Global growth: Are you being left behind?

| Summary: Investors across the globe are changing their asset allocations, with a high percentage favouring capital growth over yield assets. As well as equities, investors are shifting into alternative investments such as infrastructure, hedge funds and private equity. |

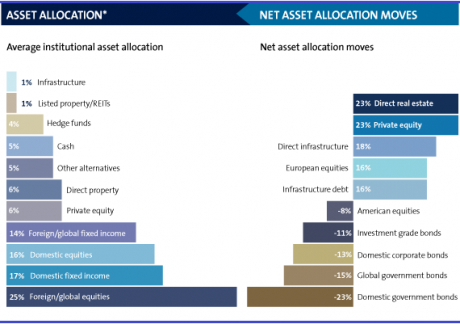

| Key take-out: Institutional investors are reducing exposure to US equities and bonds, while increasing exposure to Europe, emerging markets and direct real estate. |

| Key beneficiaries: General investors. Category: Strategy. |

Investors still piling into yield stocks may want to sit down and think again about their allocations. Institutional investors have already moved on to ‘growth’ opportunities. And, while yield is still part of the equation, the hunt has evolved and become more sophisticated.

AMP Capital’s new Institutional Investor Research Report, which surveyed investing institutions to find out asset allocations and investment trends for the June-September quarter and beyond, shows that institutional investors have been fine-tuning their investing approach by complementing yield holdings with growth assets.

In a marked shift, a substantial 77% of institutional investors surveyed now favour capital growth over yield.

Institutional investors are hunting for low-priced options, but bargain-basement prices can’t last forever and the hunt is moving at a swift pace. (Eureka Report first reported on the global swing towards growth over yield in a recent Barron’s article).

We’ve heard for some time now that the US recovery is underway, and that investors should be looking to park some capital into US equities. If you were holding back, fearful that the US recovery was a ‘false dawn’, you may well have missed your chance to get in early.

Indeed, right now, institutional investors are reducing exposure to the US, while increasing exposure to Europe, emerging markets and direct real estate. Just take a look at the chart below from AMP’s report.

In the equity space, Europe has become the focus as big investors look to take advantage of a recovery in that region. (For more on Europe’s recovery and the opportunities for investors, see Kerr Neilson dives into Europe.)

Investors are also shifting into alternative investments such as infrastructure, hedge funds and private equity.

“Sophisticated investors are seeking alternatives such as hedge funds that can maximise equity returns, while at the same time providing downside protection if there is another turn for the worse on global share markets,” the AMP report says.

While there has been a marked shift toward growth among this influential group, yield still has a part to play – although in new forms.

Allocations to high-yield corporate bonds are expected to lift, while demand for assets such as direct property and infrastructure is also on the rise, with the stable bond-like payment structure providing predictable and consistent returns over the mid to long term, the report says.

In fact, the greatest demand from institutions in the third quarter was for direct real estate, the report found. As ever with real estate, location is crucial. A small number of key markets around the world are of great interest to these institutions … and Australia is one of them.

“The US real estate market is a global bright spot, supported by its recovering economic fundamentals. The newly energised Japanese market, which was stagnant for 20 years, is supported by changing fundamentals and is not an asset bubble. The recovery in the European market has been slow, but London is showing good rental growth. While conditions in Australia are weak, the country’s high yield—one of the highest in the world—is still very attractive to institutional investors,” the report says.

This interest in “real assets” is certainly something Australian retail investors can identify with. Indeed it seems that some Australian retail investors might be ahead of our financial institutions, with the early moves of private investors into property in recent months signalled by the lift in investor loans at the major banks.

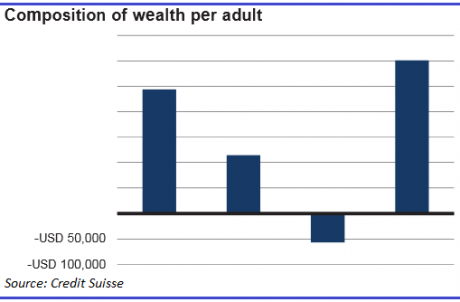

As the recent Credit Suisse 2013 Global Wealth Report highlighted, Australians have much more of their wealth in non-financial assets, i.e. property, than the global average.

In fact, ‘real assets’ in Australia amount on average to $US294,100 and form 58.5% of gross household assets, Credit Suisse found. The average level of real assets in Australia is the second-highest in the world after Norway. The world average is 45%.

Credit Suisse’s report also highlighted that our wealth is growing at a slower-than-average pace. Australia clocked up 2.6% growth in the past 12 months compared with the global average of 4.6%. In comparison, North America recorded 11.9% and Europe 7.7% ... admittedly these two regions are coming off a very low base.

Australian retail investors looking to join institutional investors and the wealthy in the quest for growth will likely be considering investing in overseas markets. But timing is everything.

David McDonald, chief investment strategist, Credit Suisse, Australia, warns of potential volatility in the US and Europe over the short term.

“The last 12 months were very good for returns, particularly for equities globally as well as in Australia, and we would expect things to be a bit more modest going forward. There’s a few issues out there in the short term in the US, and even in Europe and elsewhere, and when markets have had a big rise like that they can react sometimes to those wobbles a bit more.”

But McDonald suggests such caution in relation to offshore markets should just be short term.

“Over the very long term we’re still positive on equities and other growth assets like real estate. Looking into next year we still see the world recovering quite well. It seems that Europe’s starting to pick up, China seems to be stable, so we think the opportunities down the track are quite positive.”

Emerging markets is one region that McDonald points to as an investment opportunity, from both a capital appreciation perspective and as a currency play.

“If you look at the projections, focusing on growth, Asia ex-Japan is likely to grow strongly and Asia including Japan will overtake America as the wealthiest region by 2018. Obviously that has some investment implications in terms of investment opportunities and exposure to that growth.

“There are a lot of opportunities out there that you’re just not going to necessarily get exposure by keeping your money at home. If you add to that the potentially lower Aussie dollar, that makes it an even more attractive proposition,” he says.