How to beat the mystery of managed funds

One of the basics of portfolio construction is asset allocation, or how your money is divided among the major asset classes. Regardless of whether it’s a bull market or a bear market, a recession or a rising interest rate environment, the investor should be able to point to their allocation levels and say, OK, I’m happy with that, or consider whether it’s time to rebalance.

The amount of capital held in local and international equities, fixed income, property and cash, for example, should be easy to view. It’s important to keep a tally of allocations to check they’re not drifting away from strategy, especially if you’re planning for the long term. If allocations are left untended, investors will only miss out when it comes time to access that capital.

REALITY CHECK

Where allocations to equities are held in direct stocks or exchange-traded index funds, there is no argument about weightings. You know the balance is wholly derived from the value of the underlying securities. But where managed funds are involved, investors need to understand the allocation levels they think they see may in fact be a fuzzy distortion of how their capital is really invested.

Here’s a very simple example.

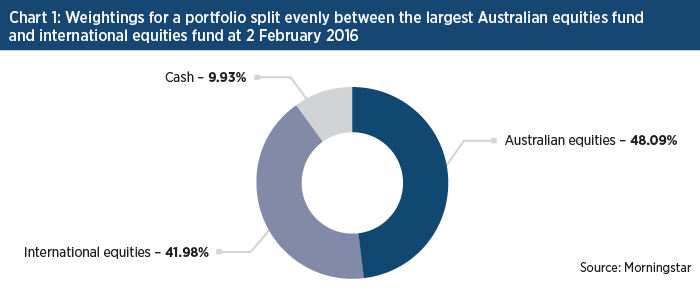

Let’s say you are only interested in local and international equities, and want a portfolio split evenly between the two. You decide to invest using two managed funds, and for this example we’ve chosen the two biggest funds we can find for Australian equities and international equities.

Instead of the capital being split 50:50, however, the latest data available in early February showed the hypothetical portfolio would be split 48% Australian equities, 42% international equities and 10% cash.

OUT OF BALANCE

What should the investor do to bring the allocations back into line? Should the weighting to the international fund be increased? It’s not that easy, because it turns out it’s the international fund which is hoarding cash, at 15.1%.

Dialling up the weighting towards the global fund would only increase the portfolio’s allocation to cash.

If the owner of the portfolio is confident the fund manager will deliver a great return from only having 85% of the global allocation invested, that’s no problem. But if she wants to know all the risk (possible gains and losses) of owning foreign companies will be reflected in her allocation to international equities, it may feel better to choose a route where 100% investment in guaranteed, such as ETFs or direct shares.

LOCAL FUND, GLOBAL HOLDINGS

In this example, the cash holding in the Australian equities managed fund was low when we looked — less than 2%. But there was a surprise somewhere else. The fund was 3.05% invested in companies in emerging Asian economies and 3.37% invested in companies in the United States.

Our hypothetical investor seeking a 50:50 weightings split between local and international equities probably hadn’t counted on that.

It turns out for investors who use manage funds the job of knowing exactly how their funds are invested isn’t easy. In fact, in a survey of 25 developed markets, investment research company Morningstar found Australia remains the only country which does not adhere to any mandatory portfolio holdings disclosure.

RIGHT TOOL FOR THE JOB

Australian fund managers aren’t required to declare their holdings but many do. The results used here were derived using the portfolio tool on the InvestSMART website, which draws on a vast repository of live data. When managed funds declare any changes to allocations, updates will be reflected for portfolios input on the InvestSMART site.

It’s easy to test a portfolio of managed funds by plugging it into the portfolio manager within the website and then viewing how the entire investment is allocated.

Investors with portfolios that include managed funds can finally keep track of their allocations, and some may reconsider how their weighting levels.

It’s better to know exactly how your money is invested than to only have a fuzzy idea.

Frequently Asked Questions about this Article…

Asset allocation is the process of dividing your investment portfolio among different asset classes like equities, fixed income, property, and cash. It's crucial because it helps manage risk and ensures your investments align with your financial goals, regardless of market conditions.

To keep your portfolio balanced, regularly review your asset allocations to ensure they align with your strategy. If you notice any drift, consider rebalancing by adjusting your investments to maintain your desired allocation levels.

Managed fund allocations can sometimes be misleading due to factors like cash holdings within the fund. For example, a fund might hold a significant portion in cash, affecting the actual allocation to equities or other assets.

If your managed fund holds a large cash position, consider whether you trust the fund manager's strategy. If not, you might want to adjust your portfolio by investing in funds or instruments that align more closely with your desired asset allocation.

While Australian fund managers aren't required to disclose their holdings, many do. You can use tools like the InvestSMART portfolio manager to view live data and updates on your fund's allocations.

The InvestSMART portfolio manager allows you to input your managed funds and view detailed allocation data. This helps you track your investments accurately and make informed decisions about rebalancing or adjusting your portfolio.

Knowing exactly how your money is invested helps you understand the risks and potential returns of your portfolio. It ensures your investments align with your financial goals and reduces the chance of unexpected surprises.

If your managed fund invests in regions you didn't anticipate, like emerging markets, assess whether this aligns with your risk tolerance and investment strategy. You may need to adjust your portfolio to better match your desired geographic exposure.