Growing your wealth

| Summary: As agribusiness grabs headlines and offers diversification potential, the premium returns from the asset class are still unclear. Strong dollar and droughts have always been factors that hurt the industry, although profits can be made when these circumstances reverse. |

| Key take-out: Ever at risk from drought and currency fluctuations, agribusiness remains a difficult asset class. |

| Key beneficiaries: General investors. Category: Investment portfolio construction. |

The business of agriculture is all over the media right now. “Happy are the cheese makers” indeed are long term investors in Warrnambool Cheese and Butter (WCB). So too are almond investors in Select Harvests (SHV), who enjoyed a 300% return in 2013 making it the top performing stock on the Australian share market. Here we look at the case for and against having a “soft commodity” and “agribusiness” asset allocation tilt to your portfolio and how you can go about getting it.

Hard and soft commodities

Australians are hard commodity investors. About 1/3rd of the Australian share market is mining and energy resource stocks as I illustrated earlier (Goodbye to the 'All Ordinaries'). This makes our share market a little bit more volatile than other countries as the world’s love of commodities rises and falls. However the inflation protecting power of commodities is perhaps the reason why our country market outperforms most others over the very long-term.

The cousin to hard commodities is soft commodities, those things grown not mined. Our local share market has less than a 1% agribusiness exposure, which inevitably means when miners and energy companies aren’t delivering we can’t rely on agriculture to fill the gap.

We've got wood and veges

There are multiple ways to introduce an agricultural allocation into your portfolio:

- speculate in the price of the commodities;

- invest in “agribusiness” companies listed on the ASX or overseas exchanges;

- invest with others in managed funds and ETFs;

- buy the farm!

Speculating on the price of soft commodities at first glance doesn’t look like it will add a lot of value to your portfolio. Local ETF supplier BETASHARES offers an Australian dollar hedged investment into the prices of four major soft commodities: corn, wheat, soybeans and sugar via ETF QAG. To January 31 2014 it returned -23% to investors, although perhaps that was being true to its strategic role to diversify against share market prices - which grew by 30%. However when shares fell in 2008 by 50% so did the price of these commodities, so I’m skeptical about its diversification benefit. Regardless the chart below shows an unfortunate characteristic of commodities which is their price volatility. Unless you have an insider view on pork belly futures, speculating in soft commodity prices might not save your bacon.

Performance of the S&P GSCI Agriculture Enhanced Select index since January 2000

Source: Betashares

US ETF supplier Blackrock has an ishares ETF for just about everything and not surprisingly to help you invest in agribusinesses. This includes WOOD which invests in companies around the world making money in timber and forestry and “VEGI” which invests in global agricultural businesses. The returns in US dollars investing in both of these is shown below compared to the returns from the MSCI All Countries World Index – a benchmark for global stock performance.

US$ returns from investing in global companies invested in timber (WOOD in green) and agriculture (VEGI in red) versus the from broader global stocks (ACWI in blue)

Looking at this you too might question whether money grows on trees or from the ground. During the GFC, WOOD fell 65% in price compared to the broader stock market falling 50%. During the Greek sovereign bond crisis in 2011 it declined again more. At least then VEGI declined only as much of the broader market, however, since then global investments in agribusiness companies (including Monsanto, Deere, Archer-Daniels-Midland) returned zero compared to 20% for world markets.

Should you think that you need an expert navigator to farm profits for you, then you could look to Colonial First State Investments Global Soft Commodity Share Fund which is one of the rare managed funds that operate in this sector. The fund has generally kept up with its hybrid index of three parts agribusiness and one part timber and after paying a hefty 1.25% fee (versus 0.4 and 0.5% for their low turnover ETF relations). Their performance suggests it’s not easy spotting the best and avoiding the worst companies in the sector.

Sovereign Timber

While Australian individual investor experience would say otherwise there is reason to suspect direct timber investing could add value at least in institutional portfolios. Over a longer twenty-year period, the returns from the US “Timberland Index” averaged 11% versus 8% for companies in the S&P500. Perhaps this is why sovereign wealth funds like our local Future Fund hold timber in their portfolio. While the fund’s annual report indicates an allocation of 8% in “Infrastructure and Timberland” on closer checking this is nearly all infrastructure investments. While the prices of timber may closely follow the economic and construction cycles, an attractive feature of growing timber is that if you don’t like the sale price on offer you don’t have to harvest and you’re still rewarded with growth.

