How to Keep Crypto Record Keeping Under Control

Unlike traditional assets, crypto investing introduces some new challenges for investors when it comes to recording transactions for tax purposes and administering portfolios. Smart investors who keep their crypto records up to date will have a more accurate view of their position in real-time and will reduce the effort required by their accountant or tax agent at tax time.

One of the most significant differences with crypto is that transfers from one wallet to another incur cost, even if both wallets belong to the investor. An investor transferring Bitcoin from their wallet at an exchange to their personal hardware wallet will receive slightly less Bitcoin in their personal wallet due to a network fee charged by the underlying Bitcoin network. On the Ethereum blockchain, so-called “gas” fees arise when transferring Ether. The same goes for most other layer 1 blockchains (or crypto tokens that run over a layer 1 blockchain such as Ethereum).

An investor who purchased $1000 of Bitcoin on an exchange will not only pay the exchange commission but will also pay the Bitcoin network a fee for moving that Bitcoin to their personal cold storage wallet. Any transaction history report provided by the exchange won’t typically show this fee, as it occurs after the Bitcoin has left the exchange.

Wallet software will usually show this fee because most wallets are reading the public Bitcoin blockchain ledger to construct a transaction history and maintain account balances. Wallets show how much Bitcoin is received, which is slightly less than is sent by the sender.

Because the exchange doesn’t know which wallet addresses belong to the investor and the investor’s wallet doesn’t know which wallet addresses belong to the exchange, it isn’t possible for either to produce an aggregated summary of all crypto movements across the network. This means the investor needs to track and record this for themselves, either manually or using a software package designed for the purpose.

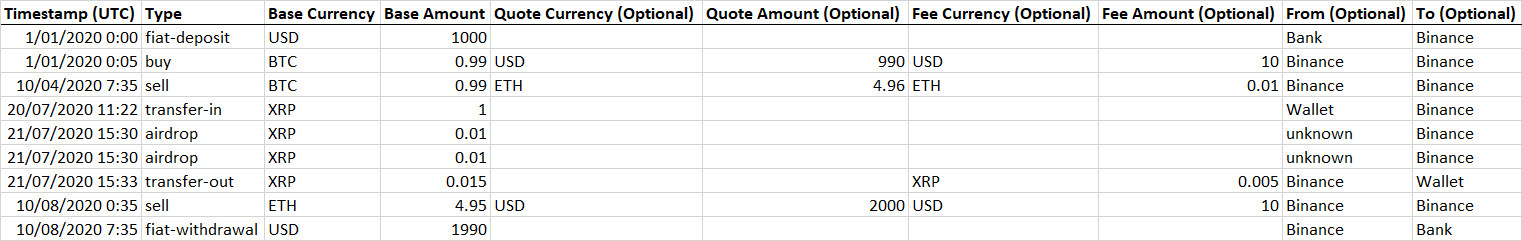

Investors who can drive a spreadsheet, and have the appetite to do so, may find that this gives them the most control over their crypto records, even if the spreadsheet is then imported into a system such as https://cryptotaxcalculator.io/:

Eagle-eyed investors who love nothing more than diving into Excel will notice “transfer-in” and “transfer-out” transaction records which allow the blockchain network fee to be accounted for during crypto transfers.

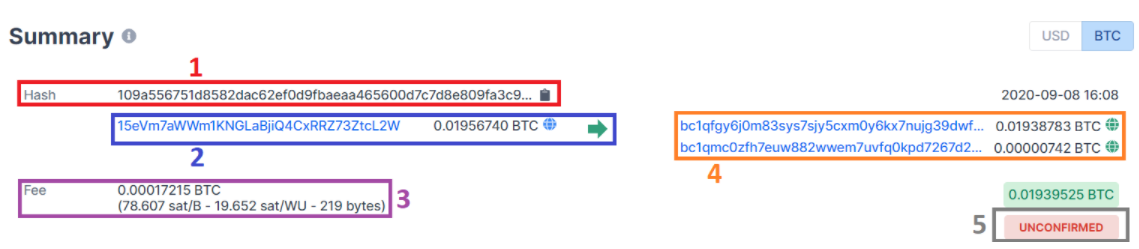

Investors will need to obtain the fee from their wallet software or a freely available blockchain explorer, such as https://www.blockchain.com/explorer. Here’s an example of a typical Bitcoin blockchain explorer showing:

- The transaction reference.

- The source wallet address.

- The network fee.

- The receiving wallet address and its corresponding change address.

- The transaction status (Bitcoin transactions are completed only once confirmed by the network and can be considered “pending” until confirmed).

