongly, adding 3% in August. This contributed positively to InvestSMART's international portfolio, which has a 49% exposure to US markets.

Emerging markets faced challenges in August, notably due to Turkey's currency crisis, which affected other markets like South Africa, Indonesia, and Malaysia. This led to underperformance in European banks with exposure to Turkey.

InvestSMART altered the securities in the International Portfolio to better reflect global markets while offering a lower fee structure, maintaining strong performance with a 3.59% gain in August.

Property securities rebounded in August, with domestic and international exposures gaining 2.4% and 4.6% respectively. However, infrastructure underperformed, though some securities like Transurban and Sydney Airport met expectations.

The Australian housing market saw a 1.9% decline over the past year, with tighter credit conditions and out-of-cycle rate rises contributing to reduced market activity.

The InvestSMART Hybrid Portfolio returned 1.13% in August and 3.91% for the quarter, exceeding its performance objectives. Key contributors included NABHA, MBLHB, and MQGPC.

The US Federal Reserve is anticipated to implement a third interest rate hike this year, while the RBA in Australia has pushed out the timeframe for a rate rise, expecting inflation to fall in the latter half of the year.