International fund manager series: BT Wholesale European Share Fund

Summary: The BT Wholesale European share fund (BTA0124AU) has managed to beat the benchmark even during the more tumultuous periods of European markets over the past five years. Stocks that are considered are consumer-focused with the ability to grow in all market conditions – holdings include UK food wholesaler Booker Group, L'Oreal and fragrance company Smyrise AG. Macreconomic data out of Europe is looking positive, particularly for the manufacturing sector. |

Key take out: The fund recommends investments in the fund for at least five years – this time frame should let businesses weather any poor conditions, while also enjoying the good times. |

Key beneficiaries: General investors. Category: International investing, managed funds. |

Thinking about Europe

Sinking commodity prices and uncertainty over the future of interest rates and banking regulations has turned the spotlight on new – or newly considered – markets. At the same time, Europe has emerged as a key investment theme in 2016. Putting these two ideas together, we have identified a fund to consider – the BT Wholesale European Share Fund (BTA0124AU).

A European fund, including the UK, might seem like an unlikely choice considering much of the investment-related commentary focuses on where investors are currently most interested – the US and China. However, despite what's happening around the world, the economic data coming from Europe is worth considering in detail.

For Australian investors who are typically heavy on banks and commodity companies – including those that service the sector – a top class European fund offers industry sectors simply not available on the ASX.

Moreover, it's worth pointing out that many of the best European stocks are global multinationals, with far ranging investments and operations.

The numbers and the fund

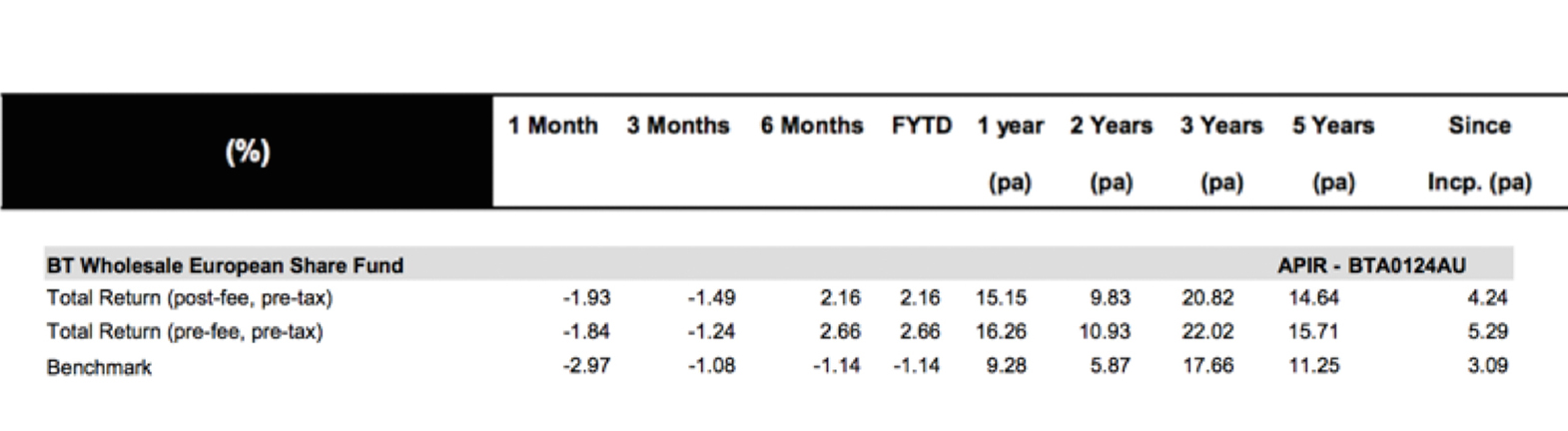

The past five years have seen Europe battle the ongoing sovereign debt crisis, however through careful management, the fund has been able to consistently outperform its benchmark.

Even in the tumultuous times, the BT European fund has made investment decisions that have lead to a return greater than the benchmark. Few funds in the sector have been able to outperform over one, three and five year periods, highlighting how rare steady performance is.

While the fund is branded a BT investment, the management team is MFS International – a UK based asset management firm. It means investors have access to a team of local investment professionals.

While company sales data is freely available, having a team on the ground able to do the qualitative research into why sales have peaked or are lagged can be the key factor in making an investment decision.

Investing directly with BT requires a minimum investment of $25,000, otherwise the minimum amount stipulated by your platform provider applies (this is $1,000 with brightday).

