Henry and the tax experts are wasting their breath

Australia needs drastic tax reform to avoid an imminent budget crisis, according to leading tax experts, former Australian Treasury secretary, Dr Ken Henry, and former Liberal leader Dr John Hewson.

In a speech at the Australian National University, Henry admitted frustration at the lack of progress made since he led a wide-reaching review of the Australian tax system in 2010. A vast majority of those recommendations were never implemented and many that were, such as the carbon and mining taxes, are set to be unwound.

Perhaps more troubling is the fact that tax reform does not appear to be a priority for the current Coalition government, nor was it a genuine priority for the previous Labor government. Emphasising the lack of seriousness, Social Services minister Kevin Andrews recently announced a welfare review that excludes consideration of the aged pension -- the category most in need of reform.

Speaking about his 2010 tax review, Henry said: “We did not identify a crisis for the Australian tax-and-transfer system but I think we are getting closer to the point that we can say the crisis is imminent because so little progress has been made in addressing challenges.”

How did we get to this point? Particularly after running budget surpluses for years?

It would be naïve to simply blame the Labor party. It is an easy solution, perhaps, but it ignores that spending rose significantly throughout both the Rudd/Gillard and Howard governments.

The main driver of the budget deterioration was instead the sharp decline in tax revenue, which began following the onset of the global financial crisis and never properly recovered. It is why any serious attempt to fix the budget must include widespread tax reform rather than simply cutting spending.

The media focuses far too much on the short-term budget fluctuations but it is the long-term structural issues that are the main cause of concern for the long-term sustainability of the budget.

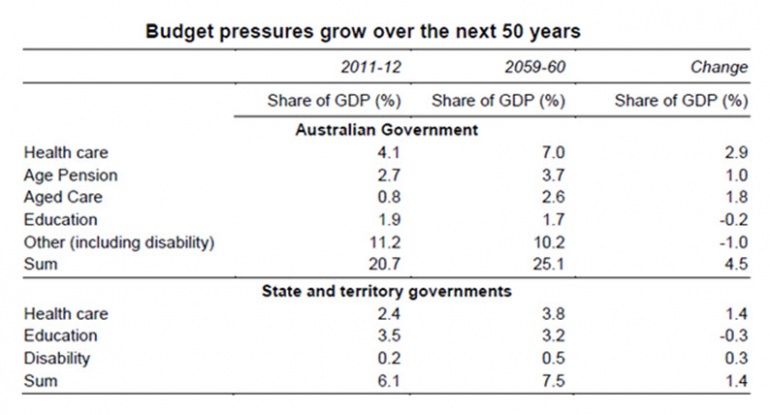

The Productivity Commission estimates that an ageing population could increase aged care, aged pension and health care expenditures by around 7 percentage points of nominal GDP by 2059/60 (Pension privilege in the crosshairs, February 25). The real effect though could be larger since an ageing population also narrows the tax base and weights on revenue.

Luckily for Australia there is still a range of ways in which we can improve our tax system and put the budget on a sustainable path, without entirely gutting our welfare system and failing to provide an adequate safety net.

At the end of January, I wrote an article about the billions of dollars in lost revenue that the government fails to collect annually due to selective and differential tax policies (It’s time to fix Australia’s leaky tax sieve, January 31). Research from the International Monetary Fund indicated that no other advanced country forgoes more tax revenue, through ‘differential, or preferential, treatment of specific sectors, activities, regions or agents’ than Australia.

According to the IMF estimates, we could gain tax revenues worth 8 per cent of GDP simply by removing or reducing differential tax policies, such as negative gearing, capital gains tax and superannuation concessions. That’s more than enough to solve the imminent budget problems, massively reduce government debt and put the budget in an excellent place to meet the challenges of an ageing population.

But although addressing tax concessions could delay the budget crisis by decades, we should not neglect the opportunity to reform health and welfare spending. The Grattan Institute estimates that the government could save $12 billion a year simply by raising the retirement age to 70 and a further $7 billion a year by including the primary residence in the means test used to determine who should receive the aged pension.

Welfare, excluding the aged pension, actually isn’t that much of a problem since the share of the population on welfare has actually declined over the past decade. But for now it remains the primary focus on political discussion, which is unfortunate but also not surprising. Tackling the aged pension is a much bigger task and will prove less politically popular, particularly for a Coalition that relies on the vote of older Australians.

Hewson actually went far enough as to say that Australia should consider the introduction of an independent tax commission, similar to the RBA, to ‘analyse, develop, educate and deliver the reform packages it believes necessary over the next several decades.’ It is a good idea, particularly given the difficulty of reforming the tax system without bipartisanship support. The type of reform required will unfortunately not be conducive to winning elections.

The comments by Henry and Hewson are a timely reminder that the current structural budget balance is not sustainable in the long-term. Our tax system requires a wide variety of reforms but luckily Australia still has a range of ways in which it can improve the tax system without gutting the welfare system and safety net. But the changes required are going to be politically difficult and I fear the comments by Henry and Hewson will fall on deaf ears as the government looks to short-term solutions to a long-term problem.