How to get 'money for nothing'

Summary: A novel way of getting 'money for nothing' during tax time using super and pensions.

Key take-out: Concessional contributions can end up being a real boon to retirement income, just check out the calculations.

Want money for nothing? If you're a taxpayer who understands the benefits of superannuation concessional contributions (CCs), then you may already be getting that.

I am reminded of the case of one of my clients, let's call her ‘Samantha', a former public servant and a member of the Commonwealth Superannuation Scheme who was able to access the benefits of a CSS ‘54/11 strategy ( the practice of resigning from the Commonwealth Public Service before turning age 55 to preserve CSS super benefits).

As an alternative to 100 per cent reliance on her ‘unfunded' government retirement income eroding with the ravages of inflation, she cashed part of her CSS benefit and invested this into the market via a combination of super accounts and account-based pensions (ABPs).

Samantha's annual taxable income was $55,217, including a retained CSS pension of approximately $47,302 per annum. (Her gross annual income was, in fact, $58,325 as she also had tax-free ABP income of $3,108 per annum.)

Samantha estimated she was due for a tax bill of just over $2000 for 2017-18, but she decided that this year she would not make a CC to super as it was “not worth the effort”.

Now, Samantha has an excellent understanding of taxation and superannuation issues, and as a former PAYG employee, she felt that a tax bill of around $2,000 on a taxable income of approximately $55,000 per annum was OK (which is a reasonable assumption, if you take a take the strictly linear approach that the net tax benefit of her CC strategy was only around $940 per annum).

Therefore, by making a CC in June 2018, she would in fact (as she did last financial year) be able to create a net tax saving of approximately $5,000, a further boost to her super savings pool.

However, to take a 360-degree view, we need to revisit Samantha's 2016-17 tax year results, which saw:

- Samantha receive a net tax refund of $7,567 of the tax withheld by the Commonwealth Superannuation Scheme on her final 2017 tax assessment, and;

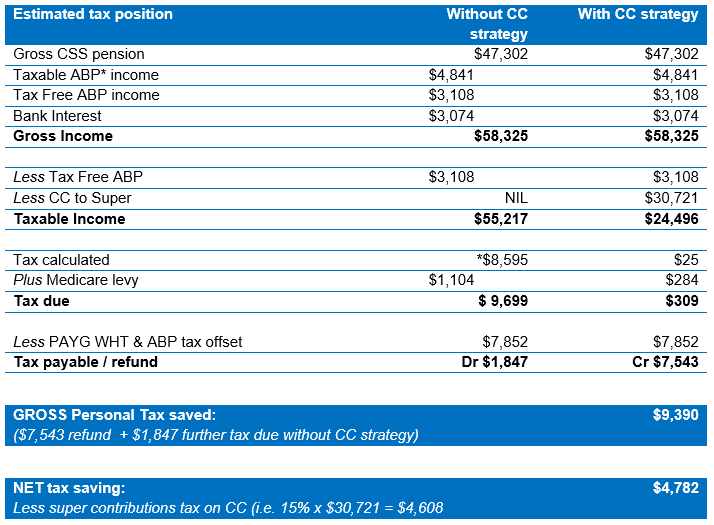

- A net tax saving (after allowing for 15 per cent contributions tax) of $4,782.

So, how exactly did Samantha get money for nothing?

In 2017, using funds from her savings, Samantha made a tax deductible/CC to super of $30,721, which reduced her taxable income to $24,496.

Without the CC tax deduction, her taxable income would have remained at $55,217, made up of her gross CSS pension, plus her taxable ABP and bank interest. (Samantha's gross income was in fact $58,325 as she also had tax-free ABP income of $3,108 per annum).

The tax payable on the $55,217 taxable income with no CC tax deduction would have been $1,847, even after allowing for the $7,851 in PAYG Withholding Tax (PAYG WHT) and the $726 ABP tax offset (which the Government permits).

Without her CC tax deduction last financial year, Samantha would have received a Notice of Assessment advising her to pay the ATO $1,847, which she was still quite happy to pay. However, Samantha had forgotten to also allow for the PAYG WHT ($7,852) retained by CSS on her gross fortnightly CSS pension which, without her CC, would have meant a net total personal tax liability of $9,699 rather than the $1,847 she thought was reasonable!

After making a CC of $30,721 to her superannuation in 2017, Samantha was entitled to a $4,782 net tax saving – or as I like to think of it, ‘money for nothing'. Comparative outcomes are tabled below:

The bottom line

By any count, a net tax saving of $4,872 in 2017 was well worth Samantha's $30,721 CC to super strategy. Overall, she has managed to improve her superannuation position and not pay additional tax – and get a $4,500 - $5,000 annual benefit.

In this financial year, of course, she can only make a CC of $25,000. Nevertheless, an estimated $4,500 per annum saving was – and will continue to be – well worth an annual $25,000 pa CC strategy from the 2018 financial year and beyond.

Samantha certainly has picked up ‘money for nothing' – but it is a pity the superannuation and tax system is so complex that most ordinary mums and dads cannot easily navigate their way through it.