It's also a fund that keeps its fees low. A flat 1 per cent fee – with no performance-related incentives – puts this BT at the cheaper end of outperforming managed funds. It's pleasing to see a fund consistently perform well without a performance fee, which ultimately eats away at the end return to investors.

Quarterly commentary from the fund takes a different approach to other managers, because both the winners and the losers of the portfolio for the period are critiqued.

Most fund managers don't provide any comment on the investments that have performed poorly in their regular commentary, making the inclusion a refreshing insight.

It's all about the consumer

The investment thesis of the fund is straightforward – look for consumer-focused companies, with business models than can weather all economic conditions. Consistent cash flows and a sturdy balance sheet are a must for inclusion in the portfolio.

Broadly speaking, the fund looks for companies that are able to consistently produce above-average growth and that are trading below their calculated value. It's no different to the investment philosophy of many other fund managers looking for value, but what sets them apart is their execution – identifying the right companies, in sectors with favourable outlooks.

In the consumer space, the fund looks to companies with an interest in leisure, restaurants and food and beverage.

Ticking the boxes in the food and beverage space is Booker Group, the UK's leading food wholesaler. With a dominant market position, the company has returned over 30 per cent compound annual growth for the five years ending December 30 2015. Using internet sales and the concept of just-in-time delivery, the company is able to use their customer knowledge combined with technology to manage costs and generate greater profit.

The fund also holds cosmetic giant L'Oreal and perfume and fragrance company Smyrise AG.

Avoiding the larger European banks, the fund hunts for diversified financial companies. This is fitting considering traditional banks in Europe face a number of issues around sovereign debt exposures and regulatory changes, especially regarding the amount of capital that must be held.

The appeal of looking beyond the classic banking model is the downside risk protection, along with a greater range of revenue streams.

The types of companies that are of interest to the fund across this sector include KBC Groep, a Belgian diversified financial and insurance company. On a share price only basis, KBC Groep has returned over 12 per cent per annum for the past five years. This performance is significantly better than what any of our “Big 4 banks” or major Australian insurance companies have returned over the same time.

A rigid mandate makes for a long list of companies and sectors the fund won't own. For one, it avoids utilities due to government regulation and the scrutiny that often goes with it. This is also a sector that generally has higher debt levels than the fund is willing to accept.

The Euro index has around a 6 per cent exposure to commodities, which is around half of the Australian market. While the fund doesn't disclose how much it invests in each sector, it has communicated it doesn't favour commodity producing companies. This could be of interest to anyone conscious of oil or gold prices, for example.

Supporting the thesis

Putting forward Europe as a serious investment option could have many investors running for the exit, still haunted by the woes of debt-ridden, infamous PIGS (Portugal, Ireland, Greece and Spain).

But there is also macroeconomic data confirming the Euro recovery is well established. The trade surplus continues to widen, confirming exports – helped by a weaker currency – are picking up, while imports remain modest. All of this has helped boost employment numbers, encouraging domestic consumption.

One of the more preferred measures for leading growth, the Manufacturing Purchasing Managers Index (PMI), has been steadily rising since late 2014 and suggests an expansion of the manufacturing sector. It bodes well for future expectations of production and consumption across the region.

It also needs to be said the European Central Bank has committed to providing easy monetary policy for the foreseeable future by pushing the deposit rate on their lending facility into negative territory during 2015, while extending their monthly 60 billion Euro asset purchasing program through to March 2017. Loose monetary policy is expected to be a positive for the share market in the immediate future.

What could go wrong

Given the fickle nature of equity markets, it's prudent to consider the possibility things could go wrong for European shares.

A slowdown in consumption from the struggling emerging markets could negatively impact European companies, which derive a significant portion of their revenue from this market. However, if the worst is over European companies should see an uptick from this market in the year ahead. It's a fine line between the two possible outcomes.

As with any international investment, currency can have a significant impact on return. While the Australian dollar has been usefully depreciating against the Euro since mid-2012, there is no guarantee this will continue.

Your portfolio

Investors would want to have the patience to let their investment be for at least five years, as per the minimum investment time frame recommended by the BT European Fund. It is a reasonable investment period that will allow companies to weather less than desirable business conditions and enjoy the good times.

While Australian investors generally need to diversify away from local shares, how much you invest in a regional play is different for everyone. For investors who are cautious, but keen to dip their toes into different markets and investment themes, starting with a small allocation and building it up over time could be a worthwhile strategy.