ER international fund manager series: Magellan Global Fund

Summary: The Magellan Global fund (APIR code: MGE0001AU) and is not tied to a benchmark and aims to return nine per cent over a full investment cycle. The team considers both individual companies and broader macroeconomic research and holds a number of global conglomerates on the cutting edge of technology, including info tech and payments. |

Key take out: This is a fund to own for capital growth rather than income generation, and can deliver returns significantly different to the wider market. |

Key beneficiaries: General investors. Category: International investing. |

Spearheaded by Hamish Douglass, co-founder of Magellan Asset Management, the fund has been one of the leading performing internationally focused managed funds. With a local management team, Magellan has become synonymous with consistently managing investor money and outperforming its peers.

Since putting together the fund in 2009, the Magellan team has been on the road presenting to investors and those considering the fund for inclusion in their portfolio. Regardless of prevailing economic conditions, whether it be the threat of Greece defaulting on their sovereign debt, or the Fed raising interest rates, the part line has been much the same - own great businesses that have goods and services people need all year round.

For Australian investors, the fund gives investors access to economic themes not available in the local market. For example, the fund considers owning Coca Cola or Nestle, providing a good way to play the rising consumption of the emerging market consumer. This includes getting a slice of the growing payments market by opting for specialist intermediaries, such as PayPal or Visa.

There's no doubt Magellan's conviction in their investment ideas has lead to their outstanding performance and billions of dollars flooding into the door. At the end of January, the fund was just shy of $8 billion, up from only $400 million at the end of 2010.

It's worth noting international shares have posted sky high returns over this time – 13 per cent compounded per annum, as measured by the MSCI World Index – but it's a fund that has earned the loyalty of both retail investors and large institutions who can see through a slick marketing presentation.

Magellan is of course just one fund available to local investors I have dealt with a range of internationally focused funds of exceptional quality elsewhere in this series, such as the (click to read) IFP Global Franchise Fund, BT Wholesale European Share Fund, Legg Mason Global Equity Trust and the Lazard Global Small Caps fund.

Also note here that we are dealing today with the Magellan Global Fund (APIR code: MGE0001AU), not the listed management company – ticker code MFG - that administers the fund.

Investment objective

The investment objective of the Magellan Global Fund is clearly defined by two points:

• Firstly, the fund focuses on capital preservation by lowering the downside risk in adverse market conditions. In other words, it's the team's objective to always outperform the index, and in bad times that means planning so that the will fund sink less than the index during a downturn or correction.

• Secondly, the fund has a return objective of 9 per cent through a full investment cycle. An absolute measure over a five to seven year period acknowledges that some years will produce those envious returns, which will be offset by weaker years. Consequently, it's a product that suits investors with a similar time frame.

The fund does not invest with consideration to the composition of the underlying benchmark - the MSCI World Index, which includes share markets from developed countries. Instead it is free to invest in countries and sectors as it pleases, with the option of holding up to 20 per cent cash. The investment objectives of the fund make it almost impossible to be a slave to the benchmark.

On the hunt

There are three phases in the investment process:

1. It all starts with team of 30-plus analysts working for Magellan looking for outstanding companies with competitive advantages. It seems simple enough, but this involves immediately discounting thousands of companies based on the fact there are other businesses with similar offerings.

2. Even the most outstanding companies will struggle to deliver strong share price gains if they don't operate in a sector with favourable economic conditions. It's for this reason macroeconomic research is the second pillar in the investment process. The fund uses this step as a way to manage potential macro event risks and how that might affect a single company, as well as the entire portfolio.

3. The third and final phase is managing the risk of the overall portfolio. Having companies from various sectors that operate in both developed and emerging markets stops the fund being too focused on just one investment idea.

With the top 10 holdings making up 45 per cent of the fund, it's important to consider the portfolio as a whole and not just as individual investments. A concentrated portfolio means the strong – or weak – performance of a handful of companies will have a meaningful impact on the overall return of the fund.

What Do They Own?

