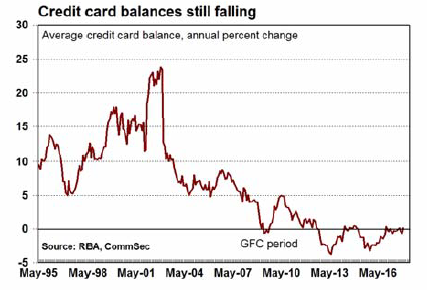

Investor Signposts: March 11, 2018

Lending data and the Reserve Bank hog the limelight

Lending data and the Reserve Bank hog the limelight

- There are no standouts in the second week of the autumn avalanche. There are a number of speeches from Reserve Bank officials and a raft of lending figures.

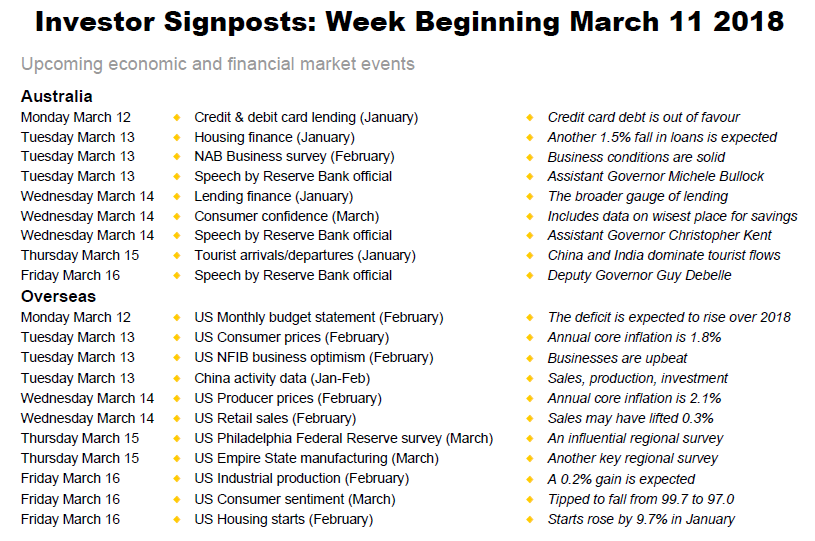

- The week kicks off on Monday with the Reserve Bank releasing the latest credit and debit card statistics.

- While the average credit card balance recorded a seasonal increase of $42.80 to $3,170.40 in December, it was up just 0.1 per cent over the year. In fact in smoothed terms (12 month average) the average balance was down by 0.2 per cent – a continuation of longer-term trends.

- On Tuesday the National Australia Bank releases the February business survey.

- The business conditions index rose recorded the fourth best monthly outcome on record in January. And the business confidence index hit a 9-month high.

- Also on Tuesday, the Australian Bureau of Statistics (ABS) issue housing finance data. In December the number of loans (commitments) by home owners (owner-occupiers) fell by 2.3 per cent– the third fall in four months. And the value of new housing commitments (owner occupier and investment) fell by 1.6 per cent.

- Roy Morgan and ANZ also release the weekly consumer sentiment data on Tuesday. Recent readings have been affected by the volatility on global sharemarkets.

- Reserve Bank Assistant Governor Michele Bullock also delivers a speech at the Seamless Australia Payments Conference on Tuesday.

- There is another speech by a Reserve Bank official on Wednesday, this time by Christopher Kent at the KangaNews DCM Summit.

- Also on Wednesday, the ABS releases lending finance data. The total value of new lending commitments (housing, personal, commercial and lease finance) fell by 4.4 per cent in December to $70.8 billion, after the largest rise in almost three years in November.

- And the Westpac-Melbourne Institute monthly survey of consumer confidence is released on Wednesday. The monthly confidence reading is more of a check on the weekly survey. But every three months the monthly survey also has a special focus on the wisest places to put new savings.

- On Thursday the ABS releases the “Overseas Arrivals and Departures” publication. The publication includes data on tourist flows as well longer-term migration data. In December tourist arrivals fell by 1.7 per cent to 6-month lows and departures declined by 1.6 per cent to 5-month lows.

- The Reserve Bank also releases the quarterly Bulletin on Thursday – a publication that includes topical articles on the economy and financial markets.

- And on Friday yet another speech will be delivered from a Reserve Bank official, this time from Deputy Governor, Guy Debelle, entitled “Risk and return in a low rate environment”.

Overseas: US inflation data; Chinese retail sales and production

- Key inflation data is released in the US in the coming week. And key activity data is released in China.

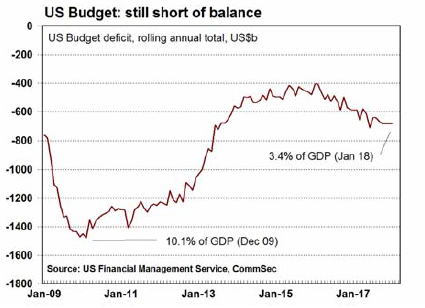

- The week kicks off on Monday with the February monthly budget figures released in the US. Two years ago the deficit eased to a US$405 billion annual total. Today the deficit is near 4½-year highs at US$683 billion – and set to widen further over 2018.

- On Tuesday the National Federation of Independent Business (NFIB) releases the February small business survey. And the usual weekly Redbook survey on chain store sales is released.

- Of greater consequence on Tuesday is the Consumer Price Index (CPI). The core rate of inflation (excludes food and energy) is stubbornly below 2 per cent. And the longer it stays low, the more considered the Federal Reserve can be with interest rate hikes. Economists tip a 0.2 per cent lift in the month and 1.8 per cent rise over the year.

- In China on Tuesday the National Bureau of Statistics releases the January and February readings on retail sales, production and investment. The latest forecasts released at the National People's Congress suggest retail sales will continue to lift at a 10 per cent annual rate.

- On Wednesday the two highlights are the measure of business inflation – the Producer Price Index – as well as the retail sales figures. Economists expect that the core PPI rose 0.2 per cent in February to stand 2.3 per cent higher on a year ago.

- Retail sales fell 0.3 per cent in January after averaging gains of 0.9 per cent a month over the previous four months. Sales may have rebounded by 0.3-0.4 per cent in February.

- On Thursday a number of influential surveys are released. The Philadelphia Federal Reserve release the March manufacturing survey. In New York the Federal Reserve issues the March Empire State manufacturing index. And the National Association of Home Builders releases the housing market index.

- The January data on capital flows is also released on Thursday with data on export and import prices. And the usual weekly data on claims for unemployment insurance is issued.

- On Thursday, two ‘top-shelf' indicators are issued: housing starts and industrial production. Housing starts are tipped to ease in February after the strong 9.7 per cent increase in January. And production may have lifted 0.2 per cent after January's 0.1 per cent fall.

- Also on Friday the preliminary March consumer sentiment survey is released with the JOLTS series of job openings.

Craig James is the Chief Economist at CommSec

Share this article and show your support