ETF - Top Investor's Guide to Exchange Traded Funds

1. What is an ETF?

ETFs are a low-cost and transparent way for investors to access nearly every sector of the market. Like purchasing shares in a company, investors can purchase units in an ETF giving them exposure to every security the ETF is comprised of in one trade.

To fully understand how an ETF works, it’s best to start off with an understanding of a mutual fund. Effectively, a mutual fund exists where a group of investors want to invest in a broad portfolio, but they lack the time or financial skillset to manage this themselves. An investment manager is hired to manage and run the portfolio, and each investor has a certain amount of ‘units’ in the fund which is representative of the money they have invested. The value of a share in the fund is calculated at the end of each day when the market closes. It is only when the market has closed for the day that the value of the fund can be calculated.

An ETF is like a mutual fund in the way that it is a pooled investment vehicle, investors contribute money to the fund, and receive units in return. Unlike a mutual fund, however, an ETF is an exchange traded fund. This means that its units are openly traded on a stock exchange, allowing for greater price transparency and liquidity.

Most ETFs aim to track the performance of an index or an asset class and provide access to a range of asset classes and investment strategies that non-institutional investors may not ordinarily have access to, for example international equities, fixed income securities and currency markets. However, there are a growing number of products coming to the market with an active element to their portfolio construction. These are generally referred to as “Smart Beta”.

The design of ETFs creates many benefits for investors,

|

Accessibility |

|

|

You can purchase or redeem units in an ETF at any time during market hours in the same way as you would for any ordinary share. This means no additional paperwork or unnecessary delays like with unlisted managed funds. |

|

Transparency |

|

|

Unlike a traditional actively managed fund that discloses its holdings at varying intervals, ETFs are highly transparent. Most ETFs are required to publish a list of their holdings on a daily basis. |

|

Cost Effective |

|

|

As ETFs are generally designed to track a specific index or other rules-based methodologies, fees are (on average) lower than a traditional actively managed fund. |

|

Liquidity |

|

|

Given their open-ended structure, an ETF can be as liquid as its underlying constituents. |

2. What is diversification and what are the advantages?

Diversification is all about lowering risk. Put simply, diversification means spreading your investment risk across a variety of assets. This way, if one asset performs poorly, your other investments help to offset this poor performance against the performance of the rest of your portfolio.

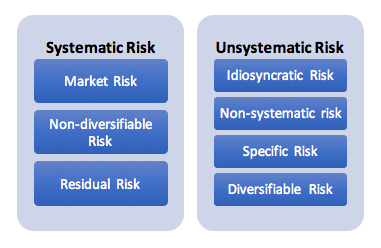

In financial markets, there are two main types of risk. These are systematic risk and unsystematic risk. These two risk categories can go by a range of names which can sometimes make things seem more complicated than they really are.

Put simply, unsystematic risk refers to risks that are specific to certain companies or sectors, but that don’t effect the entire financial market. Unsystematic risks could include an inexperienced CEO being appointed to head a company, the mining sector being lumped with a big new tax, or a major tech company collapsing.

Systematic risk, on the other hand, refers to risks that effect the entire financial market. These include macroeconomic factors such as currency rates, inflation rates, interest rates and so on. No matter which stocks or sectors you have invested in, systematic risk cannot be avoided. Unsystematic risk, however, can be reduced.

So, now that you know what diversification is, how do you diversify your investments?

