Have you heard about the 'other' DIY super?

Superannuation is very simple. It’s about income in retirement. The idea is that a lifetime of savings will provide a twilight of income. The government came up with the idea because it felt the age pension was too much of a burden.

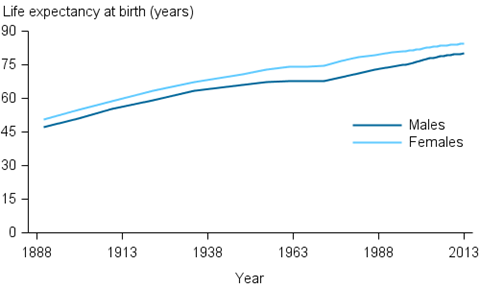

Why did Canberra wait until the early 1990s before it ventured into this grand plan? That’s a good question. When the age pension was introduced in 1909 it kicked in at age 65. That was the mortality age for men at the time, so it felt right to pay a modest income to those who lived beyond the average.

That means only half the population qualified for a pension, because only half survived past their 65th birthday.

A lot has changed since then. Men today are expected to live into their late 80s and women for about another two years or so after that.

Sources: ABS 2014a; ABS 2014b (Table S1).

Sources: ABS 2014a; ABS 2014b (Table S1).

But the age at which a government pension can be claimed has only recently nudged up by two years, to 67.

So the bald truth is that if the qualifying age had been pegged to the mortality age way back at the start of the 20th century then all of Australia wouldn’t have such a sense of entitlement to the payment. But things went a bit lax, and everyone got a bit too comfortable for about 70 years.

Be prepared

Today, the government has handed responsibility for retirement income back to the individual – but the system is not really designed to encourage engagement.

Employers make compulsory contributions to a worker’s super account, which are taxed at 15%. For those on low pay and in a low tax bracket, there isn’t much of an incentive to pitch more into super. For those on high incomes, any contributions above the mandated minimum can deliver significant after-tax advantages. But the government is well aware these savers’ balances can end up being much larger than required for a comfortable retirement, and the writing is on the wall for anyone who treats superannuation as some sort of semi tax haven.

So super is probably badly designed and likely to change, but we are all along for the ride now, well and truly. The easy way to get a step ahead is to take the initiative and get involved in your life savings. It may sound too simple, but there is such a thing as saving outside super.

Sophisticated saving

It is easy to set up a savings plan equally as sophisticated as a super fund account. The real advantage of an out-of-super alternative is the close relationship a saver can have with his or her investments.

Take the InvestSMART model portfolios, for example. An opening balance of as little as $5,000 supplemented by regular contributions can be automatically invested in a variety of exchange-traded funds, so that a simple savings plan is actually a investment portfolio of thousands of Australian and global companies, including listed property, bonds and cash.

And where super funds in Australia are so slow to report performance and find it so hard to tell their customers exactly where their money is invested, an InvestSMART portfolio can be tracked day to day online.

Hit a higher target

Savings accounts used to be all about cash, but here we have something that sounds like a savings account – a simple deposits regime and transparent reporting – but is actually an investment portfolio with a target return of inflation plus 2% (although the balanced portfolio has beaten that target and returned more than 6% since inception, annualised).

If savings were directed to cash, $1 deposited today wouldn’t be worth much more than that how ever many decades later when it was withdrawn as income in retirement.

The return that matters to investors is what’s earned after inflation. If inflation is running at 2% and a cash account is paying 2% then the real return is zero.

After 10, 20, 30 years that $1 will always be worth $1.

In a balanced portfolio, which will include growth assets such as equities and property, were inflation is running at 2% and the portfolio returns 6% the real return is 4%.

After 10, 20, 30 years that $1 is worth $1.48, $2.19, $3.24 after inflation.

Slay inflation and stay on course

Inflation has a corrosive effect, but it’s something we all have to live with. Spare money invested like clockwork in a diversified portfolio that includes growth assets can beat inflation, easily. And a strategy of saving outside super will be guaranteed to pre-empt any changes to the rules around superannuation that may hurt some savers and benefit others.

The biggest benefit to the strategy of saving outside super, however, could be that it gives the saver a clearer idea of his or her destiny. The destination is marked and the map is open.