IMF gives Australia a tick, but watch China

|

Summary: The International Monetary Fund has released a glowing report on the Australian economy, forecasting growth here will rise in 2017 before easing slightly in 2018. |

|

Key take-out: The IMF report hasn't factored in the recent falls in commodity prices, on which Australia is so reliant, and demand from China remains critical. For investors, that's definitely something to be mindful of as any economic slimming down in China is a big tail risk for Australia. |

|

Key beneficiaries: General investors. Category: Economy. |

If the International Monetary Fund (IMF) is any indication, good times for the Australian economy are just around the corner.

The IMF released its latest World Economic Outlook this week and was decidedly upbeat regarding the economic outlook for Australia this year and next. It marks a stunning turnaround given the “mediocre” assessment delivered in February.

As a general rule the IMF consults with the likes of the Reserve Bank and Treasury before releasing its outlook. This is largely necessary since the IMF delivers a global economic outlook and doesn't have the same resources dedicated to forecasting Australia as our domestic institutions.

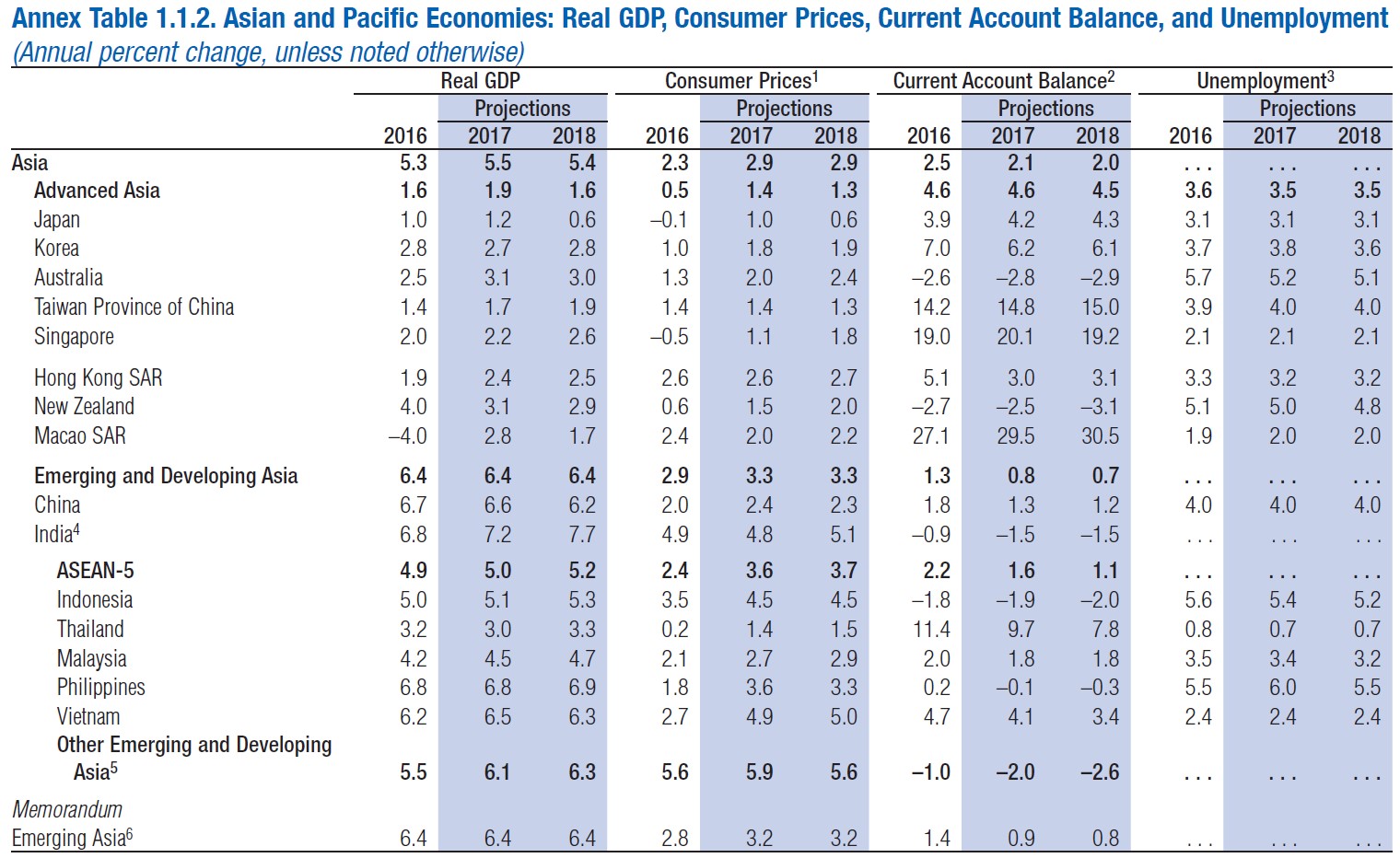

According to the IMF, economic growth in Australia will rise to 3.1 per cent in 2017 before easing slightly to 3.0 per cent in 2018. Above trend growth will translate into rising inflation – returning to the middle of the RBA's target by 2018 – along with a decline in the unemployment rate.

By comparison, in February the RBA estimated that economic growth would sit at around 2.5 per cent in 2017 before lifting towards 3.0 per cent the year after.