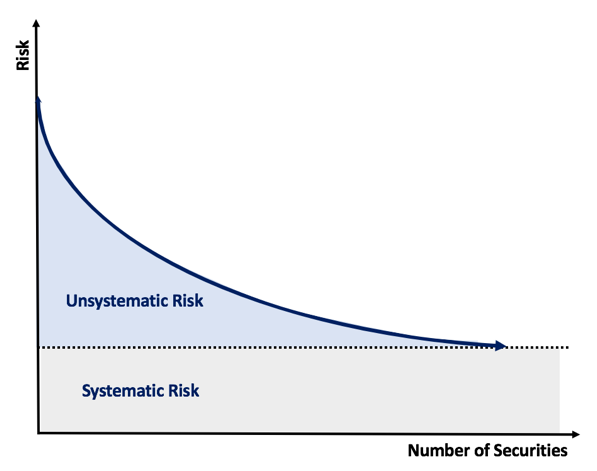

Diversification is all about spreading your risk across multiple assets – it is a fancy way for saying ‘don’t put all your eggs in one basket.’ If you invest across a range of different assets and asset classes, you are less likely to be negatively impacted by one asset in your ‘basket’ underperforming. The more assets and asset classes you invest in, the less risk you face of an underperforming asset damaging your overall returns. If we think about unsystematic risk, the more varied your investments are, the less unsystematic risk you are exposed to.

As demonstrated in the above graph, the risk of an investment portfolio will generally decrease as the number of securities in the portfolio increases. As you can see, investing across a range of assets is a good idea for all investors.

To maximise the benefits of diversification, a key factor to consider is correlation. Correlation is used to describe the relationship between assets. If assets are positively correlated, they move in the same direction. So, if one asset experiences positive returns, the other asset also experiences positive returns. If assets are negatively correlated, they will move in the opposite direction. So, if one asset has positive performance, the other asset will have negative performance. To diversify away as much systematic risk as possible, it is good to invest in assets that are negatively correlated. That way if the market experiences a downturn, not all your assets will perform poorly.

Working out how to diversify a portfolio can seem intimidating and complex – this is why ETF investments are becoming so popular. ETFs are a cost-effective and accessible way for everyday investors to access a fully diversified portfolio. When you purchase shares in an ETF, you are effectively buying shares in a range of stocks. You are purchasing an already diversified, already balanced portfolio where most of the hard work has been done for you. There’s a reason ETF investments have risen to such popularity amongst every day investors!

3. How ETFs Promote Fixed Income Liquidity

Fixed income securities are incorporated into the portfolios of many investors to provide income, reduce risk, and increase the overall diversification of a portfolio. Bonds and other fixed income securities are essentially a loan from an investor to a bond issuer. In exchange for the risk of lending their money out, investors expect to be repaid the amount of the loan plus additional compensation. The compensation for these loans (interest) is commonly paid out as a regular coupon payment – for example 5% each year. This repetitive cash flow is what gives fixed income securities their name.

Like equity ETFs, fixed income ETFs aim to emulate the performance of an index through holding a select basket of assets. While traditional ETFs focus on equities, fixed income ETFs focus on holding a selection of bonds and other fixed income assets. A such, they are sometimes referred to as Bond ETFs.

The benefits associated with fixed income ETFs make them an attractive addition to a portfolio. They are generally less volatile than equity investments, provide reliable income streams, assist with diversification, are low-cost, and offer investors efficient access to fixed income markets. Additionally, fixed income ETFs can promote liquidity.

Despite global bond market being much larger than equity markets, fixed income assets are generally not as liquid as equities. This is because they are not always traded on exchanges, with many trades occurring over the counter (OTC) or directly between the issuer and the investor. Because bond and fixed income trades don’t always occur on an exchange, their liquidity is lower than that of other assets that can be readily traded. Stocks, for example, can be traded via an exchange at any time the stock market is open, whilst this is not always the case for bonds.

Trading units of a fixed income ETF is much easier than trading in the individual bonds that the ETF is comprised of. ETF units can be easily traded on a stock exchange and buyers and sellers can offset each other’s transactions without needing to trade in an OTC transaction. As such, trading in fixed income ETFs promotes higher liquidity and transparency than directly buying and selling bonds.

4. Thematic and Sector ETFs

Many investment products exist in the ETF world and our discussion of these products would be incomplete without mention of Thematic ETFs and Sector ETFs. Similar in nature, these investment strategies allow investors to identify and invest in specific trends or sectors that they predict will create long-lasting value for their portfolios.

Sector ETFs are ETFs comprised of stocks that relate to a specific sector. This could be resources, healthcare, agriculture, energy, telecommunications and effectively any other market sector you can think of. There a quite a few of these in the Australian market.

