InvestSMART Diversified Property & Infrastructure Portfolio

The InvestSMART single asset class models are designed to be the building blocks of a diversified portfolio. Our objective in designing and managing them requires the selection of a benchmark that we believe will serve as an appropriate proxy for each asset class and then the ongoing maintenance of a model that will, over the long term provide the investor with the returns of the chosen benchmark. Studies show that diversification has delivered better risk adjusted returns over long periods.

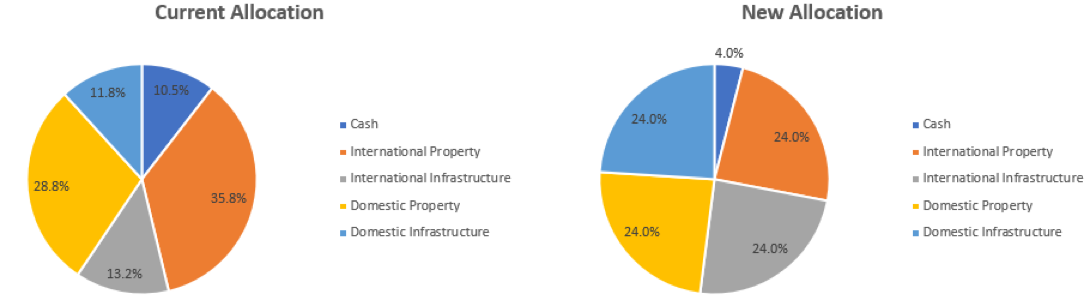

In saying, we are making some adjustments to our Property and Infrastructure Portfolio with the objective of reducing transactional costs within the portfolio while also maintaining an asset allocation that ensures we deliver returns in line with our benchmark.

The changes

We have made three broad changes,

- Reduced cash by removal of BetaShares Australian High Interest Cash ETF (AAA)

- Rebalanced exposures to be equally weighted across each category

- Replaced 5 domestic REITs with The Vanguard Australian Property Securities Index ETF (VAP)

Figure 1: Current Portfolio weightings vs New

Why VAP?

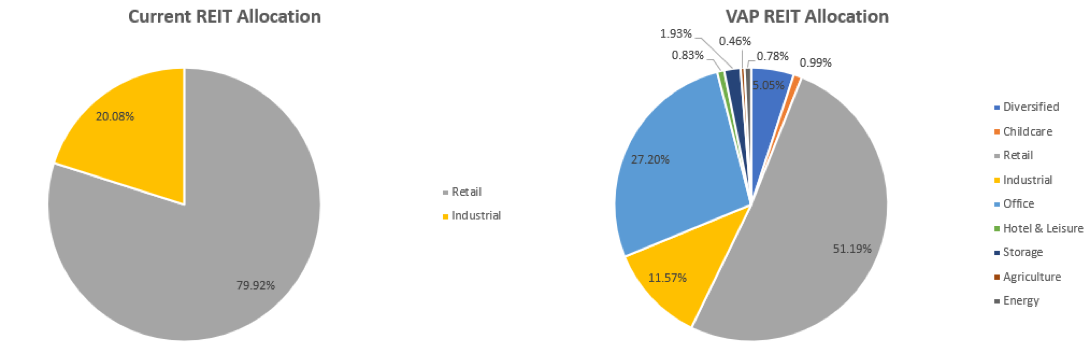

We’ve elected to invest in Vanguards Australian Property Securities Index ETF (VAP) to achieve our Domestic Property exposure. VAP seeks to track the return of the S&P/ASX 300 A-REIT Index, investing in 31 ASX listed REITs across various sectors. We favour utilising VAP for three reasons,

- ETFs are designed to track the underlying index that they are benchmarked to and investing in VAP allows us to track domestic REITs more efficiently.

Figure 2: VAP tracking difference to S&P/ ASX 300 A-REIT Index

- By investing in 31 ASX listed REITs across various sectors, VAP reduces the concentration to retail within the portfolio.

Figure 3: Current REIT allocation vs VAP

- By holding one security as opposed to five we cut down on the costs of rebalancing while still maintaining exposure to a range of securities. This is one of the core benefits of utilising ETFs in the construction of a portfolio.

Frequently Asked Questions about this Article…

InvestSMART's single asset class models are designed to serve as the building blocks of a diversified portfolio, aiming to provide investors with returns that match a chosen benchmark over the long term.

Diversification is important because studies show it delivers better risk-adjusted returns over long periods, helping to balance risk and reward in an investment portfolio.

The changes include reducing cash by removing the BetaShares Australian High Interest Cash ETF (AAA), rebalancing exposures to be equally weighted, and replacing five domestic REITs with The Vanguard Australian Property Securities Index ETF (VAP).

InvestSMART chose VAP because it efficiently tracks domestic REITs, reduces concentration in retail sectors, and lowers rebalancing costs by holding one security instead of five.

VAP benefits investors by tracking the S&P/ASX 300 A-REIT Index, reducing concentration risk, and cutting down on rebalancing costs while maintaining exposure to a diverse range of securities.

ETFs offer the advantage of tracking underlying indices efficiently, reducing concentration risks, and lowering transactional costs, making them a cost-effective option for maintaining diversified exposure.

VAP reduces concentration by investing in 31 ASX listed REITs across various sectors, which helps diversify exposure beyond just retail.

Holding VAP instead of multiple REITs reduces rebalancing costs by consolidating exposure into one security, which simplifies management and lowers transaction fees.