How ASX investors have fared in 2018

Summary: The ASX has been on a road to nowhere this year, with most investors in the red.

Key take-out: In terms of performance, where it's ending up in the scheme of global indices may not be where you expect.

It took a long time to get back there, but the Australian market started the year above 6000 points. Unfortunately, it didn’t take anywhere near as long for the ASX to fall, and it’s yet to return to the podium.

The ASX 200 started the year at 6061 points, and by our mid-December checkpoint, it had come back to around 5600 points. That's a slide of more than 7 per cent. However, on a total returns basis, including dividends, investors in the ASX 200 are down just shy of 4 per cent.

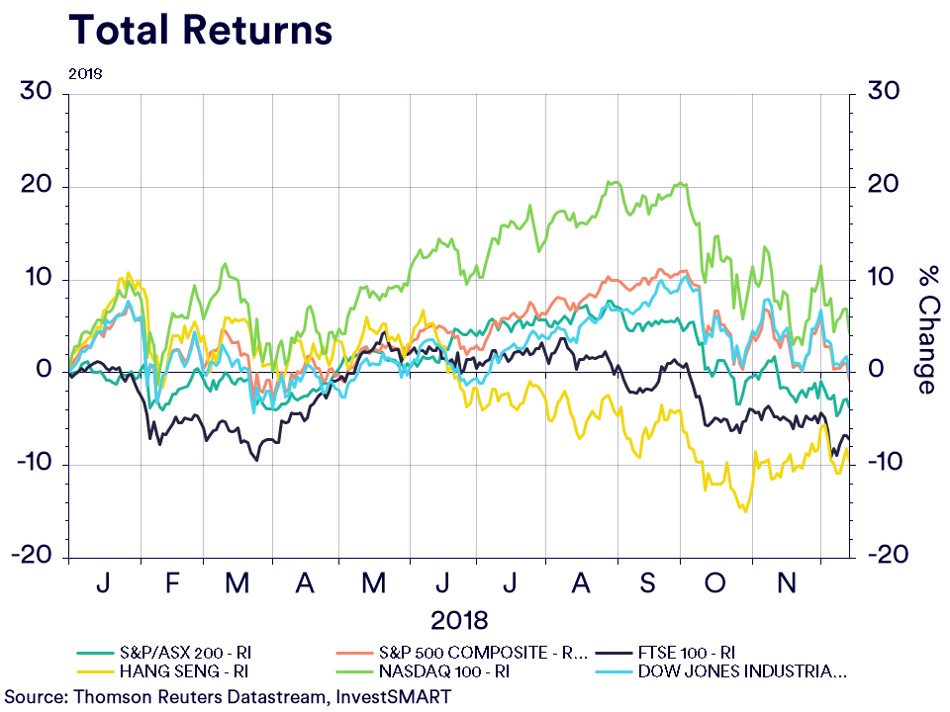

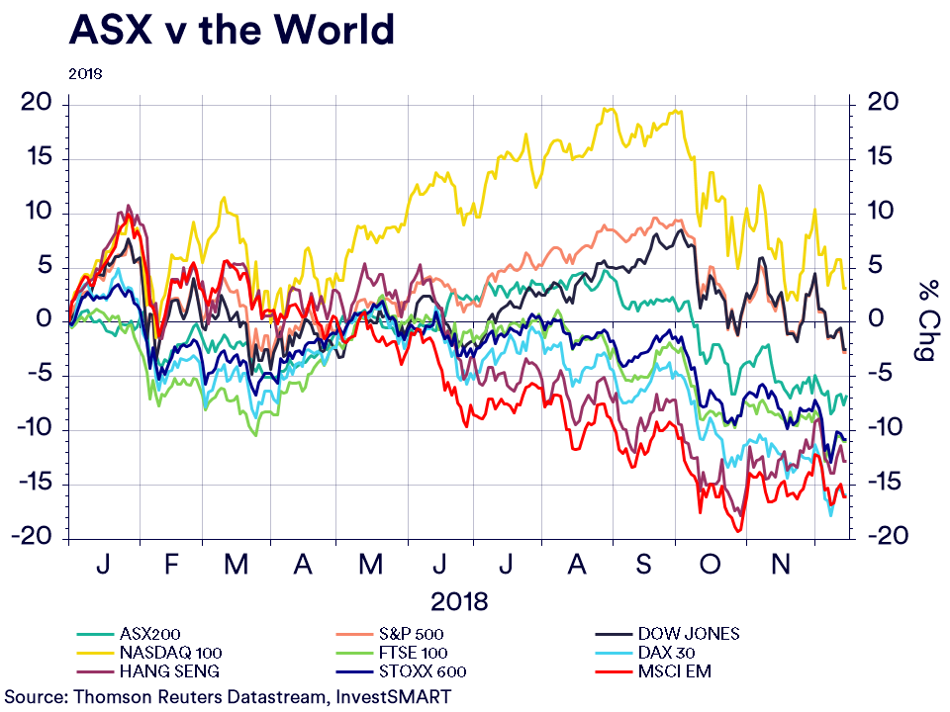

And let's not forget, we're the best performing developed market after US markets for the year.

