Growing pains in the housing market's transition phase

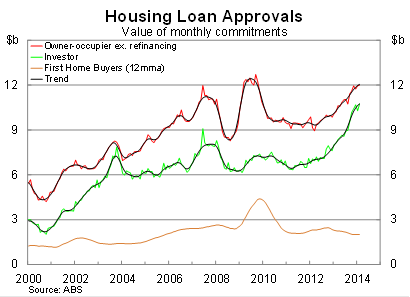

Household lending continues to rise, but has momentum slowed? Investors continue to be the driving force behind the house price boom, while first home buyer activity remains near historical lows.

The value of loan approvals to owner-occupiers, excluding refinancing, rose by 0.3 per cent in February, to be 17.5 per cent higher over the year. Recently growth had been driven by higher loan size rather than activity, but that was not the case in February. Average loan sizes, adjusted for refinancing, fell by 0.2 per cent in February, while activity rose by 0.6 per cent.

Refinancing of existing home loans remains strong, which is expected given the low lending rates on offer to home owners and investors. Refinancing accounts for around one-third of all loans approved in February.

The value of investor loan approvals rose by 4.4 per cent in February, following a solid decline last month, to be 32 per cent higher over the year.

Loan approvals to first home buyers rose by 2.3 per cent over the year to February, accounting for just 12.5 per cent of loan approvals in the month – the second lowest level on record.

Housing remains out of reach for many younger Australians, who remain quite cautious despite low lending rates and are instead choosing to save rather than leverage up.

What may not be immediately apparent is that the pace of growth has slowed significantly for both owner-occupiers and investors over the past six months.

On a trend basis, growth in the value of loan approvals to owner occupiers slowed to 0.7 per cent in February (compared with 1.7 per cent in October) while for investors, growth slowed to 1.1 per cent (compared with 3.9 per cent in September).

This should come as little surprise, though it hasn’t been emphasised elsewhere. It is a trend that we should keep an eye on. House prices are demand-driven and, if demand slows, then it stands to reason that price growth will slow as well.

Earlier today I discussed the long-term and short-term risks to housing – noting that investor demand is running at an unsustainable pace (Prepare for a sharp house price punishment, April 9). The eventual decline in investor activity is not yet apparent but the process begins with a loss of momentum. The trend data suggests that this may already have begun.

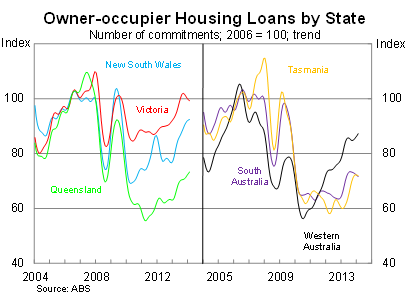

At the state level there is a variety of different trends.

Activity remains strong for New South Wales but Victoria and South Australia looks to be on the decline. Queensland is showing some strength, albeit off a low base, while growth in Western Australia has been modest. Increasingly it looks like a market that is being driven by New South Wales.

Lending activity continues to rise at a solid pace but there is clear evidence that momentum has slowed over the past six months.

The big question is whether this is early evidence that investor activity is becoming exhausted, or simply a transition to a more sustainable level of growth.

What isn’t debatable is that conditions remain tough for first home buyers and that is unlikely to change in the near-term. However, the cautiousness of first home buyers is entirely reasonable given concerns about job security and the level of house prices. For now it is preferable that younger Australians aren’t leveraging up simply because low lending rates enable it.