Investing and the Big Five

This isn't a personality test, but your traits may shed some more light on why your household invests, more or less, in certain assets.

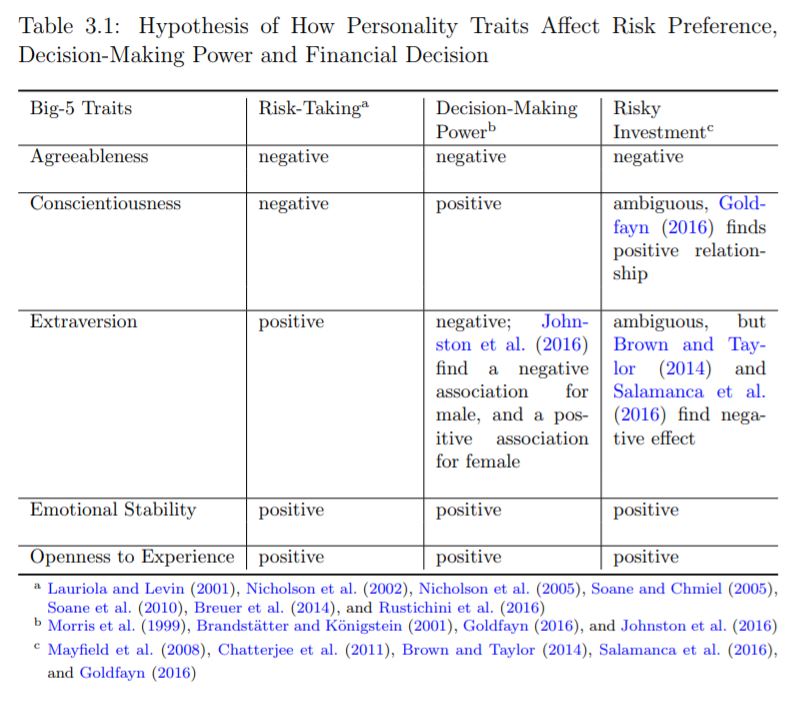

A Melbourne University PhD candidate, Kuiyin Wang, just wrote a paper on this topic, surveying 225 academics across different faculties in the process. It’s a first attempt to investigate the direct and indirect effect of personality traits (agreeableness, conscientiousness, extraversion, emotional stability and openness to experience) on asset allocation decisions. After decades of research since the 1970s, the most known measure of personality comprises of these five personality traits, known as the Big Five or five-factor model.

The paper observed personality traits of those aged between 30 and 65 in 2005, 2009 or 2018, and matched these with household assets data in 2006, 2010 and 2014 from Household, Income and Labour Dynamics in Australia (HILDA) surveys.

The author thought the only way to settle the ‘who’s the boss’ debate was to not settle it at all, and so, only included households who agreed on the financial decision-maker. All up, 471 couples indicated the husband was the sole financial decision-maker, and 173 couples thought the wife to be.

Several other studies have shown personality traits determine aversion to risk and ambiguity, and have an impact on things like credit score, health and job persistence.

Singles better for the stock market

Let’s call households where both the husband and wife share the decision-making ‘S-type’ residences, ‘H-type’ where the husband is the sole financial decision-maker, and ‘W-type’ in residences where the wife is the sole financial decision-maker.

Husbands of S-types are more risk-averse than the other two types of husbands. Meanwhile, wives of S-types are more risk averse than the other two.

Interestingly, households with sole decision-makers invest more in equities than those with shared decision-makers, maybe because there’s one less roadblock to getting over the line.

“A sole-decision-maker household invests a higher proportion to risky assets than a shared decisionmaker household, no matter which of the spouse makes the decision. It is in line with the group polarisation hypothesis.”

The extraverted roadblock

When it comes to the Big Five personality traits, extraverts are considered natural-born risk-takers, because extraversion reflects the need for stimulation. On top of that, scoring high on the ‘openness to experience’ measure is widely considered a cognitive stimulus for risk-taking too. Further, agreeableness, conscientiousness and emotional stability are thought to be correlated with resilience to risky outcomes.

Peer-reviewed studies published in 1985 (Hudgens and Fatkin), 1996 (Bajtelsmit and Bernasek), 1997 (Powell and Ansic), 1998 (Jianakoplos and Bernasek) and 2012 (Charness and Gneezy) have determined a gender gap in risk aversion does exist.

Ultimately though, if you’re in the upper echelons the Big Five model, you’re probably a ‘high risk, high stakes’ kind of operator.

That said, it may seem surprising, the more extraverted the husband, the less likely it is the household invests in equities – a ‘riskier’ asset class. An extraverted husband has a “compounding negative effect” on investing in equities, which in turn has a negative impact on household wealth.

“Husband’s extraversion decreases the likelihood of him taking responsibility in household financial decision-making, and wife’s emotional stability increases the likelihood of her taking the responsibility,” reads the study.

“Without interaction terms, the probability of investing in equities decreases by 2 per cent if the husband’s extraversion increases by one standard deviation. Wife’s openness to experience decreases the probability by 2.8 per cent.”

It may seem contrary that extravert-dominant households invest less in equities, considering equities are inherently riskier than many other assets. But this makes sense when you think about it on a deeper level. Extraverted decision-makers may communicate more openly, and when it comes to investing as a couple, it takes one to strike up conversation but two to tango.