Income First model portfolio update

Summary: Nearly two months after launching in an unsettled market, our Income First Model Portfolio is a little more than 50 per cent invested, with this portion showing similar volatility to the Australian market. Most of the stocks in the portfolio have outperformed the All Ordinaries on a price only basis. Based on the current holdings, the portfolio's forecast cash yield is currently around 3.54 per cent. |

Key take-out: More of the portfolio will be invested in coming months so the portfolio can generate the desired level of income - potentially more than 6 per cent. |

Key beneficiaries: General investors. Category: Income. |

The ASX has proven nothing but volatile since the inception of the income first model portfolio.

Since we kicked off with our first five stocks on August 11 2015, the All Ordinaries is lower by more than 7 per cent. Pleasingly, the approach that we have taken has been to invest incrementally over the last few months, to a point that we are now only just over our minimum target of a 50 per cent portfolio investment. The high cash holding in the portfolio to date has created a good level of outperformance, though the return has still been negative overall at a loss of around 3 per cent.

Unfortunately, it has been a difficult market for investors, and the volatility appears set to continue. On the positive side, the average forecast dividend yield on the stocks invested is 6.54 per cent. (This doesn't include franking credits, and is weighted to the current holding). So, the portfolio is well set to deliver income despite struggling markets.

In light of market volatility, now is a good time for us to touch back on the objectives of the portfolio, and both the behaviours and performance of the portfolio to date.

Returns behaviour

Perhaps providing solace in a difficult environment has been the way that the portfolio has performed to expectations thus far.

Overall, the portfolio appears to be less volatile than the market in general. There has been a level of outperformance when the market is down and a general underperformance when the market is higher.

While this is the behaviour we expected, it is worth noting that this has largely been created as a function of the high cash holding, as the portfolio is gradually invested. In terms of the performance of the invested portion, it is fair to say that volatility has been far higher than expected, but broadly in line with the market.

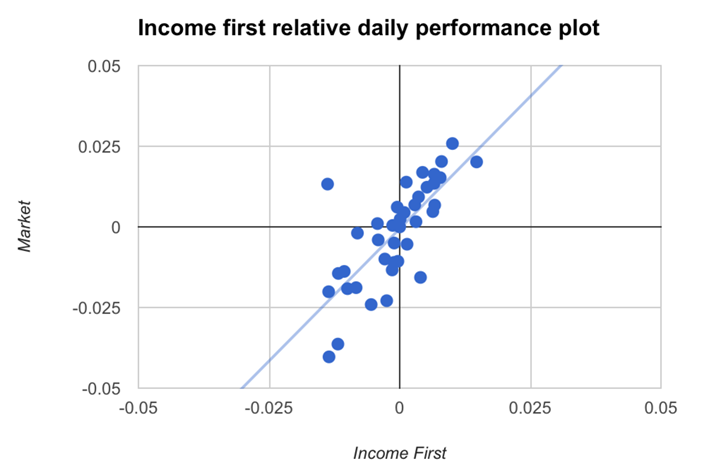

The chart below compares the daily returns of the portfolio to the daily returns of the All Ordinaries. Effectively the higher the gradient of the line, the lower the relative volatility of the model portfolio compared to the market. At present this is telling us that the portfolio is lower volatility, which is a good outcome, but we will monitor any changes over time, especially as the invested portion grows.

