Housing recovery around the corner

| Summary: In the year ahead housing will once again become a positive growth factor for Australia...but structural impediments will suppress the effect this time round. |

| Key take-out: The economy is beginning the transition back to the traditional drivers of growth, including housing, but there are several factors that could hinder the potential recovery. |

| Key beneficiaries: General investors. Category: Property investment. |

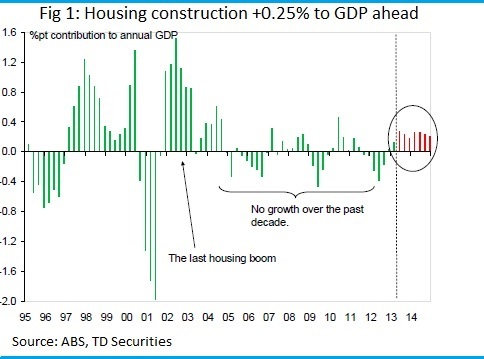

By this time next year, we expect housing construction to have contributed about 0.25% of our forecast 2.75% GDP growth. While that doesn’t seem like much, it’s a decent turnaround from the -0.4% detraction in the 12 months to the June quarter 2012, and the zero net contribution since the mid-2000s (Figure 1).

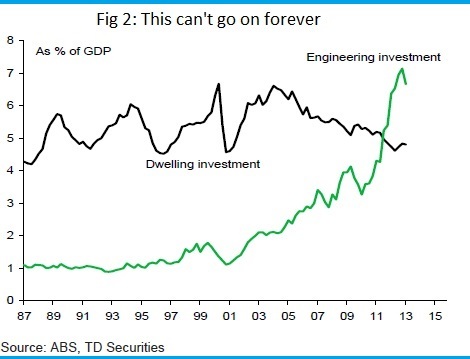

Since China and the resources boom began to dominate Australia’s outlook, and as the RBA gradually tightened rates as the economy showed signs of overheating, the housing sector has been overlooked as a source of growth. As Governor Stevens reflected this week, the experience of high inflation in 2007-08 “showed that if there was a very large rise in resources sector activity, other sectors could not continue as they had been doing”. Now that mining investment has probably peaked (or is peaking soon), the economy needs to transition once again to the traditional sectors of housing, consumption, and exports. This rebalancing task has begun, but it still has a long way to go. Dwelling investment accounted for 4.8% of GDP in the March quarter of 2013, up slightly from a trough of 4.6% but still well below its historical average of around 5.5%. In contrast, engineering investment – a proxy for mining investment – remains near historic highs (Figure 2), at close to 7% of GDP.

Will the rebalancing continue?

The housing sector’s muted response to the -200bp of cash rate reductions since late-2011 has been somewhat of a puzzle. Approvals have risen barely 15% from the lows since then. In contrast, the last time the RBA eased 200bp in a ’normal’ easing cycle (i.e. no global crisis) was back in 2001, and this ‘led’ to a 70% jump in approvals.

Is the policy transmission mechanism broken? We don’t think so. But there are reasons to think that the RBA is getting ‘less bang for the buck’ for every rate reduction compared with a decade ago, for a couple of reasons:

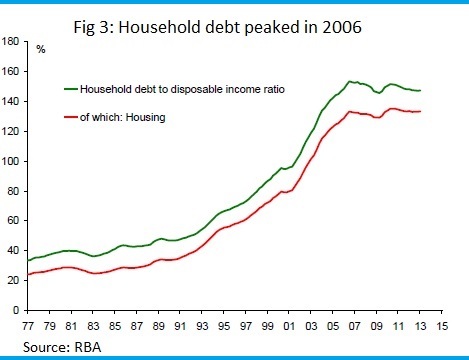

One is that the “borrow and spend mentality” which has been a feature of previous economic upswings is absent this time round; in fact, the household debt-to-income ratio peaked at 153.4% back in 2006! (Figure 3).

Households and businesses have become more conservative in their approach to gearing, and that is evidenced by 3% credit growth rather than the heady double digit rates of the past.

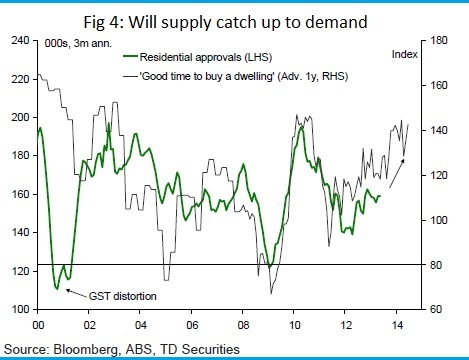

Next, structural issues have impeded the supply response to the pick-up in housing demand (Figure 4).

They range from the complexity of the planning process (including lack of coordination between council and the various regulatory bodies in the approvals process), a shortage of infrastructure, difficulty in securing land for greenfield projects, and community opposition to infill developments. The RBA published a paper on supply-side constraints and concluded that although progress has been made, it “will remain on the policy agenda for some time”.

Why we are still optimistic anyway?

The housing sector is not just about construction and construction jobs per se, but also about its multiplier effects to the rest of the economy. When housing construction recovers, purchases of associated durables (furniture and white goods) also pick up, so do job opportunities for architects, landscapers, interior designers, and conveyance lawyers. Furthermore, rising house prices – which supply constraints can only exacerbate – generate positive wealth effects, and spill over to broader consumption and confidence.

Conclusion: it takes two to tango

The housing recovery is an important component of the economy’s transition towards the traditional drivers of growth from an over-reliance on mining, but it cannot act alone. The conditions are there for a strong recovery, but structural impediments mean that a ‘boom’ will simply not materialise. Therefore, non-mining investment must also step up to the plate, a topic to be re-examined after the next private sector capex report, released late August.

Alvin Pontoh is Asia-Pacific macro strategist at TD Securities.

This article was first published on July 4.