Investor updates define industry exposure by the source of revenue, instead of pigeonholing entire companies into only one category. For a fund investing in global conglomerates, it offers a transparent way of presenting just where and how companies make their money.

Information technology dominates the fund, with a 24 per cent allocation. Here you'll find brand names you know and products you probably use – Apple and Intel. Capitalising on the evolution of banking, payments is detailed as its own source of revenue and makes up 12 per cent of the fund. This is where the likes of PayPal and Visa come in.

Despite Apple, Intel, PayPal and Visa all being different businesses, they have a lot in common. For one, they are companies with products and services in hundreds of countries, and leaders in their respective sectors, not to mention that you can't buy a similar version of in these providers in the local market. The Magellan Global Fund gives Australian investors access to companies pioneering new technology that are in the process of changing the way we live our everyday lives.

Considering that an assessment of the macroeconomic environment has a say in the sectors the fund is comfortable having an exposure to, it can be seen that utilities, commodities and energy companies don't feature in the portfolio.

The performance

Of all of the funds we have covered in this series, the Magellan Global Fund is the only one to incentivise the manager with a performance fee. The exact details are as follows: 10 per cent of returns in excess of the MSCI World Net Total Return Index AUD are payable, providing this exceeds the yield on a 10 year Australian government bond. The fee is also subject to a highwater mark, meaning the performance fee is only paid if the value of the fund is higher than the all time high.

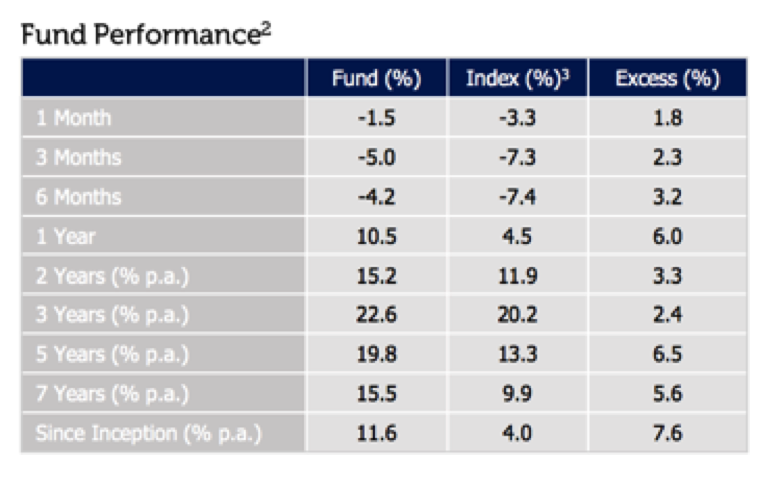

Performance as at 31 January:

Outperformance compared to the index over the past 6 months can be explained by a cash holding of around 15 per cent. Putting money in the bank when share markets are falling is beneficial for two reasons. Firstly, cash doesn't decline in value like share markets can. Secondly, when the economic outlook improves investments that are at depressed prices can be ideally made made using idle funds.

The outperformance over five years and longer is a result of consistently picking quality companies that are able to weather share markets that have bounced from high to low against a patchy economic backdrop. It's not an easy feat to notch up a return 6 per cent higher than the benchmark and is a tilt to the investment philosophy the fund pursues ad the team.

Your portfolio

The investment style is very specific based on the investments objectives of the fund, and consequently gives no consideration to how the underlying bench mark is invested. While this can afford the fund the ability to invest heavily in popular themes and ideas, it can also mean returns have the potential to be significantly different to the wider market, investable by an exchange-traded fund.

Considering the fund pursues an absolute return measure of nine per cent - which is six per cent higher than the 10 year average for the benchmark - and aims to minimise losses caused by short term gyrations, it could be viewed as more conservative than owning the market.

Depending on how much you have allocated to international shares, the Magellan Global Fund is the type of investment that would compliment other managed funds, or ETFs that invest globally.

Dividend payments from some of the world's largest company are often low relative to Australian companies. In light of this, investors should be mindful this isn't a fund you would own for income generation, rather its capital growth potential.