Sector ETFs:

|

Code |

Name |

|

AUSTRALIA |

|

|

MVB |

VanEck Vectors Australian Banks ETF |

|

MVR |

VanEck Vectors Australian Resources ETF |

|

OZF |

SPDR S&P/ASX 200 Fincls EX A-REIT ETF |

|

OZR |

SPDR S&P/ASX 200 Resources ETF |

|

QFN |

BetaShares S&P/ASX200 Fincls Sect ETF |

|

QRE |

BetaShares S&P/ASX200 Res Sect ETF |

|

GLOBAL |

|

|

BNKS |

BetaShares Glb Banks ETF-Ccy Hdg |

|

DRUG |

BetaShares Glb Healthcare ETF-Ccy Hdg |

|

FOOD |

BetaShares Glb Agltr Coms ETF-Ccy Hdg |

|

FUEL |

BetaShares Glb Energy Coms ETF-Ccy Hdg |

|

GDX |

Market Vectors Gold Miners ETF |

|

HACK |

Betashares Global Cybersecurity ETF |

|

IXI |

iShares Global Consumer Staples ETF (AU) |

|

IXJ |

iShares Global Healthcare ETF (AU) |

|

IXP |

iShares Global Telecom ETF (AU) |

|

MNRS |

BetaShares Glb Gold Miners ETF-Ccy Hdg |

|

ROBO |

ETFS ROBO Glbl Robotics and Atmtn ETF |

Thematic ETFs invest in a more specific way than sector ETFs – rather than focusing on a broad sector they narrow their focus and aim to pick the underlying themes that will add value to their portfolios. Theoretically there are infinite themes that an investor could chose to base an ETF on, but some themes are more realistic than others. In Australia, there are quite a few thematic ETFs based around dividends or ethical investments, and we expect an increasing number of thematically diverse ETFs to be introduced to the market over the coming years.

Ethical ETFs:

|

Code |

Name |

Benchmark |

|

ETHI |

BetaShares Global Sstnbty Ldrs ETF |

Nasdaq Future Global Sustainability Leaders Index |

|

ESGI |

VanEck Vectors MSCI Intl Sust Eq ETF |

MSCI World ex Australia ex Fossil Fuel Select SRI and Low Carbon Capped Index |

|

FAIR |

BetaShares Australian Sustnby Ldrs ETF |

Nasdaq Future Australian Sustainability Leaders Index |

|

UBW |

UBS IQ MSCI World ex Australia Ethcl ETF |

MSCI World ex Australia ex Tobacco ex Controversial Weapons Index |

|

UBA |

UBS IQ MSCI Australia Ethical ETF |

MSCI Australia ex Tobacco ex Controversial Weapons Index |

|

UBJ |

UBS IQ MSCI Japan Ethical ETF |

MSCI Japan ex Tobacco ex Controversial Weapons Index |

|

UBP |

UBS IQ MSCI Asia APEX 50 Ethical ETF |

MSCI Asia APEX 50 ex Tobacco ex Controversial Weapons Index |

|

UBE |

UBS IQ MSCI Europe Ethical ETF |

MSCI Europe ex Australia ex Tobacco ex Controversial Weapons Index |

|

UBU |

UBS IQ MSCI USA Ethical ETF |

MSCI USA ex Australia ex Tobacco ex Controversial Weapons Index |

|

RARI |

Russell Inv Australian Rspnb Inv ETF |

Russell Australia ESG High Dividend Index |

In the US market, there are a diverse range of thematic ETFs available – ranging from the insightful to the bizarre. A range of ETF’s exist to follow emerging megatrends and are founded on themes of wearable technology, robotics and AI, health and fitness, medical marijuana, 3D printing, mobile payments, etc. – the list goes on. There are a few stranger thematic ETF’s that exist in the US market. There is a whiskey ETF, an obesity ETF, and there are two “biblically responsible” ETFs.

