Getting ahead in your 20s

We are out the other side of an election where a number of tax arrangements were front and centre, and we are holding tight to see if the cash rate will be cut to another historical low.

Seasoned investors know how to draw on the right tools to cope with these changes. But that doesn't mean it's any less of a challenging landscape to understand.

There is one group of people, those aged in their 20s, who are in fact impacted in several ways by the recent changes, and who might be too busy to have realised. Between enjoying the end of their uni days, finishing up apprenticeships, earning (and spending) a full-time wage, moving out of home and exploring the world, they may not realise their financial decisions may matter more than any previous generation that has gone through their 20s before them.

For you, your kids, or your grandkids, here's four reasons why making better money decisions in your 20s matters more now than in the past.

1. Compounding interest

Let's start with a positive, the principle of compounding interest. Regardless of whether Ben Franklin, Albert Einstein or John Keynes coined the phrase, compounding interest is the "eighth wonder of the world". Compounding interest is what happens when investment returns are re-invested to increase the rate of earnings over time.

Behind this is the impressive long-term data where, for example, $10,000 invested in the Australian All Ordinaries Index over the last four decades (from January 1, 1980 to December 31, 2018) grows to $275,000.

Even cash over this period, with an average return of 8 per cent per year (its highest return in 1989 of 18.4 per cent) turned the starting $10,000 into $100,000.

These are the sort of feats that compounding can help people create wealth over time.

Right now, however, the return that can be earned on cash is likely to be in the 2 per cent range, with the current talk being cuts to the cash rate, not increases.

Many commentators are now talking about lowering expectations for returns when investing in shares.

If returns are indeed lowered, then compounding interest as a tailwind will be reduced. All that really means is it's better to start earlier.

2. Superannuation limits

Never before have investors been imposed with such strict and significant limits when getting assets into superannuation.

A general concessional superannuation cap limit of $25,000 per year limits many people close to retirement who want to add significant salary sacrifice contributions to their employer contributions to boost their super balances.

Super remains a tax-effective savings tool that will, for most people, be crucial to funding retirement.

Twenty-somethings do have a distinct advantage here. With compulsory employer contributions currently sitting at 9.5 per cent, this is the highest level for compulsory contributions ever. And it's only set to rise.

As we're now restricted in the ability to make large contributions closer to retirement, it pays to be sure that your super is in tip-top shape, as early as possible.

Taking an interest in super, consolidating super, and making sure that high fees or premiums don’t unnecessarily erode the balance, is more important in your 20s than ever before.

3. House prices

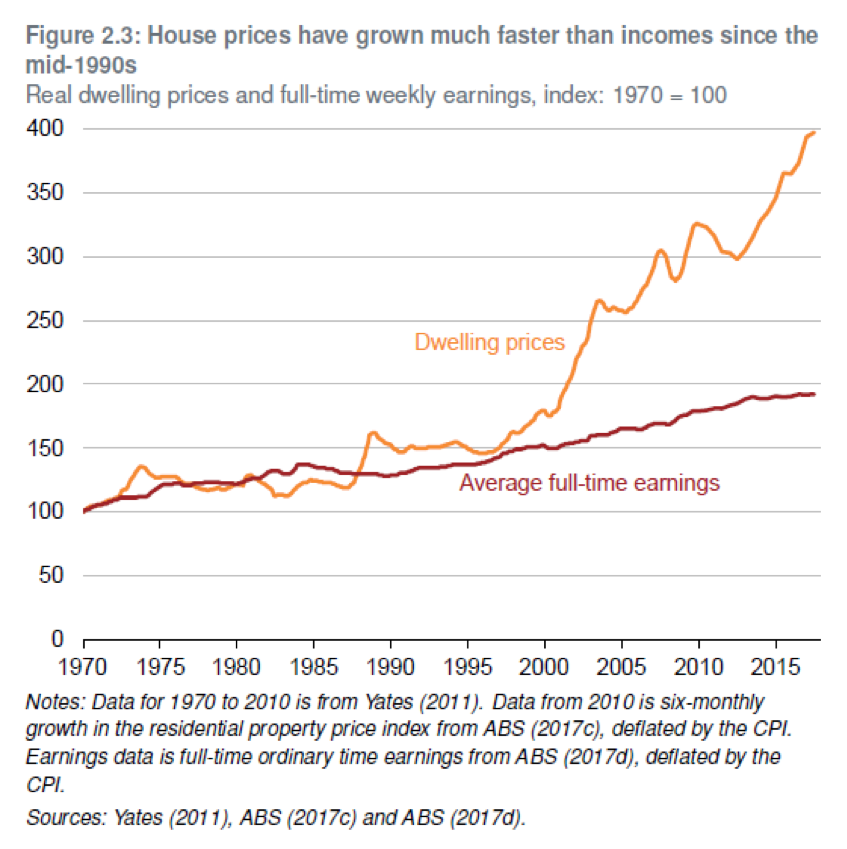

We all know the story. If you want a recap, check out the graph below.

This graph taken from Grattan Institute's report, Housing affordability: Re-imagining the Australian dream, shows the literal mountain young Australians are facing when trying to buy a house. It's a steep feat considering the substantial increase in house prices compared to the average wage.

Even with the recent government proposal to help homeowners get into the market with smaller deposits, the simple reality is that the financial effort of owning a house has never been harder, and it has never been more important to be in good financial shape before taking on that challenge.

For those in their 20s, this means building a habit, as well as a record of savings, to make sure you are well and truly ahead before you get to the point of buying.

4. Changes to the age pension

It may seem like a far and distant future for young people, but these changes are part of your reality even as a twenty-something.

In 2017, there were two significant changes to the age pension – an increase in the qualifying age, and a decrease in the level of assets that a person or couple could have to still qualify for some part-age pension.

While access to the age pension is a long way into the future for someone in their 20s, these changes stress that people need to take responsibility for their own retirements, especially if they want to retire earlier.

Spending less than what is earned, saving and investing the difference, and exposing that money to the power of compounding interest, will help build a financial base that some way down the track may help provide a better quality of retirement.

Of course, 'financial discipline’ is far from one of the more interesting phrases people will hear in their 20s. However, the financial landscape suggests that making some headway in your 20s may be more important now than ever before.

Frequently Asked Questions about this Article…

Compounding interest is crucial for young investors because it allows investment returns to be reinvested, increasing earnings over time. Starting early maximizes this effect, helping to build significant wealth over the long term.

With the cash rate potentially being cut to historical lows, the return on cash investments is likely to be around 2%. This means investors should lower their expectations for returns, making it even more important to start investing early to benefit from compounding interest.

The general concessional superannuation cap is $25,000 per year, limiting how much can be added to superannuation accounts. For young investors, starting early with super contributions is crucial, as it remains a tax-effective savings tool for retirement.

Young investors should take an interest in their superannuation by consolidating accounts, minimizing high fees, and ensuring their super is well-managed. This proactive approach helps maximize the benefits of compulsory employer contributions.

House prices have increased significantly compared to average wages, making it harder for young Australians to afford a home. Building a habit of saving and maintaining good financial health is essential to overcome this challenge.

Recent changes include an increase in the qualifying age and a decrease in the asset threshold for eligibility. These changes highlight the importance of taking responsibility for retirement savings early on.

Practicing financial discipline by spending less than earned, saving, and investing the difference can build a strong financial base. This approach, combined with compounding interest, can lead to a better quality of retirement.

With changes in tax arrangements, superannuation limits, and housing affordability, making informed financial decisions in your 20s is crucial. These decisions can significantly impact long-term financial health and retirement readiness.