Source: https://www.ledger.com/academy/how-to-read-a-blockchains-transaction-history

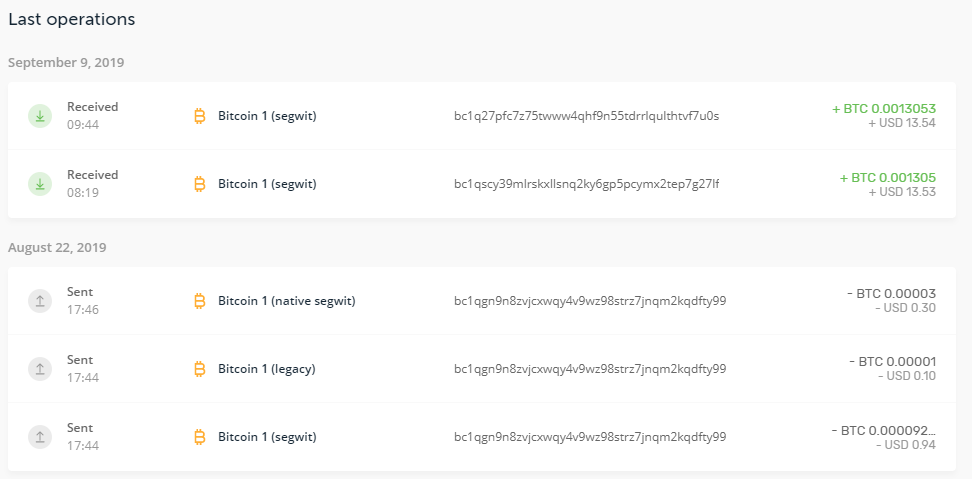

Wallets typically display this information in a way not dissimilar to Internet banking services. Here’s a sample from https://www.ledger.com:

Source: https://github.com/LedgerHQ/ledger-live-desktop/issues/2347

Transactions are displayed in chronological order and the details above can be viewed by selecting and expanding an individual transaction. Most wallets also allow transactions to be exported to a CSV file that can be imported into a spreadsheet or suitable software package.

One of the nuances of crypto assets is that wallets will often automatically assign a different wallet address for every transaction. This spreads an investor’s holdings across multiple addresses which reduces the exposure from any one address being hacked (Bitcoin’s blockchain ledger has never been hacked in its entire history) or the private key to the address being lost forever.

But this means an investor needs to account for movement in and out of every individual address, even if the investor considers all individual address as being part of their single account. Wallets will typically aggregate transaction addresses into accounts so that investors can track their “account balance” easily, but some crypto tax software solutions assume that each address is in fact an account. This can lead to complex reporting where there are many transactions.

Some investors use multiple exchanges and multiple wallets. This magnifies the recording and reporting issues as transactions in and out of every exchange and wallet needs to be captured, recorded, and reconciled by the investor. And many crypto investors hold more than one crypto asset, which further increases the degree of difficulty because blockchain addressing, network fees and other details may vary from one asset to another.

Another important nuance is that it is possible to trade one crypto asset for a different crypto asset eg. sell Bitcoin to buy Ether. Crypto enthusiasts often refer to this as a swap, but from a tax perspective, this is a sale tax event for the Bitcoin being sold and a buy tax event for the Ether being bought. Since taxes can only be paid in dollars, the value of the crypto being sold and bought must be recorded in dollars on the date of the transaction / swap. The spreadsheet sample above illustrates the recording of the dollar amount as well as the crypto asset amount.

While there are several commercial software packages and services available now to help investors manage crypto assets, investors are still responsible for their declarations at tax time. Smart investors who can grapple with the nuances and details will be better placed to verify the tax reporting that the commercial software packages and services produce.

Investors who find this daunting may prefer to get their crypto exposure from managed funds (some of which have been covered in previous Eureka Report articles). But interested investors who dive into the details will naturally increase their knowledge and are perhaps more likely to make investment decisions that deliver better outcomes over the long run.

Frequently Asked Questions about this Article…

Crypto record-keeping is crucial for investors because it helps maintain an accurate view of their investment position in real-time and simplifies the tax reporting process. By keeping detailed records, investors can reduce the effort required by accountants or tax agents during tax time.

Network fees are costs incurred when transferring crypto assets from one wallet to another, even if both wallets belong to the same investor. These fees, such as Bitcoin's network fee or Ethereum's gas fee, reduce the amount of crypto received in the destination wallet, impacting the overall investment value.

Investors can track and record crypto transactions by using wallet software that reads the public blockchain ledger or by utilizing blockchain explorers. Additionally, exporting transaction data to a CSV file for use in spreadsheets or specialized software can help manage records efficiently.

Using multiple wallets and exchanges complicates record-keeping as each transaction must be captured, recorded, and reconciled. This complexity increases with the number of crypto assets held, as different assets may have varying blockchain addressing and network fee structures.

Crypto swaps, such as exchanging Bitcoin for Ether, are considered taxable events. The transaction is treated as a sale of the Bitcoin and a purchase of the Ether, requiring investors to record the dollar value of both assets on the transaction date for accurate tax reporting.