Healthy diagnosis for medical stocks

| Summary: The health care sector as a whole carries enormous risks, but so too are the opportunities. While many nations continue to struggle with their health systems, the demand for health care support, including medical treatments, is increasing on an unprecedented scale. Australian listed health care companies such as ResMed and CSL are at the forefront of developments in many areas, and are therefore well positioned for growth. |

| Key take-out: Governments looking to fund health care programs are being forced to reallocate resources from other areas of the budget. There will be clear winners and losers as part of this. |

Key beneficiaries: General investors. Category: Shares. |

Australian listed companies are typically mature businesses, where profits grow in line with the broader economy.

We have few high-growth sectors like technology, a mainstay of the US sharemarket. Reflecting this profile, investors in Australian shares are rewarded more through dividends than share price appreciation over time, a direct consequence of the incentives created by dividend imputation and the lack of income securities in Australia.

There are precious few areas of accelerated growth in our sharemarket. Notable exceptions are the digital economy (discussed in the September 2012 report); wealth management (driven by compulsory superannuation), and health care.

Today, we consider the outlook for health services and the multi-faceted challenges facing Western governments in funding ever-growing health care spending, and the investment case for two leading Australian companies – ResMed and CSL.

When it’s too hard to take your medicine

Health care shares have performed extremely well in recent years given the sector’s strong growth and defensive characteristics – attributes that have been keenly sought after by investors since the financial crisis and aptly illustrated by Fig 1.

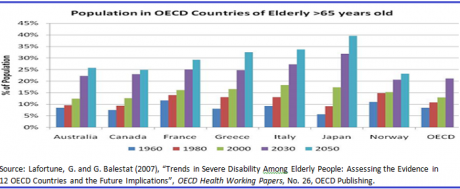

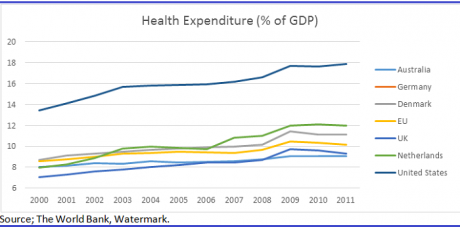

Health care is a strong growth sector, a consequence of an ageing population across developed countries as the baby boomers reach their senior years, rising obesity and related diseases, and burgeoning middle classes in emerging markets. With dependency levels increasing across the OECD (Organisation for Economic Co-operation and Development) as retirees become a larger proportion of the population, governments are being challenged in funding this growing need.

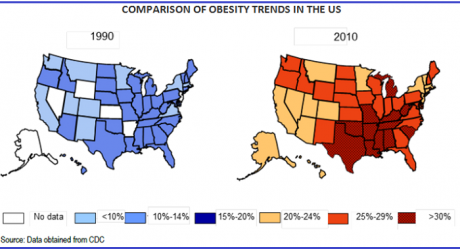

If you hadn’t yet noticed, despite the flurry of health juice stands and exercise classes, the trend of obesity is quickly reaching epidemic proportions. The figure below compares obesity levels in the US over the past two decades, and this trend is mirrored across developed countries. Even our relatively sporty and healthy country is losing the battle of the bulge – recent government figures show 10.8 million Australians, or 28% of the population, were classified as obese in 2011-12.

Markets are quick to recognise the opportunities presented by increasing demand, although the thematic also brings with it significant risks. As baby boomers retire with higher expectations of care than previous generations, demands on the health care industry are escalating. As more retirees exit the tax-paying population, fewer young people are contributing in the form of taxes, leaving government-funded health care looking lean and unsustainable (see figure below).

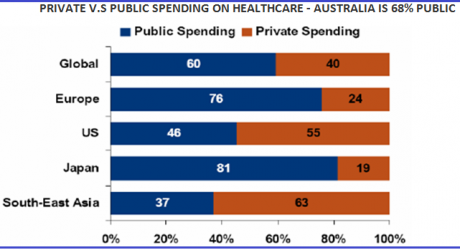

Fortunately, for Australia, the Howard government’s introduction of the health care rebate (1999) and ‘Lifetime Cover’ (2000) has seen the number of privately insured people increase from 30% to 45%, significantly lowering the federal government’s burden.

Dissensions over funding future health care needs are beginning to emerge, clearly displayed in the recent arguments over “Obamacare” in the US. Governments looking to fund health care programs are being forced to reallocate resources from other areas of the budget. There will be clear winners and losers as a result of this redistribution.

Investors became acutely aware of these budget pressures in 2013 when Medicare in the US slashed prices of diabetes drugs by up to 70%. Policy makers acted in response to the rapidly growing population of diabetics and their impact on the government purse – more than 25 million people in the US have diabetes, with a new diagnosis every 17 seconds. Johnson & Johnson’s US Diabetes Care Division revenues fell 28% in the third quarter of 2013, not what you would expect from a growth company.

ResMed

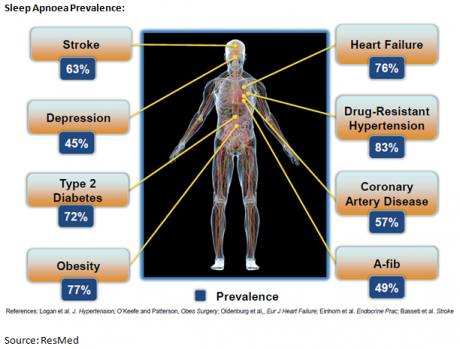

ResMed develops and manufactures products for the treatment of obstructive sleep apnoea and related respiratory diseases. With just under half of the global market and growing at high single digits, the company provides exposure to the trends discussed above. It is estimated 26% of adults between the ages 30-70 have sleep apnoea, with a 77% prevalence for the obese subset.