It’s difficult to determine whether these thematic ETFs create additional value for investors above and beyond that created through a more traditional ETF. Good thematic ETFs and bad thematic ETFs can be difficult to distinguish, but overall the performance of a thematic ETF is going to depend on the stocks it holds and the broader macroeconomic climate that surrounds us.

5. Understanding ETF Liquidity

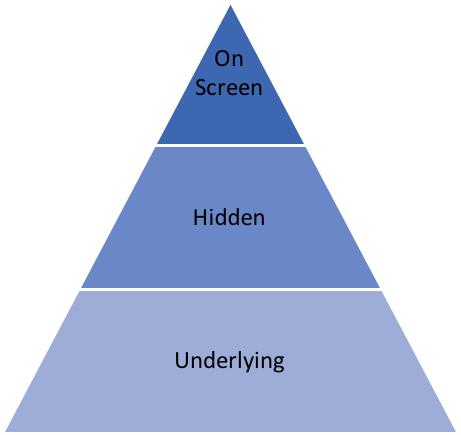

Unlike trading in stocks, there are three types of ETF liquidity broadly defined as on-screen liquidity, hidden liquidity and underlying liquidity.

On-Screen Liquidity

On-screen liquidity refers to the publicly quoted bids and offers (the buy and sell prices) you see when looking at a trading screen. Put simply, on-screen liquidity is all about what ETF units are being bought and sold (i.e. traded) on the stock exchange. Many investors wrongly believe that this is the only level of ETF liquidity.

Hidden Liquidity

Unlike stocks, ETFs are open-ended funds. This means that the supply of ETF units can be adjusted throughout the day to meet demand. Each ETF has a market maker. These market makers can add ETF units to the stock exchange when demand is high, and withdraw ETF units from the stock exchange when demand is low.

The main job of the market makers is to ensure that sufficient liquidity is available to investors during trading hours, and, to ensure that the ETF is priced closely to the net asset value (NAV) throughout the day. The NAV is the value of the assets that the ETF holds.

This type of liquidity is referred to as ‘hidden liquidity’ because market makers tend to only place orders on the screen (i.e. put forward units forward to be bought and sold) as required. As such, the volume of ETF units quoted for sale on trading screens – the on-screen liquidity – is only a small indication of the liquidity that is available. The rest of the liquidity is ‘hidden.’

Underlying Liquidity:

Underlying liquidity refers to the liquidity in the underlying market that the ETF is designed to track. If the ETF is tracking the S&P/ASX200, for example, the underlying liquidity of the ETF can be measured by the liquidity of the S&P/ASX200 index.

This is the most important measure of liquidity to use when reviewing or evaluating an ETF. You will find that the more liquid the underlying index is, the narrower the on-market bid-ask spread is. Conversely, the less liquid the underlying index is, the wider this bid-ask spread will be. As such, the bid-ask spread is an indication of liquidity.

So, how does this all work?

As an example, SPDRs S&P/ASX 200 Fund is designed the track the S&P ASX 200. If SPDR needed to satisfy demand for a large order in excess of current units on screen and held by the market makers, a market maker would simply buy the constituent securities of the ETF on market and deliver them to SPDR. SPDR as issuer would then create new units and issue them to the Market Maker who would place them on market hence providing liquidity. This is a benefit of the open-ended structure of ETFs and the reason why price will track the funds NAV for the majority of the time.

