Interest-only borrowers fail literacy test

Summary: Many borrowers with interest-only loans have taken them out without really understanding their risks and limitations. A report from UBS has uncovered gaps in both the lending data as well as in financial literacy levels.

Key take-out: Rises in retail interest rates are already putting some borrowers under financial stress. With further retail rate rises likely, the potential for forced property sales is increasing.

The Australian Prudential Regulation Authority's recent moves to clamp down on the level of interest-only mortgages by banks seems to have had the desired effect in terms of reducing speculative property lending to investors.

Figures released at the end of August show the aggregate value of interest-only loans fell by $2.3 billion in the June quarter. APRA has told banks they can only lend up to 30 per cent of their new mortgages on interest-only terms, and lenders have also lifted their interest rates to curb interest-only demand and to entice more investors into principal and interest repayments.

Yet, a new survey from investment bank UBS has lifted the lid on another big issue – an apparent lack of financial literacy among some borrowers who have taken out interest-only loans. In short, according to UBS, it seems some borrowers who have interest-only loans don't really understand them.

That is, they don't know the differences between an interest-only loan and one paying both principal and interest. When they took out their interest-only loan, the difference between the two may not have been explained very well by their loan officer or mortgage broker, or not at all.

For those that don't know, an interest-only loan means the borrower only pays the outstanding interest on the amount borrowed. The loan principal will never be reduced. So, why would you take one out? In simple terms, the repayments are lower, because they just cover the interest component.

Many seasoned property investors have used them, because the interest payments are deductible, and with a view to generating enough profit over time that will more than offset the cost of interest on their loan after taxes. That's on the assumption that property prices will keep rising.

UBS analyst Jonathon Mott, who in a separate report recently drew attention to an increase in so-called “liar loans”, whereby some borrowers have fabricated the financial information on their applications, has pointed out a discrepancy in official interest-only loans data.

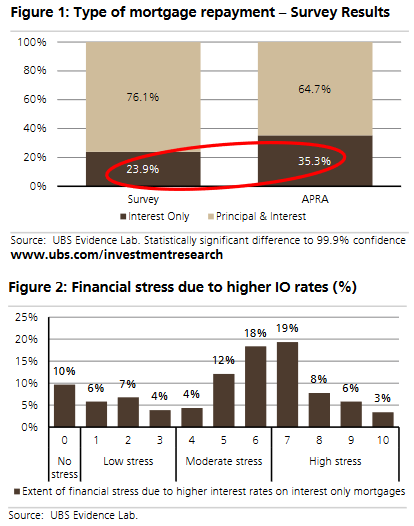

From 907 respondents to UBS's 2017 Australian Mortgages Survey, Mott found that 23.9 per cent by value had stated their mortgage loans were interest-only. This was lower than the APRA system statistics of 35.3 per cent of loans being interest-only.

“We initially suspected this was a sample error. However … we believe a more plausible explanation is that around one-third of IO customers do not know or understand that they have taken out an IO mortgage.”

There are a number of consequences. Borrowers not understanding the basics of interest-only loans, especially those who are owner-occupiers rather than investors, risk serious financial stress should interest rates rise, and even more-so should property prices fall.

While the Reserve Bank has again kept official interest rates on hold, expected rises in interest rates in offshore financial markets, where Australian banks source the bulk of their wholesale cash from, mean retail interest rates will almost certainly rise again over the coming months.

Borrowers on interest-only terms need to be attuned to that probability.

“We are concerned that it is likely that approximately 1/3 of borrowers who have taken out an IO mortgage have little understanding of the product or that their repayments will jump by between 30-60 per cent at the end of the IO period (depending on the residual term),” Mott states in his report.

UBS asked interest-only borrowers how they are coping financially since the recent increased in retail interest rates. Of the respondents, 10 per cent said they were under no stress; 16 per cent under low stress; 35 per cent moderate stress; while 36 per cent indicated they are already under high stress.

“Across all IO customers 53 per cent said they are reacting to higher interest rates by reducing consumption, while 24 per cent are considering switching to P&I. Of concern, 23 per cent of IO borrowers who are already under high stress said they are considering selling their property, while 17 per cent will need to draw down other lines of credit to meet higher rates.”

Mott notes that the findings are concerning, given there are $640 billion of interest-only mortgages outstanding in Australia.

“While these loans are well secured, we believe many borrowers may face substantial stress as interest rates rise or when they revert to principal and interest.”

Clearly, however, more needs to be done at the policy level in terms of tackling financial literacy and ensuring lenders, including third party selling agents such as mortgage brokers, operate under stricter standards.

Failing to act quickly can only have dire consequences for the stability of the financial system and the economy as a whole.