Going into 2018, there was consensus it would be another year of growth, on balance, with intermissions of volatility eating into some of the returns. The market toyed with the 6000 point-mark all year.

The ASX again followed the rhythm of the market saying – when Wall Street sneezes, Australia catches a cold. Australia is an open economy hinged on foreign investment and exports, so any hiccup over there, could at least be heard here.

US markets started the year roaring, with the Australian market catching a tailwind. However, there was only so much our local market could rally on the back of a strong US economy.

By the end of January, we saw the performance gap between our benchmark local index and the most comparable US share market, the S&P 500, widening the most it has in recent times. Then, the US fell off a cliff, a fall that it still hasn’t managed to claw its way back from.

Shortly after making record highs, US markets began unravelling in February. The Dow suffered its worst fall in two years amid fears of interest rate rises. US government bond yields, which rise as prices fall, hit their highest level since January 2014.

Naturally, the ASX felt the backlash. While markets were still reeling, in early March, Trump announced his intentions to slap double-digit tariffs on steel and aluminium imports. They were quickly imposed on several countries, though Australia was spared, at least temporarily.

With China coming back from Lunar New Year, a commodity-driven rally soon followed, not atypical for Australian autumn. On balance, the ASX performed through the second-quarter. April 2018 was the best calendar month for the market since October 2017 – a caveat, this followed one of the worst months in a long time.

The ASX traded a tight range in the middle of the year, much the same as last year. But this time, no one was really complaining. From the start of June to the end of September, the market managed to put on close to 4 per cent. The ASX was one of the best performing global indices to the mid-year mark.

Several, mostly unrelated, events started derailing the market, equal parts local and offshore catalysts. As always, the sharp slides appeared to come out of nowhere, yet none were black swans. It has taken a toll on most of our sectors (see right)..jpg)

From the late August ASX peak to the most recent December bottom, the drop in the market has measured into the double digits.

The question mark around the Banking Royal Commission heading into 2018 turned into one of exclamation, that came with a lot of explanation, in the second half of the calendar year. The anticipation, more so than the actual event, punctured the financial sector to ultimately drag down the broader Australian market, considering the market’s tilt towards financials. The Big Four banks plus Macquarie make up about one-quarter of the ASX.

The Banking Royal Commission in September met, or crashed into, a sharp and sudden slide in house prices which tore strips off consumer confidence and consumption. Political instability also returned, again, and as US economic data appeared toppy, Australia was just holding the line.

Around the time the Dow looks to have made a double-top, the ASX began October with a succession of big down days, the biggest since our local market fell nearly 2 per cent on March 23. After more than six months of relative quiet, or at least slower falls, the ASX suffered a series of 1.5 per cent-plus down days. By late October, our local bourse had given back all its gains, and then some, that it made in the six months leading up.

Let’s note though, October is generally a bad month in the US, and Australia was dealt a particularly bad deck of cards this time around. In the last 22 years, around half of the Dow’s worst percentage drops have occurred in October. Most of the time, this aggressive sell-off sparks a sharp rally in the months that follow.

Some strategists expected risk-on markets like Australia and Japan to play catch up this year, although that didn’t exactly prove the case. Many strategists expected the fundamentals to improve, considering interest rate stability and steady economic growth, but this didn’t translate into actuals for all too many Australian companies. The ASX has been one of the worst performing indices over the quarter, only trailed by the Hang Seng, FTSE and DAX. At least we look better than average across the year:

The more records this bull market broke, the more that local fund managers switched to cash. In the year to September, we saw major league fundies double their cash holdings, including Platinum Global, Pengana, Magellan and Hyperion.

Only two stocks on the ASX 200 increased more than 100 per cent in value over the last 12 months – Bravura and Afterpay. Among those returning more than 50 per cent were gold miner Saracen, tech stocks Appen and Altium, IEL, and Washington Soul Pattinson.

On the flipside, around 80 companies lost more than 10 per cent of their value over 12 months. Financials are among the worst hit, with AMP and IOOF losing over 50 per cent, Janus Henderson and CYBG losing more than 40 per cent, and Platinum, Perpetual and Challenger losing more than 25 per cent.

Typically, share markets tend to go ‘up the lift’ – and accelerate to the ‘top of the market’ penthouse – before heading ‘down the elevator’. This December the ASX sunk to a 23-month low, but it’s not like there was a sharp rally preceding.

Early December brought one of the biggest down days in recent times, with some suggesting it was an omen of what’s to come. As always, the set-up is different to what we’ve seen before. But there’s certainly less conviction in the air. At the very least, more strategists are sitting the fence, probably with a little more cash padding their pockets, than we saw heading into 2018.

*All data is current at close of market on Friday 14 December.