The US is the most widely penetrated market, however it still offers material upside with the best estimates indicating only 10-15% penetration. Studies are increasingly linking sleep apnoea with other health problems. ResMed is actively seeking to expand its addressable market with a large 1,325 patient trial, investigating the value of Adaptive Servo-Ventilation therapy to improve morbidity and mortality rates in heart failure patients with central sleep apnoea.

However, ResMed is not without its risk, with 20% short interest in the company’s shares, investors wrestling over the impact of price deflation and reimbursement cuts in the US, and the entrance of cheap Asian manufacturers.

In the US, Medicare has just implemented round two of ‘Competitive Bidding’ for Medicare, which triggered a 48% reduction in the average price for ResMed’s continuous positive airway pressure (CPAP) machines, and 39% for masks. In the context of ResMed’s global business, this might impact roughly 6% of revenues. Arguably, Medicare prices were too high to begin with – industry sources are suggesting Medicare rates are roughly in line with private health insurers, post the price cut. This has created quite a bit of noise in the market, and impacted ResMed’s first quarter results for financial year 2014.

Offsetting this price deflation is a trend toward home sleep-testing from specialised sleep labs. When diagnosed at home, the patient requires less supervision, and the benefit of auto-titration creates a natural bias to higher-priced APAP machines. Furthermore, ResMed is actively shifting in manufacturing from Australia to Singapore, and better procurement and manufacturing efficiencies, combining together to contribute a 4-6% decline in cost of goods sold per annum.

In France, the government has just confirmed the implementation of telemonitoring, hoping to improve compliance rates and stop payments to non-compliant patients. Compliance is emerging as a key area of product differentiation, with both Philips and ResMed investing heavily into digital platforms to assist regulators and distributors in managing patient compliance. It also creates a further barrier to entry, making it even harder for low-cost entrants to gain traction.

While not without its risks, we draw comfort from the studies that have clearly demonstrated the costs of not-treating sleep apnoea far outweigh the costs of treatment. A recent study on population health management demonstrated patients on CPAP therapy had 30% lower medical costs than patients not on therapy.

ResMed is trading at a significant discount to our valuation, and quarter-to-quarter sales volatility as a consequence of Competitive Bidding is providing attractive entry points into a company that is set to benefit in the long term from the structural growth themes in health care.

CSL

CSL is a world leader in immunology, engaged in procuring plasma and fractionating it into its components, which are used for the treatment of numerous diseases that are not served by other therapies.

The market is dominated by three key players, the two key competitors being Baxter and Grifols, with the three main products being intravenous immune globulin (IVIG), factor VIII and albumin. The market is difficult to enter, with long lead times to build fractionation facilities and tight regulation around plasma collection.

CSL, once government owned, benefited from the Australian government’s investment in a chromatographic fractionation process, while the rest of the world used a more expensive Cohn fractionation process.

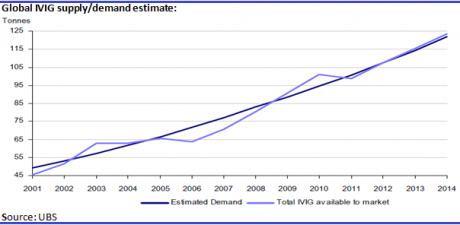

Over the past three decades, IVIG demand has ultimately determined the total volume of plasma needed on a global scale, and in recent years IVIG has been growing close to 10% per annum. In processing a litre of plasma, many proteins may be separated from the plasma and commercialised. Plasma is expensive because only small amounts can be collected from donors, resulting in collection accounting for roughly 50% of the total cost to produce plasma-based therapies.

Established players have worked for decades to extract additional proteins from a litre of plasma to treat a range of diseases, creating superior economics to a new entrant whose only source of revenue from plasma would be IVIG. This has been coined by CSL as ‘first-litre economics’.

Albumin demand in China is growing at 15-20% per annum, with local fractionators unable to keep up. The most common substitute, Hydroxyethyl Starch has serious drawbacks including higher kidney failure risk and higher mortality rates. This led to CSL’s sales in Albumin growing 7.6% in the first half accelerating to 37.5% in the second half of financial year 2013.

In the past few years we have witnessed Baxter supply constrained, and Octapharma impacted by product recalls. As a result CSL has enjoyed the majority of market growth, and further cemented its competitive advantage with the highest revenue and lowest cost per litre of plasma processed compared to its peers. This flows back into CSL’s expenditure on research and development, resulting in a rich pipeline for orphan indications in specialty products.

In the next 12 months we will see the impact of Baxter competing without capacity constraints as their new LA plant is up and running. Industry sources are indicating the market growth-rate should remain at 6-8% for IVIG over the medium term. For the time being, there appear to be no quick fixes to China’s Albumin shortages with suggestions prices are going higher and, in the US, CSL’s competitors are continuing to put through price increases. Regarding reimbursement, Medicare appears to be allowing price increases through this year, a comfort few other health care companies can provide in the current environment.

Justin Braitling is a principal of Watermark Funds Management at www.wfunds.com.au.