Based on the IMF figures it appears likely that Treasurer Scott Morrison and the Federal Government will deliver a pretty optimistic budget. However, that may change given the recent carnage in iron ore and coal markets that have sent prices spiralling and has not been incorporated into these IMF forecasts.

It also follows that the Reserve Bank may lift its economic outlook when releasing its next Statement on Monetary Policy in early May.

The economic growth forecasts will be more easily achieved than the inflation forecasts. Wage growth remains a key impediment towards higher inflation, and while we have import inflation from abroad it is hard to see a sustainable improvement until wages begin to pick-up.

The improvement in the unemployment rate is also somewhat unlikely since economic growth is likely to be driven by net exports, in particular iron ore, coal and LNG exports, which hasn't historically created many jobs.

With commodity prices falling again – and assuming that prices remain at a reasonably low level – we are likely to experience weak growth in corporate earnings and that will inevitably weigh on wage growth and employment.

What about the rest of the world?

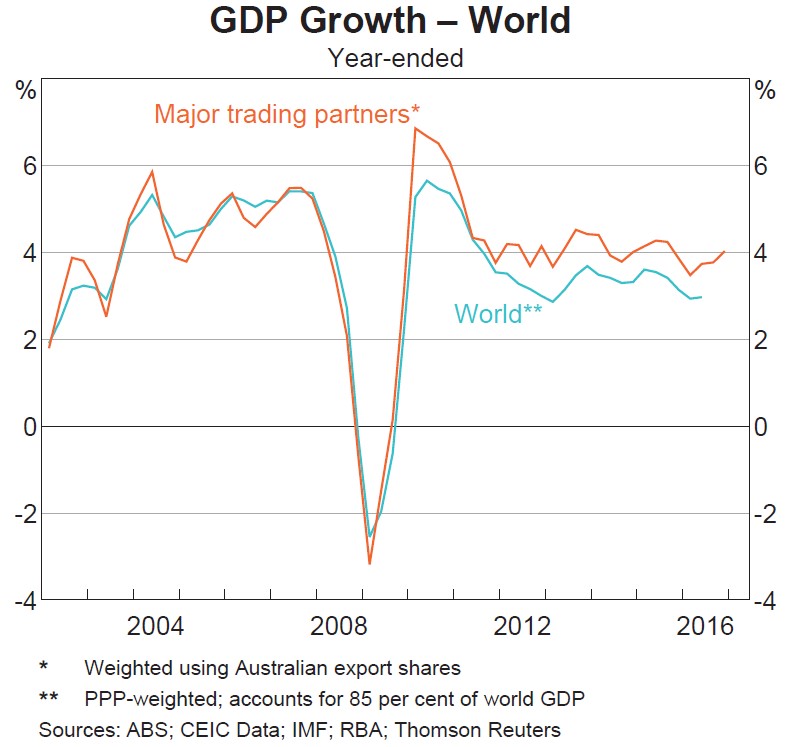

The IMF is also optimistic about the global outlook and is forecasting improved growth in 2017 and 2018.

“Consistently good economic news since summer 2016 is starting to add up to a brightening global outlook,” the IMF said. “The economic upswing that we have expected for some time seems to be materialising.

The IMF raised its outlook for global growth to 3.5 per cent in 2017, up from earlier forecasts of 3.4 per cent, with growth improving slightly to 3.6 per cent in 2018. Both results, if achieved, would mark a significant improvement on last year when annual growth came in at 3.1 per cent.

“This improvement comes primarily from good economic news for Europe and Asia,” the IMF said.

Growth in Europe was upgraded modestly for 2017 – with a broad-based improvement in Germany, France and Italy and a larger upgrade for Spain. Growth in the United Kingdom was upgraded by 0.5 percentage points for 2017 – the largest upgrade among advanced economies – and largely reflects the fact that the economic concerns surrounding the Brexit haven't yet materialised.

But the major driver of global growth over the next two years will continue to come from emerging and developing economies. The IMF estimates that these countries will grow at 4.5 per cent in 2017 and 4.8 per cent in 2018.

Strong, albeit slowing, growth in China and improved growth in India will lead the way. South East Asia is expected to be almost universally strong over the next two years. It points to an ongoing improvement in growth for our major trading partners, which is clearly great news from Australia's perspective.

Key risks

One of the key risks surrounding the global economic outlook stems from the Federal Reserve in the United States. Policy normalisation continues but there is also the possibility that the Fed begins to scale back the size of its balance sheet.

Scaling back involves selling some of the assets it has accumulated since the onset of the Global Financial Crisis. Added supply could very well put downward pressure on asset prices across the United States and spill over to other financial markets. This is one of the key risks for investors over the next few years.

The IMF also highlights China's economic rebalancing. The process continues and if China is successful it will ultimately mean less infrastructure investment (which is highly dependent on iron ore) and greater consumption and services activity.

However, the IMF continues to be concerned about China's reliance on debt to drive growth.

“Growth has remained reliant on domestic credit growth being so rapid that it may cause financial stability problems down the road,” the IMF said. “These problems could, in turn, spill over to other countries.”

In such an episode Australia would be one of the economies that suffers the greatest economic impact.

Our prosperity is increasingly tied to economic conditions in China and policymakers in Australia will be closely watching China's rebalancing process and their accumulation of debt for the foreseeable future.