Portfolio rebalancing: The rewards of timely tweaks

Most things left untended will eventually go out of control — and that’s bad (unless you’re a young man intent on cultivating an enormous beard).

Wealth is the same. Like a garden, it needs to be maintained. The level of care required to keep a portfolio on track needn’t be too extreme, however. The same way you can keep a very nice garden without spending hours chasing every aphid and rearranging pebbles, an investment portfolio can be kept in respectable shape with occasional rebalancing.

Don’t drift

Any portfolio will drift from its original settings as the values of the various investments within it go up and down. That’s very simple. It can be a good thing if predictions of growth play out but it also means the allocations of funds to the various asset classes will have changed. When that happens, portfolios can go off balance. Instead of being prepared for most eventualities — designed to withstand heavy losses from a selldown in the share market, for instance — a portfolio left too long untended may become much more at risk of losses.

How does that happen? Here’s an example.

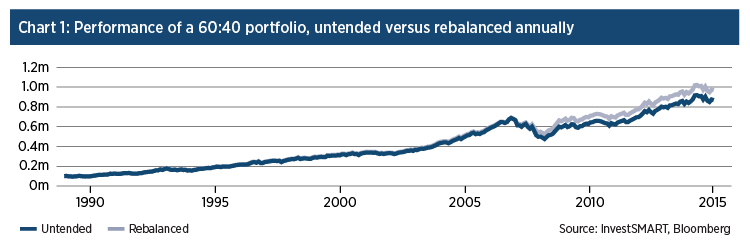

The chart shows a portfolio of 60% Australian shares, using the ASX All Ordinaries accumulation index as a proxy, and 40% Australian bonds. One portfolio is set up and left to its own devices, whereas a second portfolio is rebalanced at the end of every year to the original 60:40 setting. The data covers 25 years.

Straight away we see a portfolio that was regularly rebalanced did better than one left untended over the past 25 years. The difference in dollar terms is pretty significant: $99,785.

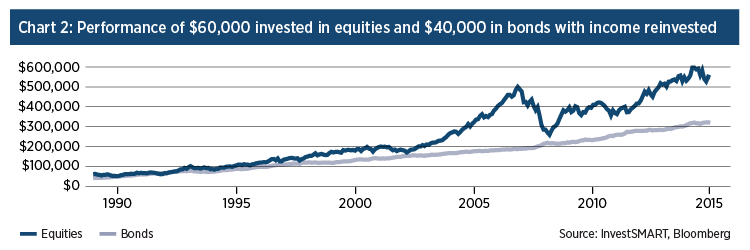

To understand what happened, we need to look at the performance of the two asset classes — equities and bonds — and see how the changes in value affected the allocation levels over the period.

Equities stand out as the strong performer, but there have been long periods where bonds have inched ahead as the share market has languished or suffered heavy losses. In those times, investors who rebalanced the portfolio to its original 60:40 setting would have been taking some of gains from bonds and buying shares after they had become cheaper.

In times when shares were performing very strongly — between 2003 and 2007, for example — it’s harder to make the case for rebalancing. But a strategy of rebalancing annually is what pulled the strategy ahead as the global financial crisis unfolded from late-2007, as was shown in the first chart.

The allocations seesaw

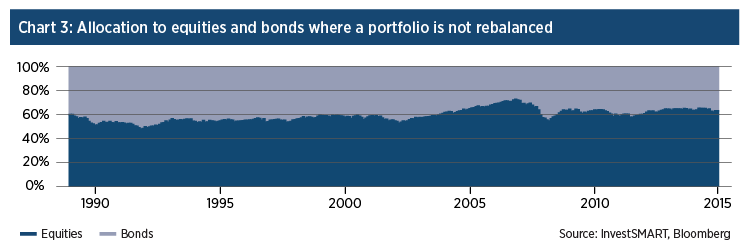

It doesn’t necessarily take constant vigilance to ensure the allocation parameters in a portfolio don’t drift wildly from original settings. In our example the simple 60:40 balance between shares and bonds was reset at the beginning of each year.

The alternative scenario of a set-and-forget portfolio left to do its own thing for 25 years is shown here. The chart shows the share of capital in shares and bonds, ratio of funds invested in shares starts at 60%, swings down to below 50% at the end of 1992 and up almost to 75% around the middle of 2007 — before a sharp drop as the GFC put markets into turmoil.

Be prepared

No-one can say what will happen next year, next month or next week in the investment markets, but there is enough evidence to show a strategy of regularly rebalancing a simple diversified portfolio delivered a better outcome than standing back and doing nothing over the past 25 years.

The first step is to decide on your allocation levels. In this example a simple 60:40 split is used as a rough example of a typical balance between growth assets (shares, in this case) and defensive assets (Australian bonds). Currently, the InvestSMART Balanced model portfolio is invested as follows: Australian shares, 36%; international shares, 21%; listed property, 7%; cash, 20%; fixed interest (bonds), 16%.

Housework starts here

The InvestSMART website includes a portfolio management tool where, once investments have been keyed in, allocation levels are tracked automatically. The menu of asset classes includes Australian shares, listed property, international equities, cash and fixed interest.

In this example we saw a hypothetical investor benefited from rebalancing once a year. It’s up to the individual to decide when to rebalance, but there is no argument about the importance of keeping track of allocation levels.

A bit of time spent on maintenance from time to time can be all it takes to stop your backyard turning into a dense thatch of lantana, or your life savings from missing out on some opportunities for extra growth.

Frequently Asked Questions about this Article…

Portfolio rebalancing is the process of realigning the weightings of a portfolio's assets to maintain a desired level of asset allocation. It's important because it helps manage risk and ensures that your investment strategy remains aligned with your financial goals, especially as market conditions change.

The article suggests that rebalancing annually can be effective. However, the frequency of rebalancing can depend on individual preferences and market conditions. The key is to regularly check your portfolio to ensure it aligns with your original investment strategy.

Regularly rebalancing a portfolio can lead to better financial outcomes by maintaining your desired asset allocation, reducing risk, and potentially increasing returns over time. The article highlights a significant difference in returns over 25 years between a rebalanced portfolio and one left untended.

Yes, rebalancing can be particularly beneficial during market downturns. By reallocating assets, such as buying shares when they are cheaper, you can take advantage of market conditions and potentially enhance your portfolio's performance.

A typical balanced portfolio might include a mix of growth assets like shares and defensive assets like bonds. The article uses a 60:40 split between shares and bonds as an example, but actual allocations can vary based on individual goals and risk tolerance.

A set-and-forget strategy involves leaving a portfolio to grow without adjustments, which can lead to significant drift from the original asset allocation. The article shows that regular rebalancing outperformed a set-and-forget approach over 25 years, highlighting the benefits of periodic adjustments.

The InvestSMART website offers a portfolio management tool that tracks allocation levels automatically. Such tools can simplify the rebalancing process by providing insights into your current asset allocation and suggesting adjustments.

Predicting market movements is challenging, and no one can say what will happen in the future. However, evidence suggests that a strategy of regular rebalancing can deliver better outcomes than doing nothing, regardless of market predictions.