After the terrible experience of individual, non-institutional investors burned by listed investments in Timbercorp, Great Southern Plantations and Gunns and direct timber growing through Managed Investment Schemes, I think it is fair to say to leave this asset class to the professionals.

Australian agricultural investing

There isn’t an ASX industry code or index for agribusinesses in Australia. If it did it would include companies like:

- Australian Agricultural Company (AAC) – Australia’s oldest operating company and beef producer;

- Graincorp (GNC) moves and markets drier climate grains wheat, barley and canola;

- Incitec Pivot (IPL) makes fertiliser and explosives;

- Nufarm (NUF) makes crop protection chemicals;

- Ridley Corporation (RIC) is an animal feed producer and distributor;

- Ruralco Holdings (RHL) is a diversified business in the agricultural sector;

- Select Harvests (SHV) is one of the largest almond producers outside of California;

- Warrnambool Cheese & Butter (WCB) which is aptly named for its product and region.

The returns from this index would have been highly affected by the ten-fold rise in Incitec Pivot’s share-price in 2008 when investors thought fertiliser was the new gold – it has since fallen by more than half and gone sideways in price for about four years. Graincorp’s takeover attempt last year saw its share price double over two years like WCB did more recently. Recent high performer Select Harvests (SHV) is benefitting from rises in Almond prices and a fall in the Australia dollar.

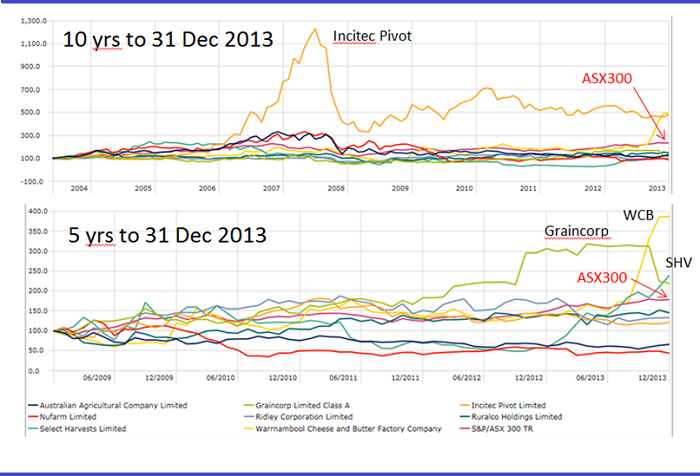

10 and 5 year returns of Australian agribusinesses versus the ASX300

The figure above shows the 10 and 5-year share prices of various Australian agribusinesses. Over the last 10 years only 2 of the 8 stocks bettered the ASX300 – and only 3 of 8 over 5 years. Nevertheless the out-performance was substantial enough to make investing in agribusiness worthwhile, provided holdings were annually re-balanced (profits taken). The chart below shows $100 invested in agribusinesses returned about $250 instead of $230 for the broader market.

Unfortunately this comparison suffers from what academic’s call “survivorship bias”. A much worse result would be shown if our initial portfolio held 10 stocks which included failed timber companies or the once great Elders Limited.

Performance of an imaginary Australian agribusiness index over 10 years

While the diversification potential of speculating in the prices and investing in businesses that grow things is clear, unfortunately the premium return for doing so is unclear. It is hard then to recommend that investors go out of their way to introduce a specific agricultural investment asset class tilt in their portfolio.

Agribusiness is a difficult business as we all know. It’s also been hard for it to compete with the hard-commodity boom and the growth in bank lending over the last decade. Drought and the strong Australian dollar have been factors that have hurt the industry. Should these factors reverse, then more profits will rain down for all those involved and investing in the industry.

On Wednesday 5 March Tom Elliott will reveal his top agribusiness takeover targets.

Doug Turek is Principal Advisor with family wealth advisory and money management firm Professional Wealth.