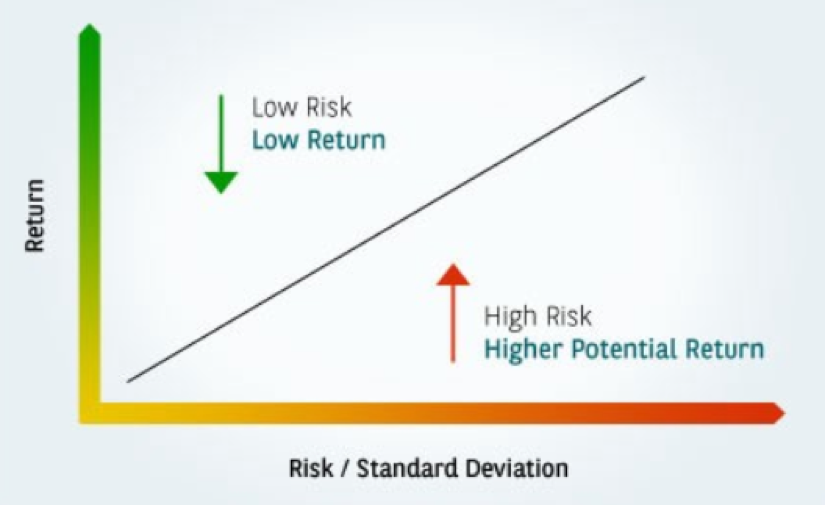

6. Modern Portfolio Theory

MPT is founded on the basis that risk-averse investors will construct optimal portfolios to make sure that they achieve the highest level of expected return for a specific amount of risk. Put simply, MPT is about investors seeking the highest possible return for a given amount of risk, or seeking the lowest possible risk for a given level of return. It is all about the risk and return trade off and investors ensuring they are optimally balancing risk and reward. The finance term for this is mean-variance optimisation.

Mean-variance optimisation references to two key factors – mean and variance. Mean is the mathematical word for average and in terms of MPT it refers to the expected return of your investment. To calculate the overall expected return, you calculate a weighted average of the expected return of each stock contained in your portfolio. Variance is used to describe the risk of an investment portfolio. So, to summarise, mean-variance optimisation is all about the optimizing the risk vs. reward trade off.

The MPT approach encourages investors to diversify their investments to reduce their overall portfolio risk and volatility. Diversification is all about lowering risk. Put simply, diversification means spreading your investment risk across a variety of assets. This way, if one asset performs poorly, your other diversified investments help to offset this poor performance against the performance of the rest of your portfolio. It helps lower your risk whilst maintaining expected returns.

MPT is used in many modern investment approaches and is the foundation on which we build our ETF Portfolios here at InvestSMART. We offer a variety of portfolios of different risk levels and have carefully crafted each portfolio to offer a well-balanced and well-diversified investment.

Frequently Asked Questions about this Article…

An ETF, or Exchange Traded Fund, is a low-cost and transparent investment vehicle that allows investors to access a broad range of market sectors. By purchasing units in an ETF, investors gain exposure to all the securities within the fund, similar to buying shares in a company. Unlike mutual funds, ETFs are traded on stock exchanges, providing greater price transparency and liquidity.

ETFs offer diversification by spreading investment risk across a variety of assets. This means if one asset underperforms, other assets in the ETF can help offset the loss. By investing in ETFs, you gain access to a diversified portfolio without the need to individually select and manage multiple securities.

Fixed income ETFs, also known as Bond ETFs, provide a reliable income stream, reduce portfolio volatility, and enhance diversification. They offer efficient access to fixed income markets and promote higher liquidity compared to directly trading individual bonds.

Thematic ETFs focus on specific investment themes, such as technology or sustainability, while sector ETFs concentrate on particular market sectors like healthcare or energy. These ETFs allow investors to target specific trends or sectors they believe will add value to their portfolios.

ETF liquidity is defined by on-screen liquidity, hidden liquidity, and underlying liquidity. On-screen liquidity refers to the visible buy and sell prices on the stock exchange. Hidden liquidity involves market makers adjusting the supply of ETF units to meet demand. Underlying liquidity is determined by the liquidity of the market the ETF tracks.

Modern Portfolio Theory (MPT) is an investment strategy that aims to maximize returns for a given level of risk by diversifying investments. ETFs are often used in MPT to create well-diversified portfolios, helping investors achieve optimal risk-reward balance.

ETFs are generally designed to track specific indices or follow rules-based methodologies, resulting in lower fees compared to traditional actively managed funds. This cost-effectiveness makes them an attractive option for everyday investors seeking diversified exposure.

ETFs are highly transparent as they are required to publish a list of their holdings daily. This transparency allows investors to know exactly what securities they are investing in, unlike traditional actively managed funds that disclose holdings less frequently.