Stock performance so far

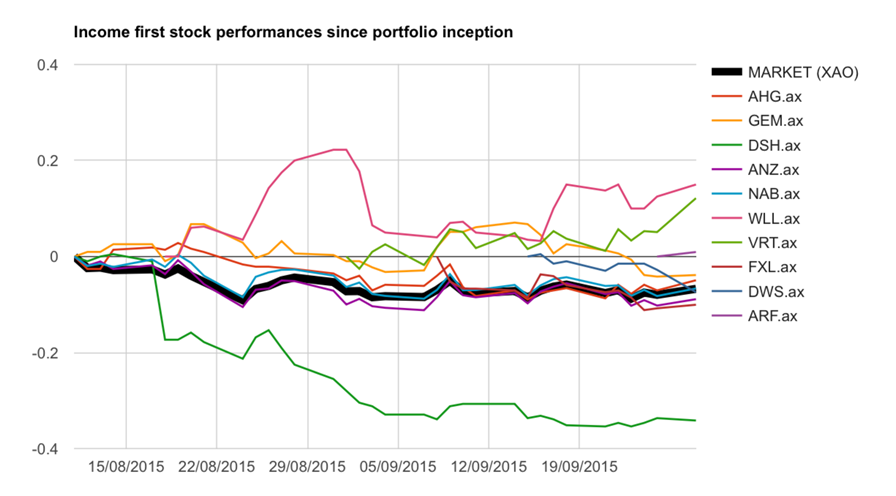

The clear laggard on performance was Dick Smith Holdings (DSH), which suffered a significant sell-down following its financial results.

The performance here has been surprising, as the company's report in August was largely in line with our expectations. Additionally, the report was very well flagged to the market in terms of guidance on dividends, earnings and cash flow timing.

Nonetheless, it has been apparent that some holders have aggressively sold out of DSH, leading to an underperformance in the share price. Additionally, short sellers now account for nearly 13 per cent of the capital base, up from 11 per cent, indicating that some in the market are taking bets against DSH.

Despite all of this negative sentiment, DSH still reflects a strong investment case. The company's store roll-outs will produce near-term earnings. What's more, cash flow uplift and the release of cash from working capital have combined with a healthy balance sheet to provide the company with options.

In fact, I suspect that with the share price languishing near $1.30 at the time of writing, DSH may be tempted to consider capital management options such as a share buyback. Of course, this is pure speculation at this stage, and may be quite premature.

Nonetheless, DSH will hold its AGM on October 28, and this could prove an appropriate time to correct sentiment either through a trading update, or any intentions to look further at capital management. It is worth noting that the majority of the company's performance will rely on the Christmas trading period, so an expectation for capital management to be announced at the October AGM may prove premature. For now, I am comfortable holding DSH in the model portfolio. As the chart below shows, the rest of the portfolio has performed well against the backdrop of a weak market.

Wellcom Group (WLL) has performed extremely well in the tough environment, generating a good level of outperformance following a healthy FY15 report and outlook. Although volatile, Virtus Health Limited (VRT) has also performed well.

As can be seen from the next chart, most of the stocks in the portfolio have outperformed the broader market (the All Ordinaries) on a price only basis - excluding the dividends accrued. The exception is DSH. Note that the big bold line is the performance of the market since the establishment of the portfolio on August 11. Each of the coloured lines represents the return since portfolio inclusion for each stock in the portfolio individually. If a stock was added after August 11, the line starts at zero on that date of inclusion (for example WLL is included on 18 August).

Forecasts and risks

Based on the current holdings, the portfolio's forecast yield is currently around 3.54 per cent (4.39 per cent if we include franking), based on the current position and expectations for future dividends. This is a level produced by a 53 per cent investment of initial capital, meaning that as we further add yielding stocks this should easily lift towards our target of 6 per cent-plus (including franking).

However, risks do exist. In this portfolio's case, the primary risk that dividends may not eventuate. This can occur when company boards consider the impact of lower share prices and a weakened economy. At this stage, I'm comfortable that the risk of dividend cuts is quite low for the portfolio – this was a key objective when selecting stocks.

Future portfolio direction

Although the portfolio has benefitted from a higher than normal cash holding so far, our intention remains to invest at a higher level going forward. This is required for us to generate the level of income desired from the portfolio, which we believe could exceed 6 per cent (including franking) on the current capital value.

Despite this, I see no need to try to time the market. Current volatility is making it very difficult to invest with confidence in the short term.

However, the objective here is to secure strong and growing income paying businesses at good value. Regardless of market volatility I am seeing good opportunities to secure such strong incomes in good businesses. Thus, I intend to continue to add to the portfolio at a relatively constant rate over the coming month or two, targeting an 80 per cent plus investment level.

I acknowledge that this will lift short-term price movement risks, but investors can manage this through their own overall asset allocation and exposure to equities more generally.