Housing investors follow Hockey's lead

Democracy is predicated on the idea that voters aren't silly – they make the right choices ... eventually.

And so it appears to be with the nation's understanding of debt. During the turbulent, acrimonious Gillard years, 'debt and deficit' became one of the three big sticks that Tony Abbott used to beat the Labor government – the others being 'carbon' and 'boats'.

The debt message cut through, while Labor's counter message – that we'd beaten virtually the entire world in keeping GDP growth on track, and inflation and unemployment contained – fell on deaf ears.

To the extent that citizens voted against Labor's 'appalling' debt position, they got it wrong.

As if to prove that point, Treasurer Hockey's first fiscal report, the mid-year economic and fiscal outlook, saw the Coalition borrowing even more heavily.

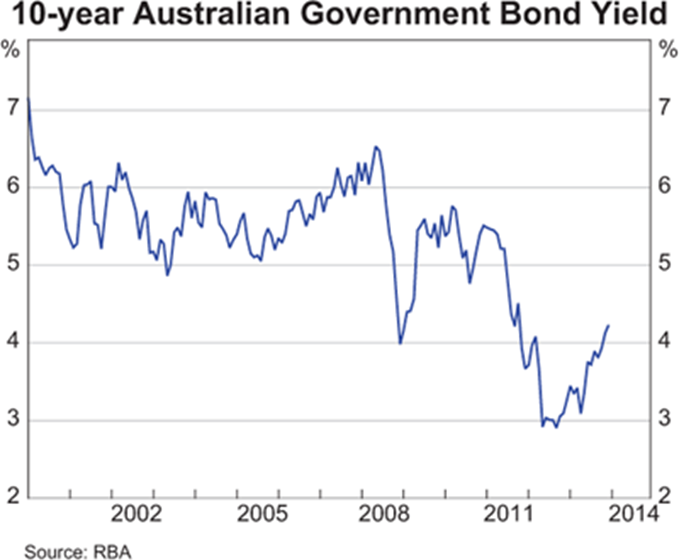

It took a few weeks of digesting that data before Hockey's motives became clear. The global debt environment is changing rapidly, and Hockey simply had to get away as much debt early on as he could (There's sense in Hockey's taper caper, December 20).

And the logic of that move is strengthened by the day. As Fairfax columnist Michael Pascoe pointed out yesterday, global investors would rather park their 10-year money in Italian and Spanish bonds than buy Aussie government securities. Ten-year rates are 3.82, 3.71 and 4.1 per cent respectively.

That's a bet against Casino Australia.

As the chart below shows, the best time to bulk up on cheap debt was during the last two years of the Gillard government. Treasurer Swan went in boots and all, and, as quickly as he could, Treasurer Hockey did the same thing.

Now, many voters who liked that 'debt-bad, Labor-bad' line, are now doing the same thing with their own finances. They are trying to bulk up on cheap debt while they can, to bet on the housing market.

In December, a third of housing loans written were at fixed rates, and the latest survey by mortgage broker AFG shows that non-major-bank lenders are gobbling up this business. Their share of the fixed-rate market has surged from 14 per cent to 38 per cent over the course of 2013.

Debt and deficit makes a lot of sense when you can lock in low, low rates. Hockey wanted his cheap money to cover the structural deficit until tax/spending reform can be achieved, and possibly to divert into much needed infrastructure.

Housing investors – who have chased first-home buyers out of the market – want their cheap money for a bet on continued strong growth in house prices. Home lending has hit a four-year high, and fixed-rate borrowers can get three-year money at a touch over 5 per cent (ING is offering 5.15, NAB 5.14 per cent).

They may get their wish, though there are worrying signs of falling rental yields on investment properties in many cities, and an ‘oversupply’ of apartments in some inner city markets, particularly Melbourne.

Are voters finally getting a sense of perspective in their views of debt and deficit? Joe Hockey will surely hope so – he needs them to vote for his amply indebted government in 2016.